Okay, so you have registered as an Economically Self-Sufficient Resident in Malta. Perhaps you’ve even told your previous country that you have left, and your old bank is asking for a new Tax Identification Number.

Since you didn’t register to work in Malta, you won’t have a Social Security number (NI number), and therefore you’re also not automatically registered for tax.

Luckily, it is quick and easy to get a tax number in Malta. There are a few different ways of doing so:

- In person at the Internal Revenue Department (IRD) in Floriana

- In person at the IRD office in Victoria (Gozo)

- Mailing a form to the IRD

- Completing an online application

And depending on which method you choose, you can get your tax number instantly.

Getting your tax number at the IRD in Floriana

These are the exact coordinates of the entrance.

You’ll see this door:

On the right-hand side when you walk in, you’ll find a table with various forms. If you didn’t already complete one and brought it with you, look for the one titled Expatriates Taxpayer Registration Form and complete it on the spot.

It’s a good idea to bring a pen in case there’s a line.

Once you have your completed and signed form in hand, just drop it off in the mailbox on the other side of the entrance door.

You should then receive your tax number via snail mail in about 1-2 weeks.

If you really need it quickly, you may be able to get it on the spot by asking nicely at the IRD office.

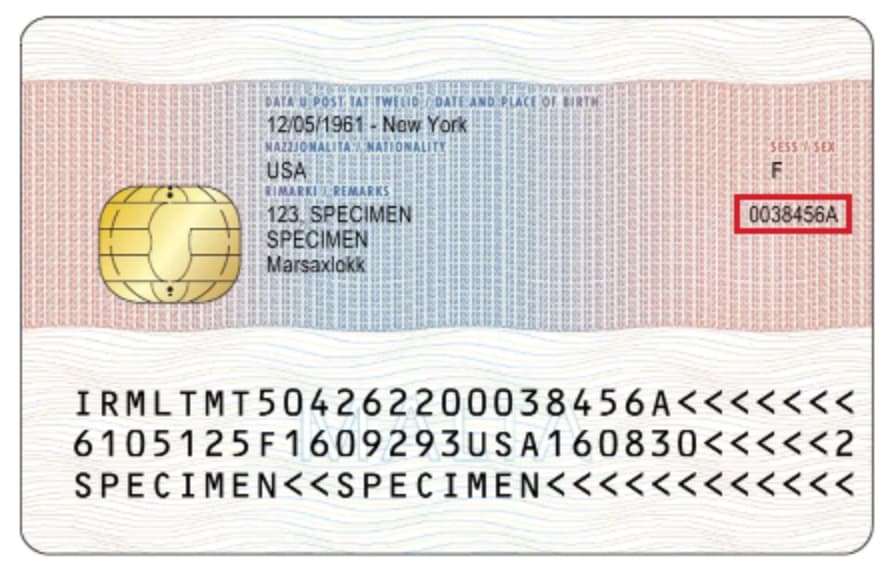

However, for self-sufficient residents, the tax number is the same as your ID number anyway. So if you just need the tax number because some third party asked you for it, simply give them the number on the back of your residence card instead:

If you didn’t get your ID/residence card yet, it’s the number printed sideways in the top right corner of your application receipt:

Getting your tax number in person at the IRD office in Victoria (Gozo)

If you’re on Gozo and don’t want to make the trek to Valletta, you can submit the Expatriates Taxpayer Registration Form at the IRD office in Gozo instead.

Just keep in mind that your application won’t be processed there. Instead, they just mail it to the IRD office in Floriana.

So if you’re in this situation, I’d recommend considering the two next options instead.

Mailing the form to the IRD yourself

Instead of handing in the Expatriates Taxpayer Registration Form in person, you can also mail it to the IRD.

You’ll find the form here. Just complete it, print it out, sign it, scan it and send it (along with a copy of your ID, either Maltese or a foreign passport) to [email protected].

Alternatively, you can post it to the IRD in Floriana: Expatriates Section, Block 1, Inland Revenue Department, Floriana

Completing the form online

Finally, you can also complete and submit the form online.

This requires that you already registered for and activated you e-ID account.

You’ll also have to print, complete and sign the accompanying Declaration Form, and upload and submit it with the electronic application form.

As you can understand by now, it’s pretty easy to register and get your tax number in Malta.

Let me know in the comments if you have any questions or comments!

Also, check out the other articles in my series on moving to Malta:

- How to Register as an Economically Self-Sufficient Resident in Malta

- How to Register for e-ID in Malta

- How to Easily Open a Bank Account in Malta

- How to activate your PostaPay card in 3 steps

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.