A lot of us digital nomads, serial expats, and others in the location-independent crowd can live and work from anywhere because we run our own independent businesses.

But no matter if you’re an indie maker, consultant, web developer, or mindfulness coach you’re likely to have run into the nightmare which is business banking for small and/or location-independent businesses.

You’ve probably already learned that most business banks accounts:

- Are ridiculously hard (if even possible) to open

- Charge you an arm and a leg in fees

- Screw you over on the exchange rate when converting currencies

While I’ve covered most of the cheap and easy to open personal bank accounts in major countries worldwide, I have yet to do the same for business bank accounts that can be opened online—from anywhere. Until now.

Table of Contents ↺

I want to be a bit more liberal with the “banking” term this time around. Most business accounts that are low cost and easy to open remotely for most people are offered by fintech companies (a.k.a. neo or challenger banks), often without full banking licenses.

In practice, this distinction isn’t always that important, since these companies are still regulated and your funds are typically held in segregated accounts with solid partner banks.

In this article, I have listed all the banks and bank-like services relevant for anyone running a small, international business. Since many of us run companies registered in a country where we’re not (full time) resident, I’ve focused on those that are easy to open and manage remotely, even if you’re not a legal resident in the country of the bank.

While some of these business bank accounts are available no matter where your company is registered, some require that you have a company in their jurisdiction. For the latter, I’ve focused on popular location-independent business jurisdictions, such as the US, UK, Hong Kong, and the EU (including Estonia).

International

Let’s start with the international category, which I define as companies offering banking services with local bank details in several important jurisdictions.

These allow you to receive payments from customers across the world, as if you had a real bank account in their country. Some (like Wise) also help you save loads of money on currency conversion costs.

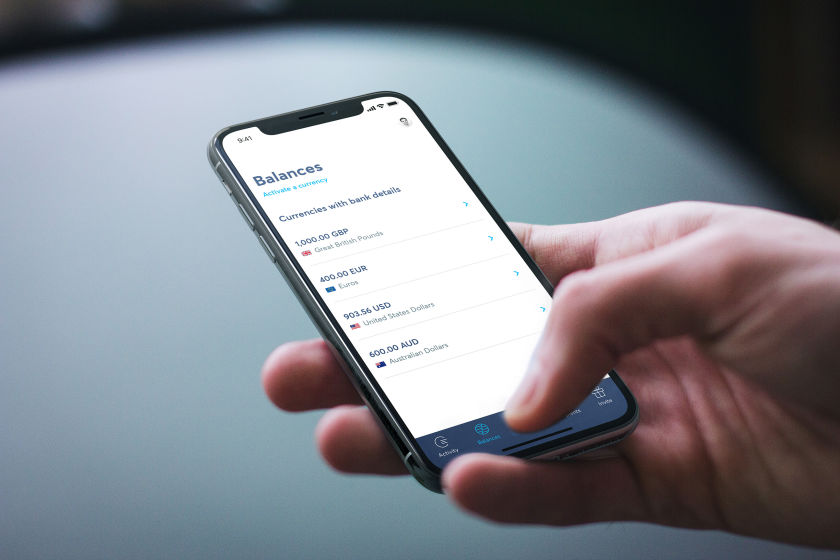

Wise Business

I think Wise’s “borderless” business account product is one of the best things that happened to us digital nomads and location-independent entrepreneurs—at least when it comes to simplifying our business finances and saving on fees. I’ve been using it for every single one of my companies in recent years.

In case you haven’t already heard about it, let me briefly explain what it is:

Wise now lets you open business (and personal) bank-like accounts in the following jurisdictions:

-

United States—with full ACH and wire details

-

United Kingdom—with local account number and sort code

-

the Eurozone (Germany or Belgium) – with a full IBAN

-

Hungary—with local account number

-

Australia—with local account number and BSB code

-

New Zealand—with a local account number

-

Canada— with local account number, transit number, and institution number

-

Turkey— with your own Bank name and IBAN

-

Singapore—local account number with DBS Bank

-

Romania – IBAN is available for residents of Romania and the UK.

All of these accounts are in the name of your company—and unlike Payoneer you can accept any type of (legal or non-restricted) payments and outgoing transfers also come from your company name.

You can also open currency wallets in more than 50 other currencies, although you don’t get unique bank details for these (yet).

Not only that—but you also get a free debit card linked to your account. There are no fees for spending in the currencies you hold in your account, and for any other currencies you get Wise’s low exchange fees (often around 0.5% markup) on top of the true interbank/mid-market rate!

If you use Stripe to sell products or services online in different currencies (e.g. EUR, USD, GBP, AUD, and NZD) you can link those accounts to Stripe and save the 2% currency exchange fee they normally charge.

The same goes if you have income from e.g. Amazon or other sources in different countries and currencies. They are a member of the Amazon payment service provider program, which means that you can now use Wise to receive any sales earnings in over 50 different currencies, making it great for ecommerce businesses, dropshippers, and wholesale companies. Read here for more info about Wise for ecommerce businesses.

Wise Business at a glance

Highlights

-

Open for both freelancers and businesses registered in most of the world

. Exceptions listed here.

-

Supports 50+ currencies and transfers to suppliers in 80+ countries, with unique bank details in the Eurozone

(Belgium

), Hungary

, UK

, USA

, Australia

, New Zealand

, Canada

, Turkey

, and Singapore

. Romanian

IBANs are available for UK and Romanian residents.

-

Comes with free debit card for business expenses (available in the UK, EU/EEA, Switzerland, Australia, New Zealand, Canada, Japan, and Singapore at the moment. US and others coming soon).

-

Low fees

for currency exchange and outbound money transfers. No fees for sending to other Wise users.

-

£200 of free cash withdraws

per month. (But who withdraws cash from their business account anyway?)

-

Great for e-residents

using Xolo to manage their business—or anyone else using Xero for accounting—thanks to direct integrations.

-

Available both on web

, iOS

, and Android

.

-

USD, EUR, GBP, and AUD accounts supports direct debit, other currencies will follow.

-

Regulated by the FCA (Financial Conduct Authority)

in the UK

as an e-money provider.

-

Competitive interest rate on your deposits in USD, EUR, GBP. Per February 2024 you earn up to 5.10% depending on currency.

Things to note

-

The online card spending limit of £45,000/mo may not be enough for everyone. Bank transfers are not limited, though.

-

There's a one-time business account opening fee in some countries (e.g. most of Europe), typically around €50, but it's higher in some markets.

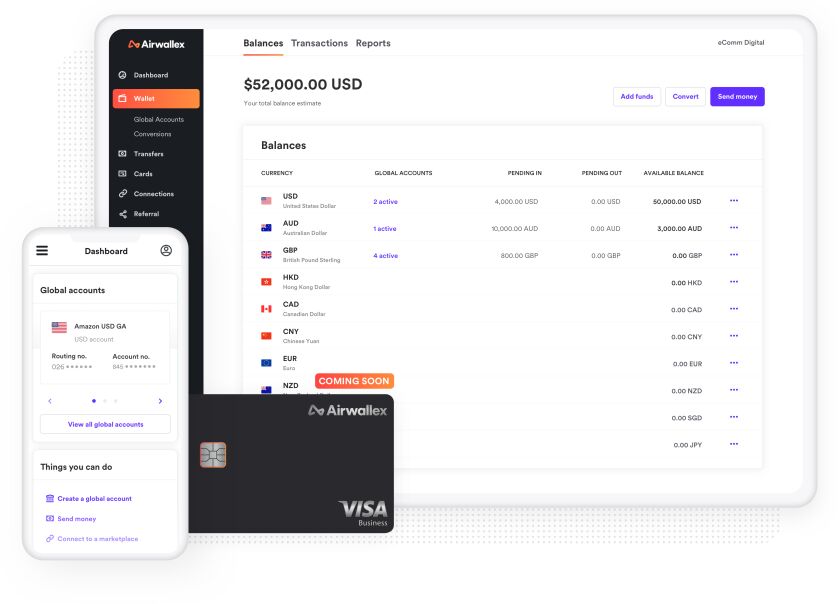

Airwallex

Airwallex is an Australian origin fintech offering business banking services for companies since 2015. Although not yet quite as well-known as Wise, they definitely have a solid, competitive product.

They offer their services to companies registered in more than 50 different jurisdictions, including the likes of Australia, China, Estonia, Germany, Hong Kong, Luxembourg, Malta, Malaysia, New Zealand, Seychelles, UAE, the UK, the US, BVI, and many more.

You can open up to 12 different currency accounts for free to make and receive payments. The FX markup fees are 0.5% for main currencies (USD, HKD, CNY, AUD, EUR, GBP, CAD, SGD, CHF, NZD, JPY) and 1% for other currencies (0.3% and 0.6% for Australian customers). They use their own interbank rate, which is more favorable than in most banks.

You can receive payments directly from Amazon, eBay, Shopify, and PayPal. They even have WeChat pay that allows businesses to receive money from Chinese consumers easily, as well as 60+ other local payment methods from around the world, such as Kakao Pay (Korea), GrabPay (Singapore) and many more. They also have a mobile app supported both on Android & iOS.

Just like Wise, they offer an integration with Xero for a better accounting experience. They will sync your records hourly, and batch payments are also supported for more convenience.

Every employee can have their own virtual card and logins to keep better track of spendings. Card spending limits default to US$ 10,000, but can be increased on request. Physical cards and Apple Pay & Google Pay are currently only available in Australia, Hong Kong, Singapore, the United Kingdom, and the United States.

Special offer:

Get $500 bonus for the first $15K spend within 90 days for US-based companies

(sign up here).

Get 10% cashback on the first $1,000 foreign currency transactions within 30 days for companies in most of continental Europe

and UK

(sign up here) and Australia

(sign up here).

Airwallex at a glance

Highlights

-

Payments possible in 22 currencies including USD, GBP, EUR, AUD, CNY, HKD, and CAD

-

12 global accounts (USD, SGD, HKD, DKK, PLN, IDR, JPY, AUD, CAD, EUR, GBP, and NZD)

-

Physical cards available for customers in Australia, Hong Kong, Singapore, the United Kingdom and the United States.

-

Direct payments from Amazon, eBay, Shopify, PayPal, and WeChat

-

No deposit limits to receive money in your account

-

Integrated with Xero

-

Separate cards and logins for employees

-

Mobile app for Android & iOS

Things to note

-

There may be an extra FX markup on the weekend or other days when FX markets are closed

-

While virtual company cards are completely free, physical employee cards cost an additional AUD 14 per cardholder per month

Payoneer

Payoneer has been a pioneer in the international payments industry since they launched their USD receiving accounts back in 2011. For many people (e.g. if you don’t qualify for a Wise account) it’s still the only option for getting US account details or to get paid from many online marketplaces.

Note that you can only receive funds from companies (e.g. marketplaces such as Amazon or UpWork), not from private individuals—so you can’t use Payoneer to get paid from non-corporate clients.

While Payoneer has proved super useful to the otherwise unbanked—they also charge extremely high fees, so it’s best to avoid them if you have other options available to you.

Receiving USD costs 1% of the transaction, other currencies free. Spending money with the Payoneer debit card (which costs $30/year) costs 3.5% if used outside the country of issue (typically US or UK) or if used in a different currency. ATM fees are high, exchange rates unfavorable (typically 2-3% markup), and even withdrawing money to a normal bank account costs 2%.

Payoneer at a glance

Highlights

-

One of the first bank-like products providing access to receiving-accounts in the world’s largest economies to people resident anywhere.

-

Nearly anyone can open an account.

-

10 global currency accounts available

Things to note

-

Fees are a bit high for certain transactions.

-

Not meant to replace your bank account, but to supplement it. E.g. outbound transfers do not come from your business name, and not all inbound transfers are accepted.

-

The online card spending limit of £5,000/day may not be enough for every business. Though, bank transfers are not limited.

United States

Let’s move on to the land of the free. While you can still open a business account as a non-resident in several large US banks—especially if you show up in person and agree to a large initial deposit—that’s impractical for most of us.

Options such as Wise above is still good enough for most foreign companies, but if you have a US entity (even as a non-resident foreigner) read on to learn how you easily can open a US business account remotely, for free.

Tip: If you need a proper US account for a primarily non-US business, it’s cheap and pretty straightforward to register a non-resident LLC in many US states, and it shouldn’t have any tax consequences. I’d recommend New Mexico and Wyoming for most purposes (especially if you value privacy), or Delaware in the case you have ambitions of raising money or selling the business down the line.

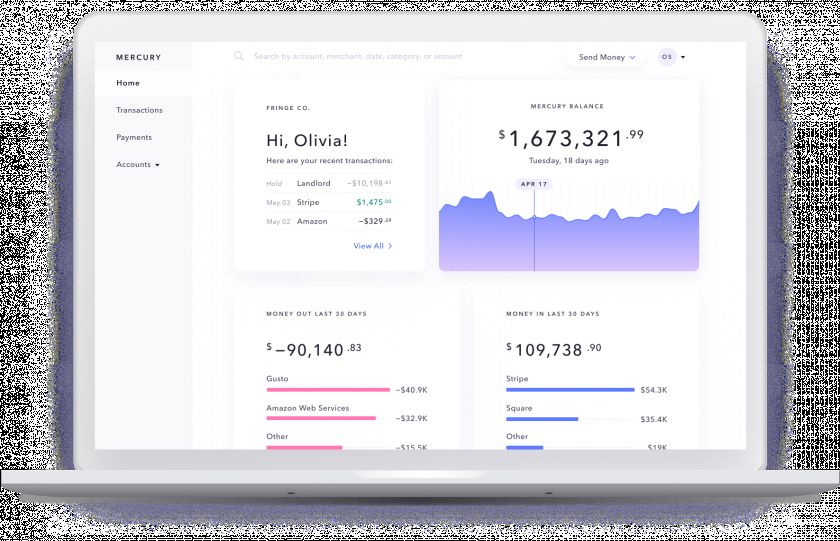

Mercury

I was a bit surprised that Mercury didn’t initially receive more attention in the location-independent business community since after their launch in April 2019.

The original version of this article (from December 2019) was likely the first article targeted at digital nomads, PTs, and other location-independent people featuring them.

However, by now they are quite well known.

If you are a non-US resident with a US business (e.g. LLC or corporation) who needs to an easy-to-use business account, with low fees, that you can open remotely—this is the one to get.

Mercury recently revamped its fee structure, eliminating charges for both domestic and international wire transfers altogether.

On the flip side, they now charge a 1% foreign transaction fee. While much lower than most US-based banks, if you do a lot of foreign transactions you may want to pair it with for example a Wise Business account to save even more.

That said, it’s now the only thing they charge for, so the overall package is still very attractive. Additionally, for those processing over $200K/month, they offer customized rates upon contact.

Everything else, from ACH transfers to ATM withdrawals, remain completely fee-free.

Mercury at a glance

Highlights

-

No wire transfer fees, ATM withdrawal fees, account opening fees or overdraft fees—just a 1% foreign exchange fee

-

Open for companies registered in the US, including LLCs and corporations with foreign resident managers/owners

-

Real US bank account with associated debit card

-

Relatively high interest rates

-

Can be used with US PayPal and Stripe accounts

-

Powerful API so if you're technical you can automate a lot of your banking

Things to note

-

Outgoing transfers are not made in the name of the business, but rather Mercury (business name can still be added to message)

-

If asked it's better to state that you'll do business with US companies (not necessarily exclusively), as they may otherwise not approve your account

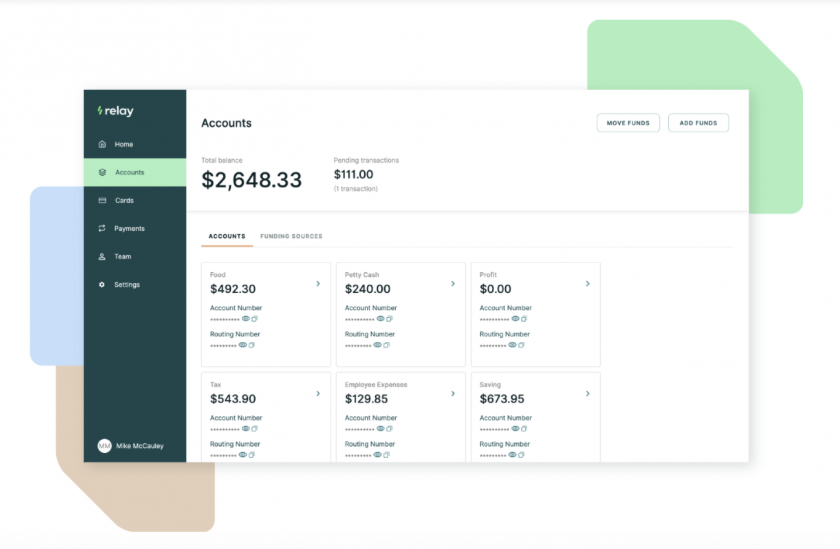

Relay

Another great remote business banking platform for the US is Relay. And this recommendation comes from our very own Nomad Gate readers.

They only charge for wire transfers—$5 for domestic and $10 for international. However, for only $30 a month you can upgrade to Relay Pro, which comes with unlimited free domestic and international wire transfers.

It has other great business banking and budget management features such as the ability to issue debit cards to your team, set spending limits, track expenses, as well as integrate accounting tools such as Xero and Quickbooks.

Relay at a glance

Highlights

-

Low fees for both domestic and international wire transfers

-

Great reviews for its customer support team

-

Supports US corporations, LLCs, sole proprietors, and freelancers in over 200 countries

-

No minimum balances, no transfer fees and unlimited transactions.

Things to note

-

Doesn't offer interest on money in their accounts

-

Doesn't accept restricted industries such as crypto, privately owned ATMs, money services, unlawful internet gambling, or cannabis sales.

Europe

Holvi

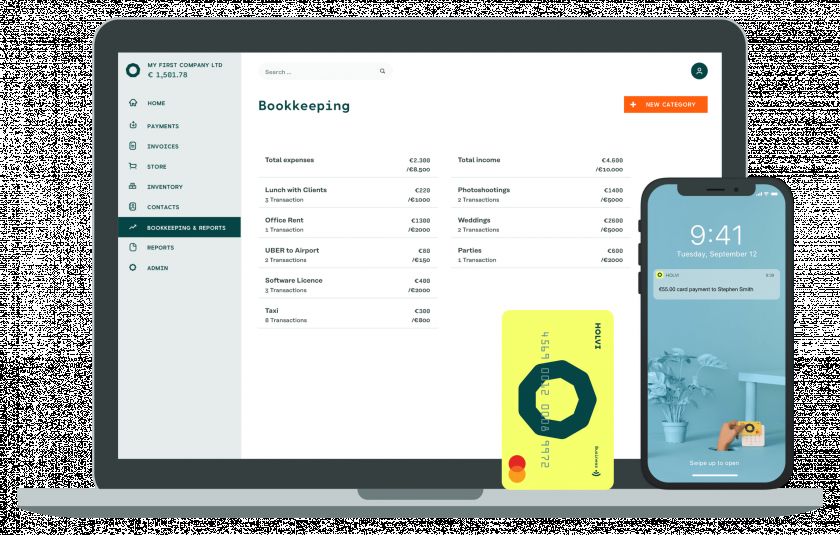

Holvi is a Finnish challenger bank—technically a payment institution as they don’t have a full banking license. Regulated by both the Finnish and German financial supervisory authorities, giving you the choice of either a Finnish or German IBAN.

Their offering is a solid combination of business banking features, simple bookkeeping and invoicing features (from the €9/mo Holvi Lite plan and up).

You get a bright yellow Mastercard debit card and unlimited free SEPA transfers (if you’re based in the Eurozone). Transfers outside the SEPA region is only possible with a third party (I suggest Wise for this—see above) and you can also not receive non-SEPA transfers directly.

Holvi at a glance

Highlights

-

Provides Finnish or German IBAN

-

Open for freelancers and businesses registered in several EU countries

-

Very popular for German, Finnish, and Austrian businesses; Unlimited free domestic transfers

-

Real debit card, not prepaid, meaning better acceptance

-

Pricing from €9/month, up to €99/month

-

Accounts include simple invoicing and accounting tools

-

Regulated by the Finnish Financial Supervisory Authority (FIN-FSA) as a payment institution

Things to note

-

No international (non-SEPA/UK) transfers

-

No longer available for UK customers

-

Use in foreign currencies could be cheaper (2% markup over the Mastercard rate)

-

ATM withdrawals have another 2.5% surcharge (regardless of currency)

-

The card has a spending limit of €10,000/day, €45,000/mo, and €300,000/year.

N26 Business

N26 is a German neobank who’s main claim-to-fame is one of the best personal bank accounts for travelers. Their business product is almost identical—which is both good and bad.

On the plus side you get a fantastic mobile and web app, some of the lowest fees available in Europe, and some pretty handy budgeting features.

You also get unlimited free SEPA transfers. For non-SEPA transfers, you can use Wise (see above).

One added bonus for the business account (compared to the personal one) is the addition of 0.1% cashback on all your purchases (or 0.5% for their metal card).

You can also get included travel insurance and zero ATM withdrawal fees in foreign currencies by opting for the Business You (€9.90/mo) and Business Metal account (€16.90/mo). You’ll also get car-sharing insurance, covering damage and theft to cars, and even scooters and bikes rented through a shared mobility program. Business Metal plan also adds car rental insurance and phone insurance (up to €1,000 covered for theft and damage). Now there is also COVID-19 coverage for trips that started on or after January 22, 2021. It covers you and your travel companion if you have to cancel or shorten your trip due to becoming ill, having to quarantine, or up to €1,000,000 emergency medical bills. So you can have extra peace of mind.

The drawback of the N26 account is that it’s only available for freelancers and self-employed. You can’t use it for an incorporated business. It’s also pretty weak when it comes to bookkeeping and invoicing features (they are pretty much absent).

N26 Business at a glance

Highlights

-

Provides fully insured bank account with German IBAN

-

Open to freelancers (not corporations) across all the EEA countries where N26 operates

-

You earn 0.1% (or 0.5%) cashback on all card transactions

-

No/very low fees

-

Good travel insurance with COVID-19 coverage for premium plans

-

Often special deals and discounts with partners (former and current examples include Hotels.com, GetYourGuide, Booking.com, Lime, YOOX, Taxfix, etc.)

Things to note

-

You can't have two N26 accounts in the EU, so you have to choose between either a personal or freelancer account. My recommendation would be to use N26 for your personal banking, and use Wise or Holvi for your business activity.

-

Lack of useful accounting and invoicing features

-

Monthly card spending limits of €20,000. Outgoing SEPA transfers are limited to €50,000 per day.

-

Deposit fee of 0.5% for balances over €50,000 (only for accounts opened after 19.10.2020 and does not apply for Portugal).

Monese Business

Monese is (like N26) perhaps best known for their personal banking product, but their business account is also great!

Together with Tide (below) and Wise it’s one of the few banking options for non-UK residents with a UK registered company.

It does come with a small monthly fee (£9.95), but the included services are more than worth it.

You’ll get six free ATM withdrawals per month, only 0.5% currency markup on spending and international transfers, and free incoming and outgoing bank transfers, including direct debits.

Monese Business at a glance

Highlights

-

Unlike most UK banks, they accept UK companies with foreign directors/owners living in the EU/EEA

-

For £9.95 you get a user-friendly business account, with no/very low transaction fees

-

You will get local GBP

account details (EUR

accounts are launching soon)

-

It also includes a personal Monese Plus account (in both EUR and GBP), which normally costs £4.95/mo

Things to note

-

To open a business account, you'll have to open a personal Monese account first (meaning you'll need to be resident in the UK or EU/EEA)—then you set up the business account with a few taps inside the app

-

Somewhat low limits (e.g. £50,000–£100,000 maximum balance and £4,000 max per card purchase and £7,000/day).

Tide

The UK is one of the most popular jurisdictions for location-independent businesses due to several factors such as a stellar reputation, good access to services such as merchant accounts, and a good business environment.

The only significant obstacle for location-independent UK businesses with non-resident owners/directors was to open a bank account. No UK banks wanted to work with non-residents (unless you were bringing loads of business to the bank).

That was the situation until 2016.

Enter Tide.

Finally, there was a banking solution available to non-residents with UK registered companies!

Not only that, Tide also comes with automatic transaction categorization, accounting integration, multiple accounts, easy invoicing, and fully featured mobile and web apps.

You can choose from a free account (although transfers are 20p each), a Tide Plus account for £9.99 monthly (with 20 free transfers per month), a Tide Pro account for £18.99 per month (unlimited transfers), or a Tide Cashback account for £49.99 a month—which comes included with a personal account manager.

Tide at a glance

Highlights

-

Unlike most UK banks, they accept UK companies with foreign directors/owners living abroad

-

You will get local GBP

account details

-

Reasonable prices, powerful business features and apps

-

Create up to 35 debit cards for your whole team

-

No currency exchange markup (you get the official Mastercard rate)

Things to note

-

You'll need to be a sole trader based in the UK or have a company registered there to open an account.

-

Tide does not currently support international bank transfers. However, you can use Wise for that.

-

Initial balance limits of £25,000-£100,000 depending on account. Debit card limits of £10,000-£50,000/mo. You may be able to raise the limits on request.

Honorable mention: Starling Bank

I would like to quickly mention Starling Bank while discussing banks for UK companies . It’s a great option, if both you and the business are resident in the UK. It’s not open to non-UK residents, unfortunately, however they intend to allow the opening of EUR and USD accounts soon.

If you qualify, definitely check it out. They have a completely free plan, including free spending abroad. If you want more advanced accounting features you can add the Business Toolkit onto your free business or sole trader account for £7 per month, the first month is free.

Bunq Business

Bunq is another bank that’s probably more known for their excellent personal accounts. But if you run a business based in the Netherlands or Germany, then Bunq’s business account may be what you’re looking for.

It offers accounting integrations with many Dutch accounting systems (and some German). And in case there’s not direct accounting connection you can request automatic monthly CSV exports to send to your accountant or upload to your own accounting software.

Bunq Business comes with loads of other useful features, like multiple bank accounts, access for multiple users (to the whole account or just parts of it), and automatically setting aside VAT for your incoming payments so you’ll never come up short come tax day.

Bunq also strives to be an ethical bank, with responsible investment policies and you can even take control over where your money is invested.

Bunq Business at a glance

Highlights

-

IBAN from the Netherlands, Germany, Spain, France, or Ireland

-

Popular bank in the Netherlands, which also offers corporate accounts in the Netherlands

and Germany

, as well as accounts for freelancers in a handful of other EU countries

-

Business accounts are €7.99/month, also with an free option of basic features

-

They come with useful features such as auto-VAT management, and automatic completion of payment details of scanned or PDF invoices

-

Powerful API so if you're technical you can automate a lot of your banking

-

Daily card spending limits of up to €50,000 which is among the highest limits I've seen when doing research for this article

-

0.27% interest for all plans

Things to note

-

You can only send and receive SEPA (EU) transfers—but if you need international transfers you can open a Wise (formerly TransferWise) account as well

-

Bunq will charge you a fee for keeping more than €100,000 in your accounts

Paysera

While it wouldn’t be my first option, Paysera is still a viable option if your business needs an EUR account and does not qualify for any of the options above.

They claim to support over 180 countries, however, unless you are in Europe—which seems to be mostly fine—the level of support may be limited. For example, registration and onboarding for clients in many countries outside of Europe have stricter requirements. Also onboarding is is currently unavailable for citizens of many countries that they claim to cover.

Paysera at a glance

Highlights

-

Reasonably priced e-money account, based in Lithuania

-

Claims to support over 180 countries

Things to note

-

Transaction costs are not the lowest I've seen

-

Outgoing non-SEPA transfer show up as coming from Paysera, not the name of your business

-

Daily debit card limit of €10,000

Asia

Aspire

Singapore has one of the most favorable jurisdictions for businesses in Asia and very popular for location-independent entrepreneurs. While it’s usually possible to open business bank accounts with several Singaporean banks for non-resident owners, it typically requires in-person visits, a ton of paperwork, large minimum deposits, and often high charges for both account maintenance and transfers. So it’s no wonder that in 2019 Aspire was voted the number one hottest startup by Singapore Business Review.

Opening a business account with Aspire is as easy as it gets. The signup is done online in 5 minutes, your account and a virtual card will be ready in as quick as an hour. Oh, and I should probably mention that it’s free to open, there are no monthly fees, and no minimum deposit. Currently, you can open SGD, USD, EUR, GBP, and IDR accounts with them.

The free monthly account comes with two admin/finance accounts and 10 employee user accounts, as well as one physical card and unlimited virtual cards. Additional admin accounts are 9 SGD per user, and employee accounts 5 SGD per user.

It offers cheap international transfers at the mid-market rate, easy accounting, and 1% cash-back for some business costs. Also, you can apply for a line of credit easily in your Aspire account. Their convenient expense management system allows you to have a separate bank card for each employee with their own name and specified spending limits.

Furthermore, they are helping startups and new businesses by waivering their subscription fees for the first 12 months after your business’ incorporation date, for both new and existing customers.

Aspire accepts clients with businesses incorporated in over 18 countries but is primarily focused on businesses incorporated in Singapore and Indonesia. That said, if your country is not on the list, they claim that you can contact their sales team to discuss a custom package.

Aspire at a glance

Highlights

-

Offers currency accounts in SGD, USD, EUR, GBP, and IDR

-

Accepts Singaporean and Indonesian companies, [as well a few others in the Asia-Pacific region](https://support.aspireapp.com/faq/what-countries-does-aspire-support), open to both local and foreign directors

-

The Visa card has no limits but can be implemented if wanted

-

1% cash-back with the card (on online marketing and Saas spend)

-

Integrates with Xero and Wise

-

Offers incorporation options, if you also want to register a business with their help

-

Can apply for a fast line of credit up to S$300k

Things to note

-

You will only get one physical debit card, other cards are virtual

-

Unclear fees for customers with businesses incorporated outside of Singapore and Indonesia

Other banks and regions

Most of the banks listed so far in this article are so called fintechs or neo banks. They work great for many types of businesses, but sometimes you may have more specific needs, or require services not offered by this type of bank.

Maybe you require an account in a specific country, or your business is incorporated in a jurisdiction that most banks won’t open accounts for? Or perhaps your business is classified as “high risk” by most banks?

If this is the case, you may want to open an account with a more established bank, or one that’s willing to work with more “high risk” clients. While this isn’t always straightforward, it’s more than doable if you’re armed with the right information.

I’d recommend that you stay away from so-called “bank introducers” that often charge thousands of dollars to introduce you to banks that would have accepted you anyway if you had applied directly. They don’t add much, if any, value.

Instead, I’d recommend asking people in your network who have successfully opened the type of account you’re looking for. Or if you don’t know anyone you can ask, I’d recommend signing up for a service like GlobalBanks.

They maintain a database of hundreds of banks in 50+ countries, including information about account opening requirements, fee schedules, reviews, tips for applying, including contact persons at many of the banks, whether you can open remotely, and so on.

Let me know in the comments if you know any other good options, or if you have any feedback about any of the ones I listed above!

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.