So you recently moved to Malta, and now you want to open a bank account?

First of all, do you really need a local Maltese bank account?

Surprisingly, for most of us, the answer is not really. Especially if you just need a regular checking account to receive and send payments, with a debit card for spending and cash withdrawals.

Any euro account in the Single European Payments Area (SEPA) will do just fine. And honestly, Maltese banks are far from the best on the continent.

So perhaps you should just open an account with someone like Bunq, Monese, or Wise?

It will save you lots of frustration, time, and money.

But there are some reasons you might want to bank in Malta:

- You’re a non-domiciled resident and want a Maltese account to remit money to (that you for some reason want to be taxed in Malta).

- You want to build a relationship with a local bank to apply for a mortgage in the future.

- Some direct debits might be easier to set up/only work with a local bank account.

The banks

There used to be a couple straightforward options that would give you a Maltese Bank IBAN by simply completing an online application.

Sadly, LeoPay moved their accounts to Bulgaria, Nemea lost their banking license, and SATA Bank is currently not open to new applicants while dealing with an ongoing investigation by the Malta Financial Services Authority (MFSA).

Currently, you will need to open an account in person (except for with MeDirect). If you have troubles opening a regular bank account with the banks listed below, check out the last section about opening a “basic payment account” in Malta in accordance with EU regulations.

The following are the most popular banks among expats in Malta. The easiest to open are listed first.

MeDirect

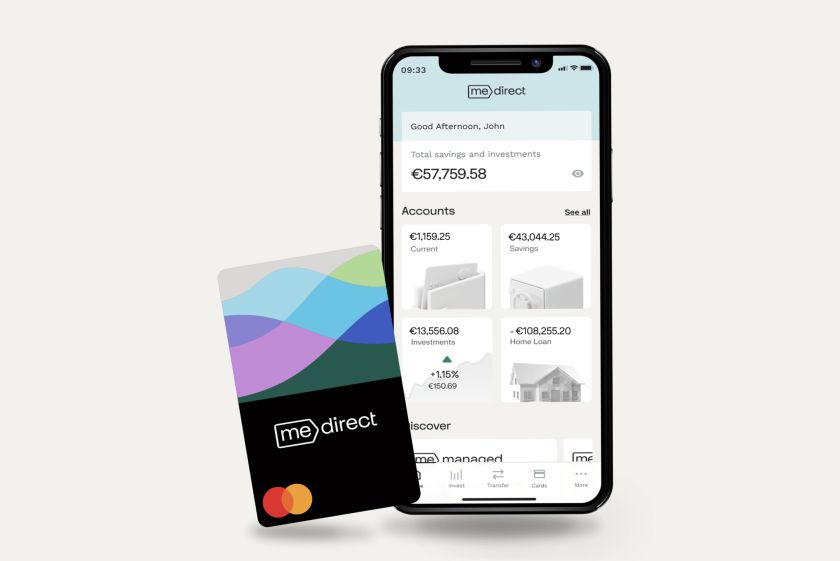

Formerly known as Mediterranean Bank, MeDirect is Malta’s third largest bank and with a history specializing in savings an investment products.

However, after recently launching their (multi-currency) debit card they have become the obvious choice for anyone looking for a Maltese bank account for everyday transactions domestically and abroad.

Temporary offer*: MeDirect is offering Nomad Gate readers a €25 welcome bonus when entering the following referral code when signing up:

Important: To qualify for the bonus, do the following within two months of opening your account: 1) Download and link the MeDirect app, 2) order a debit card (virtual or physical), and 3) use the card for at least five purchases totaling at least €300. Full T&Cs.

* Required disclaimer: This is a joint marketing communication by Nomad Gate and MeDirect. MeDirect Bank (Malta) plc, company registration number C34125, is licensed by the MFSA to undertake the business of investment services under the Investment Services Act (Cap. 370).

The only requirements for opening the account is that you reside somewhere in the EU/EEA, the UK, or Switzerland. It is also the easiest account to open of all as it can be done completely online with none of the unnecessary hurdles imposed by other Maltese banks. (Bank reference letters, I’m looking at you!)

To verify your ID you can either upload a scan and use your webcam to take a selfie, or you can take photos of your ID + a selfie with your phone. You can also verify yourself at their branches either in Tigne, Sliema or in Gozo. Unlike virtually every other bank in Malta, these guys actually treat you well and provide excellent service, as well as excellent online banking!

Note: As this is primarily an investment bank, I’d recommend checking out their investment options and high-interest term deposit accounts as well.

MeDirect at a glance

Highlights

-

The easiest option for opening an account in Malta

-

Modern online banking and app

-

Free multi-currency debit card (virtual or physical)

-

Support for Apple Pay and Google Pay

-

Excellent investment and savings products, including high-yield term deposit accounts (usually among the best interest rates in the eurozone)

-

Competitive mortgages for up to 90% of property value

-

Free same-day SEPA transfers

-

Accounts in EUR, GBP, USD, AUD, NOK, CAD, CHF, JPY, DKK, and SEK

-

Free cash withdrawals up to €350 per month

Things to note

-

1.5% exchange rate markup on purchases in currencies you don't have a sufficient balance in (reasonable for Malta)

PostaPay

PostaPay is a prepaid debit card account that comes with a unique Maltese IBAN. It’s offered by Lombard Bank through all MaltaPost offices across the islands.

While not technically a bank account, PostaPay should work just fine if you just need a Maltese IBAN (e.g., for demonstrating ties to Malta), and a debit card that’s fee-free in Malta and in the rest of the eurozone (ATM withdrawals have a small fee for non-Lombard Bank ATMs).

You’ll find their current fee schedule here.

They now also have internet banking (something that was clearly lacking for a while). For a one-time 15 euro fee, you can get access to internet banking through use of a software token together with their mobile app.

What’s needed to open the account seems to be a bit unclear. I asked in several MaltaPost outlets and got somewhat different responses every time. And all differed a little from what was listed on the MaltaPost website.

Here’s what you will (definitely) need to open the account:

- €50 minimum deposit

- ID (e.g., your eResidence card and passport)

- Proof of address (can be your eResidence or ID card)

You might also be asked for:

- Color copies of said ID documents (two MaltaPost outlets asked for this, but where I eventually opened my account they said it wasn’t required)

- Residence permit (listed on the website, but your eResidence card should be sufficient)

- Utility bills (listed on the website, but not needed if the address listed on your ID/residence card is correct)

- Pay-slips or other documentation showing your income (I was asked this at one MaltaPost outlet, but the others didn’t ask for this)

The account opening should take about two weeks, and you will receive your debit card, account number, and PIN in the mail when it’s ready.

I also wrote a quick guide to help you activate your PostaPay card once you receive it.

BNF

While opening an account with most of the “regular” banks in Malta can be a soul-crushing experience, opening an account with BNF (formerly Banif) is usually just mildly frustrating.

While they still require a lot of paperwork, documentation, and usually a €500 12-month term deposit, at least they don’t ask for a reference letter from your previous bank.

Like with the other banks featured in this article, the exact requirements may vary depending on the branch you visit and the mood of the banker assigned to you.

Yet, here is a list of what you’d usually need to open an account with BNF in Malta:

- ID (e.g. passport & e-Residence card)

- Address proof (utility bill, bank statement, ID card with your address, etc.)

- Employment contract (can be from a non-Maltese company) or other proof of income

In most cases, you will also be asked to deposit €500 for a year. You’ll earn interest but can’t touch the money during that period. While some people have reported that they were not asked for this, most seem to be.

To open an account, you should schedule an appointment either by calling them at (+356) 2260 1000 or by filling out this online form.

Bank of Valletta

By far the largest bank in Malta, BOV has been around since 1974, offering a complete range of banking services.

While it is a well-regarded and robust bank, it can be a bit of a hassle to open an account when first arriving in Malta.

BOV’s requirements aren’t all that different from BNF, with the exception that they up until now have required a reference from your current bank. Usually your current bank will charge you for this service (often somewhere between €20-100)—if they will even do it at all. In recent years they have also started accepting references from your employer, which might be easier. However, it seems BOV (at least certain branches) now (as of fall of 2019) have stopped asking for reference letters—at least in certain cases. YMMV.

This is what you’ll need to open an account with BOV:

- Your national ID card or Passport

- Your Maltese residence card (if you’re living in Malta)

- Address proof if your ID/residence card does not contain that information (e.g., utility bill, rental contract, bank statements, government correspondence, etc.)

- As a new arrival in Malta, you’ll need a document proving your connection to Malta:

- Work contract

- Contract of property purchase

- Valid rental agreement (at least 6 months duration)

- A bank or employer reference (only possibly)

To start the account opening process, fill in their contact form , and you will hear back in the next couple of days.

Note that their account opening process involves several steps, which need to be completed within about a month.

- Schedule an appointment for onboarding.

- Complete onboarding (account application) in person.

- About two weeks later, if they accept your application, you will be called back to complete the account opening in person.

Important: You need to complete the account opening within 1 month from when you completed the onboarding (step 2)—if not you’ll have to start over from the beginning.

HSBC

HSBC is the largest of the international banks in Malta. While I don’t have much personal experience with the bank, it seems to entail at least as much hassle as BOV, and not really any significant benefits.

To quote Streber, “in Malta, the H in HSBC stands for Headache.”

Still, if you’re already a customer of HSBC in another country that might ease the account opening process a bit. Contact your current HSBC branch for more information.

For anyone else, the requirements are more or less the same as with BOV (at least on paper), except that they seem only to accept a bank reference—not an employer reference.

Even though the official requirements are similar to BOV, in practice it seems they tend to ask for more supporting documentation that—depending on the circumstances—might be harder to provide (e.g. audited financial accounts for your company if you run your own business—even when just applying for a personal account).

Start the account opening process by completing their online contact form or contacting their branch in Sliema to speak with an “International Specialist.”

Note that appointments for account openings take a while (currently about 2 weeks) to schedule, so make sure to plan ahead.

Other banks to consider

If for some reason you fail to open accounts with the above mentioned banks, or just prefer different ones, you can also try APS Bank and Lombard bank. But honestly I don’t see any advantage in picking those over the other banks mentioned in this article.

Open a “basic payment account” instead

While it has been an EU regulation for a while, Maltese banks have only recently started complying with the rule that any EU resident with some sort of legitimate interest should be able to open a basic bank account in Malta. As long as you pass their KYC procedures and you’re resident in the EU, you have the right to one such account in Malta (as long as you don’t have a comparable account in Malta already), with any of the following banks:

- APS Bank

- BNF Bank

- Bank of Valletta (BOV)

- HSBC

- Lombard Bank

And for this type of account (which you need to specifically request) they are not allowed to ask for silly things such as bank or employer references.

A basic payment account includes a (usually free or very cheap) checking account, international debit card, SEPA transfers, EU direct debits, and online banking.

According to the MSFA, such an account should also be offered to:

- Persons with no fixed address

- Refugees, stateless persons or asylum seekers

- Persons without a residence permit, but that for legal or practical reasons can’t be repatriated

With any additional questions or issues opening a “basic payment account” in Malta, you can contact the MSFA on [email protected].

Please share any questions and comments in the comments below!

Also, check out the other articles in my series on moving to Malta:

- How to Register as an Economically Self-Sufficient Resident in Malta

- How to Get a Tax Number in Malta as a Self-Sufficient Resident

- How to Register for e-ID in Malta

- How to activate your PostaPay card in 3 steps

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.