Are you looking to become an EU or Portuguese resident (and eventually a citizen) without needing to move there full-time?

Chances are you’ve already heard about Portugal’s Golden Visa program.

For many, it’s the perfect way of getting permanent, unlimited access to Europe.

But the program has its issues. In this guide, we’ll explore all sides—the good, the bad, and the ugly.

Ultimately, you’ll know if the Portuguese Golden Visa is a good fit for you and your family.

ℹ️ Rewritten for 2024→ applicants: I’ve rewritten this guide to reflect the changes to the Golden Visa program that took effect on October 7, 2023. You can still access the old guide here.

Let’s first look at the pros and cons to help you decide if Portugal’s Golden Visa is for you.

⚠️ 2025 changes on the horizon: While the current government on the one hand has signaled plans to improve the Golden Visa program, on the other they have put forward a separate proposal to amend Portugal’s Nationality Law which may increase the required period of legal residence for naturalization from five to ten years. We’ll only update this guide if and when changes are finalized—in the meantime we’ll share the latest developments here as they unfold.

Table of Contents ↺

- The good, the bad, and the ugly

- History of the Portuguese Golden Visa

- Requirements for obtaining the Golden Visa

- Available investment options

- The application and renewal process

- Preparing and submitting your application

- Frequently Asked Questions (FAQs) about the Portuguese Golden Visa Program

- Webinars

The good

The Portuguese Golden Visa program is one of the most popular in Europe and the world. There are many good reasons for that:

- You can choose from several investment options that will let you apply for permanent residency or citizenship in about five years (but more on that timeline below).

- There’s no need to move to Portugal or become tax resident to keep renewing your residence permit or apply for citizenship—an average of seven days in the country per year is enough!

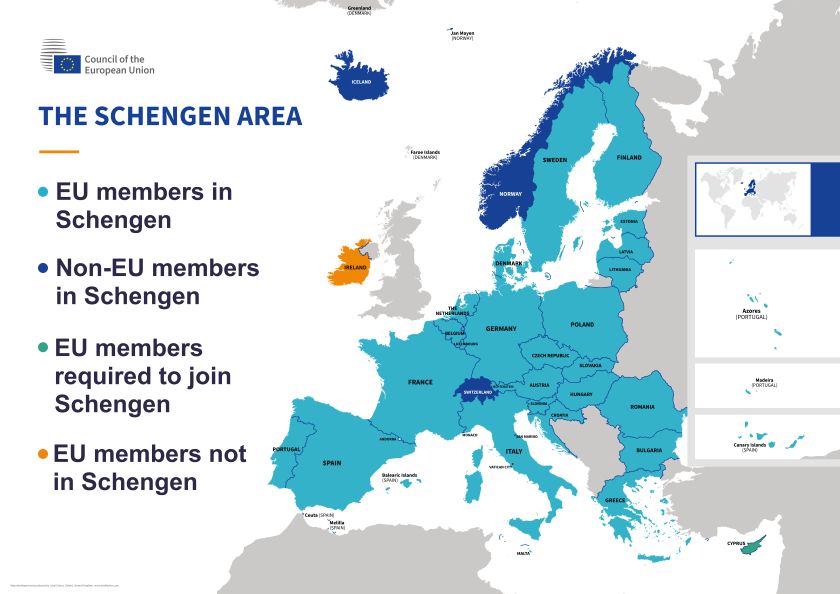

- While a Golden Visa resident of Portugal, you will have visa-free access to the European Union’s Schengen Area.

- Once you become a citizen, you can live and work anywhere in the EU/EEA and get the world’s fourth-best passport for nomads and global citizens.

- The program is not blacklisted by the OECD, unlike many other Golden Visa programs.

- Portugal is a safe and stable country with an excellent and affordable quality of life, good healthcare and education options, well-connected airports, and the best climate in continental Europe.

The bad

The items on this list aren’t really that bad, but it’s still important to be aware of them.

- While Portugal offers favorable tax benefits for newcomers, if you decide to settle there long-term the taxes are on the higher end. But there’s no need to if your goal is to get citizenship.

- You do need to visit Portugal for 14 days every other year until you apply for citizenship to be able to renew your residence permit.

- To qualify for citizenship or permanent residency, you do need to learn some Portuguese. Luckily, you only need A2 level proficiency, less than most countries require.

- While there have been attempts at streamlining things, the application process is still quite bureaucratic.

- Portugal recently restricted the program’s investment options, leaving €500,000 fund investments as the best option for most.

Still, as far as European residency-by-investment programs go, the Portuguese program is relatively accessible. These are the best options for most people:

- A €500,000 investment into a private equity or venture capital fund.

- Donation of €250,000 to support arts or cultural heritage (which can be reduced to €200,000 depending on location).

- There’s even an entrepreneurial option with no fixed minimum investment.

The ugly

The worst thing about the Portuguese Golden Visa at the moment is, without a doubt, the delays in processing new applications. By law, your application should be processed in just a few months. Yet the wait time has now stretched to approximately three years.

Yup, you read that right. Three long years.

The Nomad Gate community has crowdsourced a Golden Visa Timeline Database—and the data doesn’t lie.

This is, unfortunately, something most Golden Visa promoters and advisors conveniently sweep under the rug.

So that makes it eight years until you can apply for citizenship, followed by close to two more years before you have the passport in hand. A total of ten years to citizenship.

To be fair, most countries are slow to process citizenship applications. 1–3 years is the norm in most places. And not long ago, it was taking “only” one year in Portugal.

A glimmer of hope?

Delays haven’t just affected Golden Visa investors, however, with large protests from other immigrant groups. This prompted the Parliament to pass legislation in early 2024 that promises to start the clock toward citizenship from the time of application, not the time of approval.

That could shave a few years off the time to citizenship.

But don’t pop the champagne just yet. While the legislation has received its final approval and will enter into force by April 1, 2024, the “time of application” isn’t yet clearly defined.

You would think that would mean the time you submit your initial online application (I tend to agree). However, there’s an argument to be made that it’s really the time of your in-person biometrics appointment that would start the clock. It’s too early to conclude one way or another, but we should know more later in 2024 or perhaps 2025.

If the interpretation ends up being the initial online submission and application fee payment, the total time to citizenship drops to just 6–7 years. That’s five years from the Golden Visa application to citizenship application, then at least another one to two years until being granted the citizenship.

However, if it ends up being the biometrics appointment that starts the clock, you’d only shave about a year or two off the current wait times.

⚠️ February 2025 update: Some good news! AIMA recently confirmed that the clock toward citizenship starts counting when you've submitted the online application and paid the associated state fee—assuming your residence permit is granted eventually. Check out this legal Q&A for an update on what we know:

We will update this section of the article to reflect this development in the coming weeks or months.

The kicker?

Even if there’s little improvement, the Portuguese Golden Visa program will continue to be immensely popular.

You see, the program is unique in Europe. It’s the only remaining program with a path to citizenship without needing to live full-time and pay taxes there.

That is if you disregard the Maltese program, which lets you apply for citizenship after 1–3 years. But it requires a €600,000-€750,000 donation—on top of buying or renting a house there.

Not exactly the same league.

So no matter if it takes six or nine years, those are years you can live your life normally wherever you want. No need to uproot your family unless you want to.

That said, you may want to.

Portugal is a fantastic country in many respects, and spending some time there may lead you to fall head-over-heels in love—like I did nearly a decade and a half ago. You have been warned!

If you already know that you want to move ahead with the Golden Visa in Portugal, you’ll find the resources you need here:

Already looking to get things started?

Otherwise, keep reading to learn more about the investment options, the application process, and all the details and gotchas throughout.

But first, a bit of history.

History of the Portuguese Golden Visa

Established in 2012, Portugal’s Golden Visa Program—officially the residence permit for investment activity (ARI)—lets non-EU/EEA citizens get a special residence permit in exchange for a 5-year investment in Portugal.

What’s unique about the Golden Visa permit is that the investor only has to spend about seven days per year in Portugal to maintain the residency while still reaping all the benefits of being an EU resident—including visa-free travel in the entire Schengen Area.

Not only that, but Portugal’s Nationality Law is only concerned with legal residency. So, seven days a year for five years is all you need to apply for citizenship. Oh, that and some basic Portuguese language skills—but more on that later.

No wonder the program became popular.

Over the years, the program was expanded to include real estate investments, fund investments, cultural donations, and more. Still, even though investment funds gained some popularity, most investors chose to invest in property. That despite limitations imposed from 2022.

Fast-forward to early 2023, and the then-ruling Socialist Party singled out the Golden Visa program as a scapegoat for soaring Portuguese housing prices.

(Never mind that Golden Visa investors were only responsible for about one percent of real estate transactions… But I digress.)

The Socialists announced they would shut down the Golden Visa for new investors. Still, in the end they essentially just excluded real estate investments from the program. The new rules took effect on October 7, 2023.

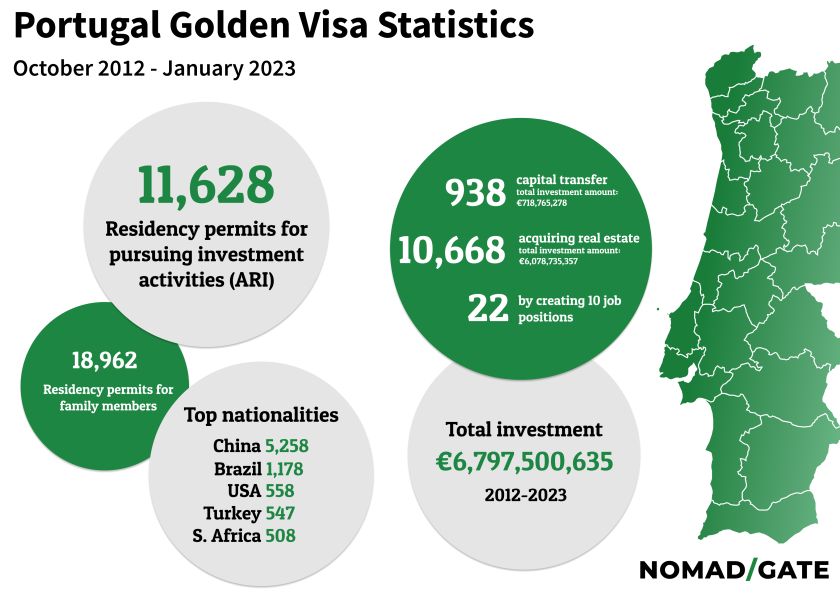

While the program has benefited more than 11,628 foreign investors so far, it has also benefited the Portuguese economy. As of January 2023, the total investment into Portugal as a direct result of the program had reached a whopping €6,797,500,635. That’s more than six billion euros.

By far, the leading share of Golden Visas have been issued to Chinese nationals (although their share has declined recently), followed by Brazilian, South African, Turkish, and Russian citizens. In the past few years, it has also been extremely popular with US citizens, with the US even taking the top spot in November of 2021.

I realize these stats are a bit old now. You can thank the new immigration agency (AIMA), which took over the responsibility for the program in the fall of 2023. They simply haven’t started publishing new statistics yet. I’ll update our numbers when they do.

Requirements for obtaining the Golden Visa

Who is eligible for the Golden Visa?

Any “third-country national”—meaning anyone except Portuguese and EU and EFTA citizens—can apply for the Golden Visa after completing a suitable investment into Portugal.

The investment can be made as an individual or through a legal entity meeting certain requirements.

You must also meet the (minimal) physical presence requirements outlined below.

Which requirements do you need to meet?

- Maintain the investment for a minimum period of five years.

- Spend a minimum of 14 days in Portugal during each two-year period after being issued your first residence card.

ℹ️ Good to know: Residence cards used to be issued first for one year, then renewed for successive two-year periods. Despite each residence permit now lasting two years, the law still states that you must spend seven days in Portugal in the first year, followed by 14 days every two years after that. To be on the safe side, it’s better to meet both requirements, for example, by spending seven days every year. Or you could spend 14 days in year one, year three, year five, and so on.

What are the available Golden Visa investment options?

So, you’ve decided the Portuguese Golden Visa might be for you. But what exactly are your investment options to qualify?

In short, your best and most likely options are:

- Invest €500,000 in a fund, let’s call it the easy option.

- Start a company that employs 10 locals, let’s call it the entrepreneurial option.

- Donate €250,000 to an approved cultural/artistic project, let’s call it the philanthropic option.

Most investors now choose to invest in funds, especially after real estate was removed as an option in late 2023. The required investment amount is €500,000, which can be spread across several non-real estate venture capital or (private) equity funds.

Another option that can be interesting for an entrepreneurial person is the creation of 10 jobs in Portugal (or eight jobs if done in a low-density area). This Golden Visa route has no fixed minimum investment amount.

An investment supporting the arts or Portugal’s cultural heritage is the option with the lowest investment amount. However, this typically takes the form of a donation. The minimum amount is €250,000 (or €200,000 in low-density areas). Theoretically, this could also be structured as a for-profit investment (e.g. in film production). But as far as I’m aware, that’s still an unproven approach, with no such projects receiving pre-approval to date.

There are also two more options, but they haven’t proved popular with investors. Plus, I don’t see any reason why you would choose those over the three options above.

Anyway, here is the complete list of options (in semi-legalese):

- Transfer capital of at least €500,000, destined to acquire units in non-real estate venture capital or private equity funds aimed at providing capital to companies that meet certain requirements.

- Creating at least 10 jobs in Portugal.

- Transfer capital of at least €250,000 as investment or support for artistic production or recovery or maintenance of national cultural heritage.

- Transfer of capital of at least €500,000, invested in research carried out by public or private scientific research institutions.

- Transfer capital of at least €500,000 to incorporate or increase the share capital of a company with a registered office in Portugal, together with the creation of five permanent jobs, for a period of three years.

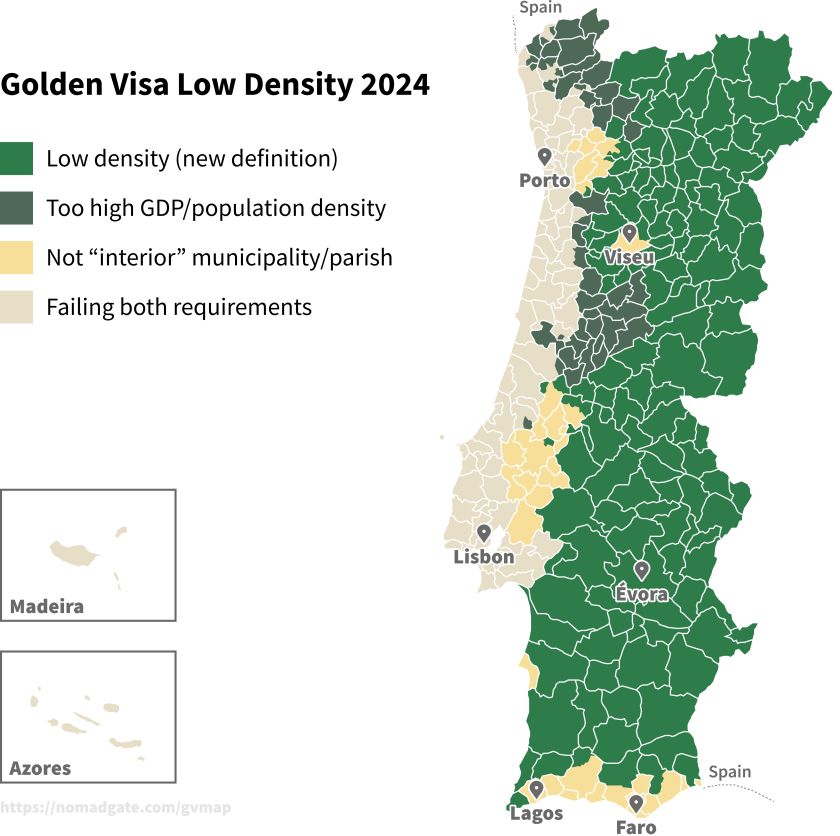

ℹ️ Good to know: The investment amounts for options 2, 3, and 4 can be reduced by 20% when made in a low-density area.

Let’s take a look at the options in more detail.

The easy option: Investment funds

If you have been following my writing for a while, you know that I am a big proponent of utilizing global index funds for growing your wealth over time. While the investment funds available for Golden Visa applicants have more traditional cost and management fee structures than passive index funds, I still think it’s the best route to the Portuguese Golden Visa for most people.

Since its introduction in 2017, the option to invest in a fund that meets certain qualifications has gradually gained popularity. Since 2022, the minimum investment threshold has been set to €500,000, which can be spread across several funds. No need to put all your eggs in one basket, so to speak.

While the investment amount is now higher than it once was, it’s still an excellent option for many people. In fact, since the removal of property investments as an option in late 2023, I’d say it’s the best option for most.

Here are a few reasons:

- First of all, as opposed to starting a business in Portugal, it’s a purely passive investment. Your ongoing responsibility only extends to filing some tax forms in your country of residence. The difficult job of making a return has been outsourced to a fund manager—who presumably knows what they are doing.

- Second, as opposed to the cultural donation option, it’s an actual investment that has a good chance of making you a decent return.

- It’s also inherently more diversified than investing half a million euros in a single company.

- From the Portuguese side, it’s also tax-efficient. If you live outside Portugal, there’s no withholding tax on distributions (though tax likely still applies where you’re resident). And if you move to Portugal, the tax rate can be as low as 10% (depending on the fund).

However, finding qualifying funds for the Golden Visa used to be quite challenging.

A fund needs to meet a few requirements to qualify:

- The fund needs to be approved and regulated by the CMVM (Portuguese Securities Market Commission).

- 60% of the fund’s capital must be invested in companies with headquarters in Portugal.

- The fund may not, directly or indirectly, invest in real estate. (Note: It’s not entirely clear yet where this line is drawn, as this is a recent addition to the requirements.)

The list of available funds also changes over time (as subscription periods close and new funds are introduced). Annoyingly, there’s no official list of funds that qualify. However, I took it upon myself to do the legwork needed to create such a list.

I reached out to the managers of every single “venture capital” fund that’s regulated by the CMVM, and met in person with dozens of them to learn exactly which of their funds qualify for Golden Visa investments.

In general, we can place the funds into one of three main categories:

- Private equity (PE) funds usually invests in mature companies and assets where they can add significant value before exiting the investment. However, some do also pay yearly dividends. Typical fund length of 6-10 years, often medium to high risk, with expected rewards accordingly.

- Venture capital (VC) funds are usually invested in early-stage tech companies with global potential. The typical fund length is 8-10 years, and the risk is higher for higher potential rewards. The goal is to maximize the capital gains at the exit, not yearly dividend payments.

- Mutual/open-ended funds investing in large listed companies (usually on the Portuguese Stock Exchange). The main benefit for investors is the flexibility of exiting the investment anytime; however, be aware that the Portuguese public stock market has a poor track record and is not very diversified. Risks are generally similar to PE funds but with lower expected returns. One popular example of such a fund is Optimize Portugal, which also has lower management fees than the alternatives. There are also some qualifying mutual funds that invests up to 40% of their assets in international markets, hopefully improving the performance compared to the ones only invested in Portugal. One example of such a fund (which also has a comparatively low management fee) is Portugal Liquid Opportunities.

ℹ️ Good to know: It’s also possible to mix and match funds, so you could place e.g. a quarter of your investment in a mutual fund for easy access to cash should you really need it (although you’d lose your Golden Visa by selling it) and the rest in PE or VC funds to improve your expected returns.

Due to Portuguese regulations, I can only include some details of the individual funds directly in the article. If one or more funds sound interesting, click the learn more button next to it to get an introduction to someone who’s authorized to provide all the details you need (including fund prospectus and more).

⚠️ Webinar alert

Choosing the Right Investment: A Dive into Closed-Ended and Open-Ended Funds

Hosted by: Lince Capital and Optimize Investment Partners

📼 Watch webinar replay

Currently available funds

As mentioned, the list of qualifying funds open for investment varies constantly. You’ll find the currently open funds below:

-

Portugal Liquid Opportunities

Investment in public equities with >60% allocation to the largest Portuguese listed equities and <40% allocated to Oxy Capital’s proprietary international listed equities strategy.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€100,000

Subscription deadline

Open-ended

Duration

Open-ended

-

Optimize Portugal Golden Opportunities

Invests in equities and bonds (corporate and sovereign) listed in regulated markets and that have a daily quotation.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€1,000

Subscription deadline

Open-ended

Duration

Open-ended

-

C2 Atlantic Open-Ended Fund

The portfolio blends equities, bonds, and commodities, each playing a complementary role, to stay balanced and resilient across changing economic cycles.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€100,000

Subscription deadline

Open-ended

Duration

Open-ended

-

Iberian Net Zero

Focuses on renewable energy, energy efficiency and clean mobility.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€150,000

Subscription deadline

February 22, 2026

Duration

8 years

You can also click here to learn about all 41 available funds.

We’re always looking for other funds to include, so if you find any promising ones, please let me know, and we’ll investigate them.

NOTE: Unfortunately, while not as common as it once was, some funds are unsuitable for US citizens and residents (due to FATCA restrictions). I have clearly marked the funds that are available to US citizens and residents here.

Investment fund webinars

From time to time, some of the funds host webinars for Nomad Gate readers. Here are the latest ones:

Golden Visa Outlook & Liquid Fund Strategies—What Investors Need to Know

Hosted by: 3 Comma Capital

📼 Watch webinar replayChoosing the Right Investment: A Dive into Closed-Ended and Open-Ended Funds

Hosted by: Lince Capital and Optimize Investment Partners

📼 Watch webinar replayPortugal’s Golden Visa in 2025: Why Farmland Is a Smart Move for Investors

Hosted by: Terra Verde Capital

📼 Watch webinar replayPortugal’s Golden Visa and NHR 2.0: The Best Tax Strategies for Expats

Hosted by: FRESH Portugal

📼 Watch webinar replay

The entrepreneurial option: Creating 10 jobs in Portugal

While starting and running a company in Portugal for 5 years doesn’t seem like an easy route to get the Golden Visa—it has the benefit of not imposing a minimum investment amount, meaning you may get away with a smaller upfront investment than the other options.

This option has been available since the beginning of the Golden Visa program but has understandably not been as popular as investment funds (or real estate before that). After all, the whole point of the Golden Visa is to get residency and eventually citizenship in Portugal without needing to spend a lot of time in the country to manage your investment.

For some time, there was a company that offered this option as a service (at a total upfront investment of €125,000—split between service fee and capital contribution), where they would set up and run a simple company on your behalf. Unfortunately, after COVID-19 happened, they no longer offer this option.

If you are a business owner or entrepreneur in your home country, you may want to build out a European operation (e.g. customer support, tech team, etc). Basing these operations in Portugal could allow you to qualify for the Golden Visa program.

Otherwise, if you can swing the €500,000 investment, the fund route is probably the better option.

The philanthropic option: Cultural donation

If return on your investment (or any money back at all) is not your primary concern, perhaps a €250,000 donation to a worthy cause in Portugal could suit you, specifically to a project supporting the arts or maintaining the cultural heritage.

Other than giving you some warm and fuzzy feelings, there’s an argument for taking this approach if you are concerned about the opportunity cost of locking up €500,000 for several years. Instead, why don’t you donate €250,000 and keep the other €250,000 invested whichever way you prefer (be it in index funds or other investments)?

Yeah, I’m not entirely buying it either… While it’s plausible that you’ll get better returns on your non-Portuguese investments, closing the initial €250,000 gap from the donation is a steep climb.

Either way, the opportunity cost may still make this option easier to swallow.

You can also reduce the required commitment to €200,000 if supporting a qualifying initiative in a low-density region.

Qualifying donations

While this category may seem broad, there aren’t many options to choose from in practice. At least if you don’t want to go through a lengthy approval process first.

You see, in addition to submitting the confirmation from your bank that you’ve transferred the required funds to Portugal, you’ll also need pre-approval from the Office for Cultural Strategy, Planning and Evaluation (GEPAC) that the project you’re supporting qualifies.

You (meaning your lawyer) or the receiving organization may apply to GEPAC for approval. The application form is on their ARI landing page.

Currently, there are just a handful of museums with pre-approved projects.

Starting this process from scratch could easily add another year to your Golden Visa timeline, assuming the project gets approved at all.

The complete regulations are set out in order no. 2360/2017.

If you are considering this option, I’d recommend reaching out to Francisco at EDGE, as they have already helped several clients pursue the cultural donation path.

Organizations with pre-approved projects

Below, you’ll find more information about donation projects that are currently available and eligible for Golden Visa. All these are in high-density areas, meaning the donation amount is €250,000.

Culturgest had one low-density project (DESCONCENTRAR) in the past, but this one is already filled, and they don’t have any more €200,000 donation projects planned at the moment.

The available projects and number of available spots for Golden Visa donors will change over time. Our list was last updated in the summer of 2024 and we’ll try to keep it updated from time to time, however you can also receive an updated list of approved projects by getting in touch with GEPAC.

We have also shared the contact details for the responsible person at each foundation here (free Nomad Gate login required).

Ricardo Espirito Santo Silva Foundation (FRESS)

A museum of decorative arts founded in 1953 by the banker and collector Ricardo do Espírito Santo Silva. Besides the museum, the foundation hosts workshops and runs a school teaching traditional Portuguese arts and crafts.

Current projects:

- Restoration of Azurara Palace: Restoration of the building of Museum of Portuguese Decorative Arts, a 17th century palace in Lisbon. Room for 21 Golden Visa investors.

Batalha de Aljubarrota Foundation

This foundation focuses on restoring and enhancing the part of Portuguese cultural heritage associated with the historical battlefields. It has a museum and an adventure park 1.5 miles north of Lisbon, which is open to visitors.

Current projects:

- A film about the life of Nuno Álvares Pereira (a Portuguese general who was instrumental during the 1383–1385 crisis, securing Portugal’s independence from Castile). Room for 2-3 Golden Visa donors (until Sep 2024).

- Reconstruction and archeological works of Aljubarrota battlefield from 1385 as part of the Independence War. Room for unlimited Golden Visa donors.

Caixa Geral de Depósitos—Culturgest Foundation

Culturgest is a large-scale arts venue for contemporary creation that has been operating since 1993. It organizes visual art exhibitions and holds music concerts and film festivals.

Current projects:

- Scaling up a performing arts program (theater, dance, musical theater, and performance) that aims to produce and tour 20 large-scale performances over five years. Room for 20 Golden Visa investors.

They’re also considering creating a similar project for visual arts in the future.

D. Luís I Foundation:

Founded in 1996, the D. Luís I Foundation is responsible for the management and program side of cultural facilities in Cascais. It promotes cultural activities programs based on proposals from interested parties or in cooperation with other institutions and companies

For their first project eligible for Golden Visa donation—Cascais Opera 2024—they were only looking for one donation, and this is filled now. They will soon launch the Cascais Opera 2025 project.

Current projects:

- Cascais Opera 2025 – fundraising will start soon, and there will be room for two Golden Visa donors.

Serralves Foundation

This foundation manages a contemporary art museum, the House of Cinema, an Art Deco villa, and Serralves Park in Porto. It also hosts exhibitions and concerts.

Current projects:

- Serralves: At the forefront of art

- Cinema/cine-mas: Unfolding and expansions of moving images

- Artistic Production, Heritage Promotion: Major Events in Serralves

- Álvaro Siza Wing: Legacy and Future

- Joan Miró: New Perspectives

- Serralves Park: Enhancing the Heritage of Serralves Park

- Serralves Foundation: Performing Arts program

All of their available projects originally had space for more than ten Golden Visa donors; however, some have fewer now due to filling up.

For-profit investments for artistic production

In theory, it’s also possible to make a for-profit investment to support artistic production. This could take the form of an independent film production.

However, you should be aware of the risks.

First, to my knowledge, no such projects have received approval to date. Although I know of at least one that attempted this a couple years ago.

Even if your chosen project eventually gets approved, you risk significantly delaying your application, residence permit, and ultimately, your citizenship.

Second, how many independent films have you heard of that managed to turn a profit? Or break even?

Yeah, likely not many.

My point being, you shouldn’t expect to see close to your whole investment ever returned to you.

Other options

As mentioned previously, there are two more options to choose from. But honestly, I’m not sure why you’d consider these over the three options above.

Anyway, you can also choose to contribute €500,000 as either:

- Supporting scientific research—but if you’re feeling philanthropic, why not just do the cultural route?

- Corporate capital infusion, including employing five people—but then why not invest in funds or start a new business without any specific capital requirement?

It’s also a matter of finding qualifying research projects or investments. I don’t think anyone has taken these paths yet, so you can’t really rely on the experience of those before you.

That being said, we were recently approached by a planned fitness studio in Lisbon that claims they have an investment opportunity that would qualify. If you’re interested, you can reach out to them here. Just note that this is no endorsement of the investment whatsoever. Do your own due diligence!

The application and renewal process

While it’s technically possible to do everything on your own, most people hire a lawyer to take care of the process for them.

Whether you use a lawyer or not, getting a realistic, high-level understanding of the process upfront is helpful.

⚠️ January 2025 update: AIMA is in the process of streamlining the application, biometrics collection, and approval process. We're still waiting on the full details, but for now you can read this legal Q&A for an update on what we know by now:

In the rest of this section we're explaining how the process has been until the beginning for 2025, however, if you apply today you can expect a somewhat condensed, more digital and less bureaucratic process.

The application process looks like this:

Submit initial application

Once you’ve made your investment and collected all supporting documents, you submit your application through the ARI portal.

Pay application fee

Pay the application fee as soon as possible after submission, as you only secure your spot in line once it has been paid.

Receive pre-approval

After some time (supposed to take less than 90 days, but realistically about a year now), you receive an email from AIMA stating that you’ve received preliminary approval.

Book biometrics appointment

The online calendar to schedule your biometrics appointment opens up quarterly. You’ll be notified via email when you can book your slot.

Attend biometrics appointment

On the chosen date, you’ll bring all the original documentation to your in-person biometrics appointment at your chosen AIMA office in Portugal.

Submit missing documentation

If any documents are missing from your application or have expired, you’ll be asked to re-submit them. This adds a bit of delay, so it’s better to bring updated documents to the biometrics appointment if you can.

Receive final approval

After a few months (or more than a year—depending on which AIMA office you chose for biometrics), you should receive your final approval. Congrats!

Pay resident permit issuance fee

You’ll find the payment information in the ARI portal shortly after receiving your approval. Make the payment as soon as possible, as this will trigger the official start of your Portuguese residency!

Receive resident card

Barring any delays at the printing press, you’ll receive your shiny new residence permit approximately 10-20 days later.

The initial application is submitted online, including copies of the supporting documentation. Once you pay the application fee of €605.10 (per family member), you’ve officially secured your spot in line.

After the request is pre-approved by Agência para a Integração, Migrações e Asilo (AIMA), you will have to appear in person for a biometrics appointment.

AIMA will email you or your lawyer once you can schedule your appointment in their online calendar.

ℹ️ Good to know: The processing time varies significantly between AIMA locations, with Lisbon historically being the slowest. Check current processing times in our crowdsourced Golden Visa timeline database before booking your appointment.

Currently, the overall processing time from application to final approval is about 20-30 months, depending in large part on the location of your biometrics appointment.

You’ll need to submit the originals of the supporting documentation at your biometrics appointment, and due to the wait times, some of the documents may have already expired.

I’d recommend renewing what you can just ahead of the appointment. If anything is missing, AIMA may request additional or updated documents at this point. This could cause unnecessary delays, although usually not too long.

Once AIMA has everything they need, they’ll process your application and (hopefully) give you your final approval.

At this point, you’ll pay a residence permit issuance fee of €6,045.20 for each applicant, which marks the official start of your Portuguese residency. Congratulations!

After ten to twenty days, you should receive your residence card, valid for two years from the payment date.

Two years later, when the first card expires, you must renew your residence permit.

This used to require an in-person appointment to update your biometric data and supply fresh documentation that you still meet all the requirements. However, since 2023, this has been replaced by a much simpler online procedure. No in-person appointment or supporting docs required!

It’s unclear whether this online procedure is here to stay or just a temporary fix while AIMA grapples with the massive application backlog. Time will tell.

This timeline shows at what point in the process you need to renew and when you can apply for your Portuguese citizenship:

Year 1–2

Your residence card will allow you to live and work in Portugal, plus travel freely within the Schengen countries (you also need to bring your passport) without applying for any visas.

In the first two years, you must spend at least a total of 14 days in Portugal.

To renew your residence permit and receive a new residence card, you must go through a renewal application process between 30-90 days before your current residence card expires.

As of 2023, the renewals are now online (they used to require another in-person SEF appointment), with no further biometric appointments needed. You still need to pay the same application and residence permit fee as if it were an in-person appointment.

Year 3–4

Your new residence card is valid for two years, and you again need to spend at least 14 days in Portugal to qualify for further renewals or citizenship.

At the end of the period, you’ll go through another renewal process.

Year 5+

After the fifth year, you can apply for permanent residency or citizenship (you can choose which one). If you don’t want to apply for either, you can keep renewing your Golden Visa every two years (at the end of year 6, year 8, and so on).

How to prepare and apply for the Portuguese Golden Visa

So you’ve found an investment you like? Let’s look at the next steps you need to take to get your application in.

While the process isn’t very complicated, it involves gathering a lot of documentation—both in Portugal and your country of origin. It will be beneficial to work with a native Portuguese speaker (typically your lawyer) if you don’t already know the language.

The steps for the initial application look something like this:

- Get a Portuguese fiscal number (NIF), open a local bank account.

- Transfer the investment amount to your Portuguese bank account and invest from there.

- Gather all required documentation from your country of origin (at most three months before submitting your application).

- Have it all legalized and translated into Portuguese.

- Gather necessary documentation in Portugal (your lawyer can help with this)

- Fill out and submit the application for the Golden Visa (typically through your lawyer).

- Pay the processing fee.

- Wait until you hear back from AIMA with a preliminary approval.

- Pick a date, time, and place to attend your biometrics appointment.

- Bring the originals of the documentation submitted with the application to your in-person appointment.

- Wait for final approval.

- Pay the residence permit issuance fee and get your residence card.

-

Repeat a substantially similar process for renewals at the end of years 2 and 4.Update: Since 2023, there has been a system for automatic online renewals, making renewals much easier. Note: It’s not certain whether this system is here to stay.

All of these steps can be completed remotely (with the help of a lawyer), except for the biometrics appointment—you will have to travel to Portugal for that.

Let’s take a closer look at some of the steps.

Getting a NIF and opening a Portuguese bank account

I won’t go into details on how in this article since I already explained in great detail in two other articles (how to get a NIF and how to open a bank account in Portugal as a non-resident).

You need those things because you need a Portuguese bank’s confirmation that you have transferred the funds and made your investment. You need a Portuguese tax number (NIF) to open the bank account.

Getting the NIF is simple and can be done in less than a day (in person). To get a tax number as someone without a fixed legal address in the EU/EEA, you will need a Portuguese representative for the tax authorities or sign up for electronic notifications through Portal das Finanças.

Your lawyer or other representative can also help you remotely apply for a tax number. Some banks allow remote account opening, too.

Note that bank account openings have gotten very slow recently, typically taking about a month for non-residents. Also note that if you’re a US citizen or resident, not all banks can offer you a brokerage account (which is needed if you go the investment fund route). Notably, this includes Millennium BCP, so find another bank.

🙋 Legal Q&A:

Transferring the investment amount

Once you’ve identified your investment and opened your bank account in Portugal, it’s time to transfer the investment amount to your Portuguese account. Since this is a substantial international transfer by most standards, it often pays to shop around for the best rate.

It’s unlikely that just going to your regular bank and asking them to set up an international wire transfer to Portugal will be very economical, as most banks may charge a “hidden” FX markup of several percentage points. After all, a 3% markup on a €500,000 transfer is €15,000…

Luckily, there are better options! One of the most popular options is to use Wise, which is known for its easy and relatively quick transfer process and transparent rates (no hidden FX markup). Depending on which currency you transfer from, you often pay around 0.5% on top of the mid-market rate. Still, you can likely do even better for a transfer this large.

If you prefer a concierge-style transfer where you can negotiate a competitive fixed rate for the transfer ahead of time, you should check out RegencyFX. Their initial quote might not be the best, but if you let them know that you are comparing rates with multiple providers, they should come down to one of the best offers you’re likely to get from a dedicated foreign exchange company.

Finally, if you want the best possible rate and are okay with jumping through some hoops to get it, you’re unlikely to find any better provider than Interactive Brokers.

Their markup is only 0.002%. No, that’s not a typo. However, as they are primarily an investment broker (and probably one of the best in the world at that), they might frown upon you only using their services to exchange currency. So I’d recommend placing some investments with them as well. There are some gotchas to not accidentally delay your transfer for up to a couple of months, so I’d recommend reading this forum thread for all the details.

Gathering documentation

Here are the things you always need to gather for your application:

- A valid passport.

- Evidence that you are legally present in Portugal (your visa, entry stamps, valid travel medical insurance, etc.).

- Your criminal records from your country of origin, or, if you’ve lived elsewhere for at least the last year, your criminal records from that country. The extract of the criminal records must be issued within 3 months of the online application, legalized, and certifiably translated into Portuguese.

- Completing a form authorizing AIMA to get an extract of your (hopefully non-existing) Portuguese criminal records.

- A sworn statement declaring that you will comply with all the minimum investment requirements (amount and 5-year holding period).

- Documents showing good standing with the Portuguese Tax and Customs Authority and Social Security system. These can, at most, be issued 45 days before your online application.

- A receipt showing that you already paid the application processing fee.

- Specific documentation relating to your investments (see below).

Again, all documentation (unless otherwise noted) needs to be issued at most 90 days before the date you submit your online application.

Anything issued by a foreign entity has to be legalized (e.g. with an apostille if your country of origin has signed the Hague convention).

Moreover, anything not in Portuguese must be translated and certified.

Your lawyer can generally take care of anything you need to collect in/from Portugal. That includes the documentation relating to your investment.

What type of additional documentation you need depends on your chosen form of investment. Click each investment type for more information:

-

Capital transfer of the amount of €500,000 for the acquisition of units of non-real estate investment or venture capital funds (

translation)

-

The creation of at least 10 jobs (

translation)

-

Capital transfer on the amount equal to or above €250,000 for funding/supporting the arts or restoring/maintaining the national cultural heritage (

translation)

-

Capital transfer on the amount equal to or above €500,000 for investing in research activities (

translation)

-

Capital transfer of the amount equal to or above €500,000 for the establishment/reinforcement of a commercial company with its head office in Portugal (

translation)

And finally, if you’ve included any family members in your application, see the required family reunification documentation ( translation).

Submitting the application

The easiest and safest option is to let your lawyer handle and guide you through the application process.

However, if you insist on doing it yourself, these are the steps:

- Go to the AIMA application registration form.

- Fill it out, and upload all the supporting documentation (legalized and translated). Ensure everything is correct to avoid extra costs and wasting precious time. If you have a lawyer, have them look over everything before submitting.

- A payment request (“DUC”) will appear in the ARI portal after submission. Pay this through your Portuguese online banking interface.

- After you receive pre-approval (which currently takes a while—upwards of a year), you will receive an email letting you select a date and location for the in-person biometrics appointment. This is done through an online calendar on AIMA’s website, with availability opening quarterly. If you’re not already based in Portugal, make sure to pick a date when you and any family members (if you get invited at the same time—which isn’t always the case) can all travel to Portugal.

- Show up for your appointment on the agreed date and time. Your lawyer typically takes care of all the talking. Make sure to bring the original versions of all the documents you submitted online as part of your application. It’s best to request updated versions of all the documents ahead of time, as many likely have already expired. If you don’t have time, you can submit updated documents after your appointment if requested.

- Wait a few months until AIMA notifies you that your application has been approved. You now pay the remaining application fee (€6,045.20 per person) using the new DUC in the ARI portal.

- Once your payment has been registered, your first residence card will be sent to the printing press. Barring delays, you’ll receive the card to the Portuguese address stated on your application in a couple of weeks.

Frequently Asked Questions (FAQs) about the Portuguese Golden Visa Program

FAQs ↺

- What are the advantages of the Golden Visa in Portugal?

- What counts as a low-density area?

- Should I apply for the Golden Visa or another residence permit?

- How much does it cost to obtain the Portuguese Golden Visa?

- Which investment funds are available for Golden Visa investments?

- Can I spread my fund investment across several funds?

- If the investment fund is shut down before getting permanent residency or citizenship, what happens to the application?

- Can I make the investment through a limited company?

- Could an art or cultural heritage donation be tax deductible?

- How long is the wait/processing time for the Portuguese Golden Visa?

- Can the Golden Visa application be done remotely or in an embassy/consulate?

- When do I have to travel to Portugal?

- How do I schedule my biometrics appointment?

- Does the visit for biometrics count toward the required time spent in Portugal?

- How is the time spent in Portugal calculated?

- How do I prove that I’ve been in Portugal?

- Should I work with a lawyer to obtain the Portuguese Golden Visa?

- Should I avoid certain firms offering Golden Visa services?

- Can I include my family on my Golden Visa application?

- Do dependent children need to stay dependent during the whole Golden Visa process?

- Should all supporting documentation be translated into Portuguese?

- I’m not living in my home country. From which country do I need to obtain criminal records?

- What is the expiration date of the supporting documentation?

- Do I have to pay taxes in Portugal?

- How long does it take before I can acquire Portuguese citizenship and passport?

- Do I need to learn Portuguese before getting my citizenship?

- What happens if I can’t renew my residency in time or have a gap in my renewal?

- How expensive is it to replace a lost residence permit?

- How much time can I spend in other Schengen countries while a Portuguese resident?

- I heard the EU wants to stop Golden Visas—could that happen in Portugal?

What are the advantages of the Golden Visa in Portugal?

In short, you can:

- Live and work in Portugal

- Bring your family with you

- Apply for permanent residency and/or Portuguese citizenship after five years

- Access the Portuguese healthcare and education system (on the same basis as Portuguese citizens)

- No need to spend more than an average of seven days in Portugal per year

- Travel freely in the entire Schengen Area

The Schengen countries include Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Cyprus is required to fully join the Schengen Area in the future, but as a Portuguese resident, you can already travel there visa-free. Other than that, Ireland is the only EU country outside the Schengen Area.

What counts as a low-density area?

The updated Golden Visa law of October 2023 changed what counts as a low-density area.

Previously, this was defined by the so-called NUTS III areas (regions) with a population density of less than 100/km2 or a GDP of less than 75% of the national average.

Now, in addition, only municipalities and parishes included on a list of “interior” areas within the above-mentioned NUTS III areas count as low-density.

I’ve created this map to visualize the areas that still qualify as low-density:

So, why should you care whether an area is low-density or not?

Well, it only matters if you’re pursuing the Golden Visa by either a) supporting art or culture, b) employing 10 people in Portugal, or c) supporting scientific research.

In those cases, your required investment will be reduced by 20%:

| High-density requirements | Low-density requirements | |

|---|---|---|

| Supporting art or culture | €250,000 | €200,000 |

| Employing people in Portugal | 10 employees | 8 employees |

| Supporting scientific research | €500,000 | €400,000 |

Should I apply for the Golden Visa or another residence permit?

The benefit of the Golden Visa is that you can get Portuguese permanent residency or citizenship without needing to live in the country most of the year. It’s as if your investment is spending the time in Portugal instead of you for 5 years.

It is also the only option if you are not ready to move to Portugal yet but want to start the clock, so to speak, toward permanent residency or citizenship.

On the other hand, if you are ready to move and want to spend the next five years in Portugal, alternative ways might be cheaper (and have a shorter processing time). For more details, look at our comparison of the D7 and Golden Visa.

Webinar Alert: Portugal’s D7 vs Golden Visa - which one to apply for?

Hosted by: Property Finder Portugal

📼 Watch webinar replay

How much does it cost to obtain the Portuguese Golden Visa?

We have an article dedicated to the taxes and fees for the Portuguese Golden Visa, which we regularly update with information specific to each individual option. Nevertheless, to give you the “tl;dr” version:

You will need to pay a €605.10 application fee when submitting your application per family member, followed by €6,045.20 per person for the initial issuance of the Golden Visa.

The two renewals (at the end of years 2 and 4) are charged at €3,023.20 each, per person. You must also pay the €605.10 application fee again for each family member.

This means that, currently, you will need €13,906.90 per person for the application and permit fees for the whole process, including two renewals required for permanent residence. These rates increase slightly every year to keep up with inflation.

Note that, officially, the fees are about a third higher than what you actually pay. The reason is that since late 2023, there’s been a 25% discount for submitting your application online (which essentially everyone does).

| How often | Full fees | Fees with online discount | |

|---|---|---|---|

| Application Fee | Initial application and each renewal | €806.80 per person | €605.10 per person |

| Residence Permit Fee | Initial application | €8,060.26 per person | €6,045.20 per person |

| Residence Permit Renewal Fee | Each renewal | €4,030.90 per person | €3,023.20 per person |

These fees were last updated on March 01, 2024 and are still valid as of June 2024. You’ll always find the latest fees on AIMA’s ARI website under “Taxas”.

July 2024 update: Some investors are being asked to pay just €177 euros to renew. It’s too early to tell which investors will benefit from this lower fee and whether it will apply consistently going forward.

It’s likely linked with the conversion of the Golden Visa permit to a special D2 entrepreneurship permit under the More Housing law of 2023. This should only apply to those who qualified for the Golden Visa with an investment type that has been discontinued (property investment and capital transfers), but it’s too early to conclude either way.

If you’re applying for the Golden Visa today, you should still expect to pay the renewal fees listed in the table above.

Additionally, you’ll have to factor in the cost of hiring lawyers and any costs of obtaining, legalizing, and translating the supporting documentation.

Which investment funds are available for Golden Visa investments?

Exactly which funds are available varies over time. You can find all active funds on the website of the regulator. However, most of these are not open for subscriptions or do not meet the requirements.

Luckily, we’ve created a continually updated directory of qualifying investment funds.

Do check it out!

Can I spread my fund investment across several funds?

Yes! Several investors have successfully received approval with their investment spread across several funds. That said, many funds apply high minimum investment thresholds (even as high as €500,000). So, for that reason, as well as to not drastically increase one’s compliance burden, few people invest in more than two or three funds.

If the investment fund is shut down before getting permanent residency or citizenship, what happens to the application?

In that case, you would have to move your investment into another fund under the same Golden Visa category. To avoid that from happening, make sure you invest in a fund with a long enough duration.

You can also invest in an open-ended equity fund such as Optimize Portugal Golden Opportunities where you can sell your stake at any time.

Can I make the investment through a limited company?

Yes, you can make your investment through a legal entity. However, it must be a company with a single owner (empresa unipessoal) registered in Portugal. Companies registered in the EEA are also accepted if they have a permanent establishment in Portugal.

You can’t make an investment through an investment or holding company that has more than one owner or member of the company.

Could an art or cultural heritage donation be tax deductible?

While there may be some exceptions that I’m not aware of, the answer is most likely no.

It’s up to the country where you are a tax resident whether or not they will let you claim deductions for donations to foreign charities. In most countries, that’s only possible if the charity is registered or approved domestically. That’s unlikely to be the case for the projects you can support in Portugal.

One possible exception was the UK, which used to allow deductions for charities registered in the EU or EEA. But starting in 2024, that’s no longer possible.

Another possibility could be a small deduction in Portugal, but that would only work if you’re already a tax resident. You could deduct 25% of the donation but only up to 15% of your total tax liability. This assumes that you make the donation to an approved entity. Worse yet, total tax credits are capped at €1,000 per year, so the deduction in Portugal would be insignificant in any case.

Otherwise, you can always check the rules for your country—perhaps they are more flexible than most.

How long is the wait/processing time for the Portuguese Golden Visa?

It varies over time. It used to take around five or six months, but the processing time has increased significantly in later years. In particular, those who applied at the end of 2021 have seen pre-approval times go beyond two years in extreme cases.

Check out our crowdsourced Golden Visa timeline database for up-to-date information about current processing times.

In addition, once scheduled make sure you attend your biometrics appointment no matter what. Otherwise you’ll experience significant delays. And I really mean significant. Like, at least one or two years. So don’t miss it!

Can the Golden Visa application be done remotely or in an embassy/consulate?

The application is submitted online, but you must travel to Portugal for biometrics after your application is accepted. Currently, it is not possible to do biometrics in an embassy or a consulate.

When do I have to travel to Portugal?

Your biometrics appointment takes place about one to two years after submitting your initial application. It depends on how long your application takes to receive pre-approval.

After doing biometrics and getting your first residence card, you will need to spend 14 days in Portugal every two years to renew your permit.

How do I schedule my biometrics appointment?

AIMA’s online scheduling calendar typically opens quarterly for those who have received pre-approval.

AIMA will send the invitation email, in chronological order, to investors (or their lawyers) when they are pre-approved and can go ahead and schedule their appointment.

Once you receive the email, you’ll have about two weeks to book an appointment in an allocated month. But since many slots get booked fast, it’s better to be prepared and secure your appointment immediately.

Does the visit for biometrics count toward the required time spent in Portugal?

Only time spent in Portugal after getting your first residence card counts. Therefore, the first biometrics visit is not included in the seven days you must spend in Portugal during the first year.

How is the time spent in Portugal calculated?

This question comes up quite often.

You only count full days in the country. This means you don’t count the days you arrive or depart.

So if you’ve stayed from Saturday one week until the following Saturday, that counts as six days (Sunday through Friday), not seven or eight.

How do I prove that I’ve been in Portugal?

There are several ways to prove the time spent in Portugal; however, just collecting passport stamps when traveling to Portugal isn’t sufficient.

The reason is that you can move freely within the Schengen Area without further passport controls. So theoretically, you could arrive in Portugal, then travel to, e.g. France for a couple weeks, and then fly out of Portugal again.

To prove that you’ve actually spent the required time in Portugal, you should keep the following:

- Physical boarding passes

- Hotel receipts covering your entire stay

- Any purchase or ATM receipts you receive during your stay

In addition to keeping the physical copies of your boarding passes, make sure to make a digital copy, as the ink often fades with time. The same goes for any other receipts.

It can also be a good idea to provide your NIF (tax number) whenever you make a purchase. Shops and restaurants typically ask if you want to add this (often referred to as número de contribuinte or just contribuinte). This will then be printed on your receipt. And since Portuguese tax residents get tax deductions based on certain purchases, the transactions are also reported to the tax authorities. You can later access these in Portal das Finanças.

By making purchases with your NIF every day you’re in Portugal, you have a pretty easy way to prove that you spent the time there.

Should I work with a lawyer to obtain the Portuguese Golden Visa?

I recommend that you do. You’re making a sizable investment to gain Portuguese residency (and eventually citizenship), so I wouldn’t recommend taking any chances during the application process. While the legal fees aren’t insignificant, they are much cheaper than making an investment that does not qualify or jeopardizing your application due to formal errors.

Many law firms charge upwards of €4,000–€6,000 for the primary applicant. There are also cheaper options, but it’s worth asking if certification of documents, translations into Portuguese, and/or tax representation is included. The application for dependents is cheaper and often averages between €1,000 and €2,500. The renewals of Golden Visa for the principal applicant (at the end of years 2 and 4) average around €2,000–€2,500.

When hiring one of the more expensive firms, expect to pay up to €20,000–€30,000 in legal fees for a family of four (for the initial application and the two renewals).

We’ve curated a list of experienced, reliable, and reasonably-priced Portuguese lawyers recommended by Nomad Gate readers and through our network.

Should I avoid certain firms offering Golden Visa services?

While this might be a leading question, the answer is definitely YES!

Many so-called “consulting firms” receive varying degrees of commissions from your investment (in addition to the fees they charge you directly) and tend to steer you toward the investments where they get the fattest check.

Even many law firms have been known to collect these kinds of commissions behind their clients’ backs.

While there’s nothing inherently wrong with receiving commissions from referrals (we do, too), pretending to provide objective investment advice while doing so behind your back isn’t a great look.

That’s why we explicitly do not provide investment advice!

Still, you can use Nomad Gate to research the various available options. Plus, you’ll find many discussions of different investment options in the community forums.

Can I include my family on my Golden Visa application?

Yes, you can! You can bring your spouse and your kids (as long as they are younger than 18 at the time of application or enrolled in studies and being supported by you).

In certain circumstances, you can even bring your parents and/or in-laws as long as you demonstrate that you support them.

Note that depending on your goals (e.g. if you’re just interested in eventually qualifying for citizenship for you and your spouse), you may save some money and hassle by applying alone.

You see, spouses of Portuguese citizens also qualify for citizenship after being married (or in a marriage-like relationship) for three years. After six years of marriage, your spouse doesn’t even need to pass any Portuguese language test! And yes, the time you were married before acquiring Portuguese nationality also counts.

Still, if you don’t already have visa-free access to Europe, it may be worth including everyone from the start.

Do dependent children need to stay dependent during the whole Golden Visa process?

Any dependents must meet the same criteria during each renewal, not just on the initial application.

Should all supporting documentation be translated into Portuguese?

Yes, anything not in Portuguese needs to be certifiably translated (in addition to being legalized). Not even documents issued in English are accepted.

It can be a good idea to do this in your country of origin, but it’s also possible to do it in Portugal.

I’m not living in my home country. From which country do I need to obtain criminal records?

Assuming you’re the main applicant, if you have lived for at least 12 months in the country where you currently reside, that’s the country you need to obtain the criminal records from.

Otherwise, you’ll need to obtain them from the country of citizenship.

Due to a seeming typo in the law, this does not apply to the main applicant’s spouse. In this case, the AIMA agent may request records from both the country of citizenship as well as the country where you’re currently residing.

What is the expiration date of the supporting documentation?

The expiration date varies depending on the document:

- Birth certificate: 12 months

- Marriage certificate (if including your spouse): 6 months

- Criminal record/police certificate: 3 months

For the documents obtained in Portugal (tax and social security records of no debt or no record), the expiration date is 45 days.

And yes, even your birth certificate must be reissued if it’s over a year old.

While you might think that should be valid forever, birth certificates in Portugal aren’t static documents issued only at birth. They are updated with all sorts of things throughout your life (like name changes, marital status, and so on).

While that’s probably not the case where you’re from, they still insist on a newly issued copy.

Do I have to pay taxes in Portugal?

Legal residency and tax residency are independent concepts, and you don’t necessarily become a Portuguese tax resident by utilizing the Golden Visa.

Even if you don’t become a full tax resident in Portugal, you will still pay tax on Portuguese income and real estate assets (in case you also decide to get property in Portugal).

In either case, becoming a tax resident in Portugal can be quite lucrative, especially for the first ten years, thanks to the Non-Habitual Resident (NHR) tax scheme.

Note that from 2024 onwards, the NHR scheme is now much more limited than before. However, if you started the process of moving to Portugal in 2023, you can still qualify for the old NHR program if you become a tax resident in 2024.

According to PwC, you’re tax resident in Portugal if you fulfill either of these conditions:

- Spend more than 183 days, consecutive or not, in Portugal in any 12-month period starting or ending in the fiscal year concerned.

- Regardless of spending less than 183 days in Portugal, maintain a residence (i.e. a habitual residence) in Portugal during any day of the period referred to above.

How long does it take before I can acquire Portuguese citizenship and passport?

Due to a change in the Portuguese Nationality law in 2018, the required period of residency before you can apply for Portuguese citizenship has been reduced from six years to five years.

While the citizenship application may take a while to process (currently about two years, depending on the IRN office where you apply), once granted, the application for a Portuguese passport generally only takes about five working days. Per 2024, an ordinary passport costs €65 and is valid for five years.

Do I need to learn Portuguese before getting my citizenship?

Yes, you’ll need to either pass a test (“CIPLE”) at the A2 level or participate in a 150-hour long government-approved “PLA” course.

While it’s relatively easy to pass the CIPLE test, it does require some effort and commitment. A2 is the second lowest level on the CEFR scale, which runs from A1 to C2. A2 is the elementary level, meaning you should be able to ask and answer simple questions on familiar topics.

For comparison, most European countries require at least B1 level for naturalization.

There are plenty of good ways of learning Portuguese online, and I’d recommend spending your required time in Portugal practicing further.

You can take the Portuguese language test any time before applying for citizenship or permanent residency. A potentially helpful tip is to take the language test abroad (not in Portugal), as those tests seem to be graded more favorably.

If you want to avoid taking the CIPLE exam, there are some organizations that will let you take the 150-hour PLA course remotely via video calls.

The one most frequently mentioned in our forum is EdPro, which charges about €800 per person for the full course (per April 2025), including the certificate needed for your nationality application. Nomad Gate readers can even get a 10% discount off their current price.

EdPro’s group classes are intensive, requiring 4 hours per weekday for about seven to eight weeks.

If you would rather take a PLA course at a slower pace, I recommend reaching out to CipleMaster to learn more about their flexible options.

While their classes come at a steep premium over what’s offered by EdPro, at least you can get a 5% discount if you contact them via the above link.

What happens if I can’t renew my residency in time or have a gap in my renewal?

Any period where you held an expired residence card (for example, due to no available renewal appointments) can still count toward citizenship. For it to do so, you’ll need to request a Certidão de Contagem do Tempo from AIMA.

Of course, if your residence card expires, you might face challenges traveling in and out of the Schengen Area, particularly if you have layovers in other Schengen countries. That’s especially true if you don’t already have visa-free access based on your citizenship.

How expensive is it to replace a lost residence permit?

I know this makes no sense, but if you were to lose your physical residence permit and request a new card, this will cost you the same as the initial issuance of the permit.

That means several thousand euros to replace a lost permit!

In other words, DO NOT LOSE YOUR CARD!

Some people carry a laminated copy with them to reduce the chance of misplacing the card. You only need the original when traveling in or out of Portugal and attending certain appointments.

How much time can I spend in other Schengen countries while a Portuguese resident?

Officially, you can spend 90 out of every (rolling) 180 days in Schengen countries other than Portugal. The time you spend in Portugal doesn’t count toward this limit.

However, you won’t need to keep a close tab on this in practice. Since there generally are no internal border controls in Schengen, no one really keeps track of how much time you spend in each country.

But don’t try to abuse this! You cannot reside permanently in another Schengen country without a local residence permit.

Until you receive your Portuguese citizenship, that is.

I heard the EU wants to stop Golden Visas—could that happen in Portugal?

It’s correct that the European Commission wants to end citizenship-by-investment (CBI) programs within the EU, also popularly referred to as “Golden Passports.”

However, the Portuguese Golden Visa is not a CBI program but rather a residency-by-investment (RBI) program. The difference is that you “only” get residency in return for your investment.

That doesn’t mean you won’t qualify for citizenship eventually (according to the Nationality Law), but that’s not technically part of the Golden Visa deal.

Either way, the Portuguese Golden Visa program is likely to end eventually—whether due to pressure from the EU or not. Even so, that would only affect future applicants. The rights of existing applicants and permit holders would still be safeguarded.

Golden Visa Webinars

Occasionally, some of our partners host webinars for Nomad Gate readers. Here are some of the latest:

Golden Visa 2025: Nationality Law, AIMA Updates, and Insights into Portugal’s Pharmacy Sector

Hosted by: PharmaForte

📼 Watch webinar replay

Are the changes to the citizenship law constitutional?

Hosted by: Liberty Legal

📼 Watch webinar replay

Golden Visa Outlook & Liquid Fund Strategies—What Investors Need to Know

Hosted by: 3 Comma Capital

📼 Watch webinar replay

Latest Golden Visa Announcement & New Open-Ended Fund

Hosted by: C2 Capital

📼 Watch webinar replay

Golden Visa Update: AIMA Progress, Constitutional Court Ruling & Permanent Residency

Hosted by: Prime Legal

📼 Watch webinar replay

Choosing the Right Investment: A Dive into Closed-Ended and Open-Ended Funds

Hosted by: Lince Capital and Optimize Investment Partners

📼 Watch webinar replay

Portugal's HQA® Program & IFICI Tax Regime (NHR 2.0)

Hosted by: Empowered Startups

📼 Watch webinar replay

Portugal’s Golden Visa in 2025: Why Farmland Is a Smart Move for Investors

Hosted by: Terra Verde Capital

📼 Watch webinar replay

You can access recordings from previous webinars, plus be notified of new ones.

Portugal Golden Visa Legal Q&As

While we’ve tried to make this article as accurate as possible, there are some questions that are better left to the legal professionals to answer.

Here’s a list of questions with in-depth answers provided by lawyers in our network:

Unanswered questions?

If you still have questions about the article or the Golden Visa, please post them in our active Portugal Golden Visa forum.

The usual disclaimer: Nothing in this article should be considered legal or investment advice. It is merely a best effort representation of the information I have gathered through countless hours of online and offline research into the subject. If you want definitive answers to specific questions, please consult your lawyer. If you don’t yet have a lawyer, click here to see the most popular law firms among our readers.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.