If you are someone with a global lifestyle or mindset, you probably have heard of Estonian e-Residency (the pioneer of e-residency programs). Don’t worry if you haven’t—you’ll find everything you need to know about it in our Estonian e-Residency guide. In short, it gives you a digital identity and access to lots of Estonian government services, including founding and running a company. Currently, every one in six new companies registered in Estonia has been founded by e-residents.

But let’s take a step back—why would you want a company in Estonia in the first place. “It’s the country next to Russia, right? Or was it Russian that people speak in there…? And the capital is Riga, isn’t it?” These are the questions I normally get about Estonia . Let’s set the record straight—the capital is Tallinn and Estonians speak Estonian (which is similar to Finnish and nothing like Russian). And yes, it is situated right next to Russia (along with 13 other countries

).

Estonia is still somewhat of a well-kept secret, but having a company based there is a huge advantage as 99% of government services are digital. This means you can get by without unwanted travel, long queues, and menial paperwork. For example, you can incorporate a business in just a couple of hours entirely online.

The Estonian business environment is very transparent and thriving, boasting the most unicorn per capita worldwide (some of the best-known startups are Wise, Bolt, Pipedrive, Veriff, etc). It also has the most competitive tax system in the OECD (ranked number 1 ten years in a row). One unique feature is that Estonian companies aren’t required to pay corporate income or capital gains tax if the revenue stays within the company. That means you will be able to reinvest it into your business (or financial markets, real estate, etc) with your pre-tax money. This will also allow you to take full advantage of compound interest—often called the 8th world wonder—when building a nest egg for your retirement. For ideas, how to do that, check out our retirement savings and investment guide.

I could go on singing praises about Estonia’s business environment, but I’ll leave something for you to discover as well .

For a quick overview, I have listed the minimum requirements you need to fulfill to register and run an Estonian company as an e-resident:

- Get an e-Residency card. The process takes around one month, and you can pick it up from the Estonian embassy/consulate nearest to you.

- Get an official/legal address in Estonia. On top of an official address you also used to need a contact person in Estonia if the company is run solely by non-residents. However, this requirement was removed in 2023. Now, you don’t need a contact person as long as the legal address is in Estonia. In case you register your company with a foreign address, you’re still required to have one. The contact person does not have the right to act on behalf of your company but is responsible for receiving and forwarding important documents or letters. He/she needs to be a legal/tax professional or an official service provider for companies. You can still choose to have a contact person on voluntary basis if you see a benefit in that, even if the company has an Estonian address.

- Open a bank account. You can find the best traditional and online bank options in our banking guide for Estonian e-residents.

- Make a share capital contribution (min. €0,01). With the 2023 change of the Commercial Code you don’t need to make €2,500 share capital contribution anymore. However, a minimum of 1 euro cent is required at the company opening stage.

- Submit reports. Monthly reporting is required if your company is VAT-registered or you have employees in Estonia. Others only need to present the end of financial year reports. You have to register for VAT when your company’s annual turnover is exceeding €40K.

-

Pay taxes—every business owner’s favorite activity

. The good news is that you can postpone paying most of your taxes into the future as long as you don’t pay out dividends or salaries.

If I have sparked your interest in starting an Estonian company (or perhaps you already own one!), but some of the requirements are beginning to sound a bit daunting, then you’ll probably appreciate the comparison of different service providers below.

Table of Contents ↺

For this article, I picked the ones that have tailored the necessary services specifically for e-residents and are registered as official partners of the e-Residency program. Most of them can help you with everything—starting from getting the e-Residency card, registering your company and virtual office to accounting, reporting, and tax advice.

* Magrat includes physical office with their address and contact person package.

Service Providers

Xolo

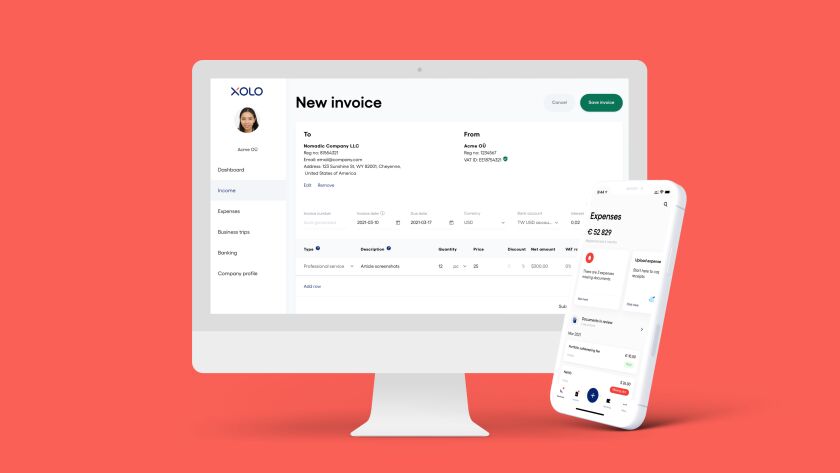

Xolo is the market leader in e-Residency services and the one you’ve most likely heard about before. Having started back in 2015, they changed the field by offering their own custom-built platform instead of just consulting and accounting like other companies.

Recently, they made two critical changes that allow a wider range of companies to use their services. First, they now also work with multiple shareholders, not only “solopreneurs”. Second, they started accepting pre-registered companies as their clients, so if you have been using a different service provider and want to switch to Xolo, now it is possible.

Xolo has monthly subscriptions with everything you need included in the plan, so you don’t have to worry about any aspect of setting up or managing your Estonian company. For company registration, there is a one-time fee of €290, which consists of the state fee (€265) and the API integration fee—they don’t charge anything extra on top of that.

Most e-residency companies are happy with just a Wise business account, however if you want a traditional bank account, Xolo will also help you get an LHV account in Estonia. Their success rate with opening LHV bank accounts is 100%, as far as I know.

Xolo’s user-friendly accounting software provides practically real-time imports of all your transactions from LHV, Wise, Stripe, and Paypal from any country.

First of all, you can choose between Xolo Go and Xolo Leap

Xolo offers two main products–Xolo Go and Xolo Leap:

-

Xolo Go—meant for freelancers and allows you to send invoices using Xolo’s legal entity. Therefore, you don’t need to own a company or even an e-Residency. On the invoices, it will read “Xolo Go OÜ - Firstname Lastname”, so your name will also appear in there. You can set it up in 10 minutes. There are no monthly fees, but you have to pay 5% for all outgoing payments. It is suitable for a small side hustle or a short-term project. If you are making more than €1600 monthly, then Xolo Leap will become a cheaper option.

-

Xolo Leap-allows you to run your own Estonian corporation (OÜ) through e-Residency with accounting, annual reports, VAT filing (including VAT MOSS), a contact person, business address, integration with LHV bank, Wise, PayPal, Revolut, and more, templates for legal agreements for employees and partners, and general support. Setting it up takes 2-3 days if you have an e-Residency card, or 4-5 weeks if you first need to apply for e-Residency.

Xolo Leap offers four different plans. These are:

- Starter—for €59 per month you will have access to all the basics to get your business up and running. You have access to accounting services but business volume is limited to five sales transactions and ten total bank transactions per month. You also can’t hire contractors or pay salaries to any employees under this plan.

- Standard-similar to Starter but with unlimited invoicing and bank transactions for a monthly fee of €89.

- Pro—as an extra, you get unlimited transactions with Stripe and PayPal. Support for paying salaries to employees who are tax residents in Estonia is also included in this plan for up to 3 people. (Paying salaries to employees outside Estonia is also available with the Pro plan.) The monthly fee of the Pro plan is €129. You can have multiple shareholders with both the Pro and Premium plans.

- Premium—you’ll get a personal senior accountant with this plan, and free access to priority services. These include more support channels (phone, Zoom), and priority to be dealt first for support and annual report. Also, the Estonian residents payroll is included for up to 10 people. Premium plan comes at the price of €259 per month.

Additionally, they now offer two new plans for running a business in Spain or Italy. Xolo Gestoría offers freelancers in Spain an easy way to work autonomously while complying with all local tax requirements, while Xolo Commercialista does the same thing but in Italy.

Xolo at a glance

Highlights

-

All necessary services included in one monthly subscription

-

As an official partner of LHV bank, they can get you an Estonian bank account, and you will only have to pay half of LHV’s monthly fee

-

User-friendly interface including a professional invoicing tool and overview of cash flow. You can even get your balance sheet and income statement reports directly from the interface.

-

Integrated with LHV, Wise, Paypal, Stripe

-

Access to perhaps the most extensive e-Residency knowledge base available, answering pretty much any question you’ll ever have about running your Estonian company

-

Free onboarding for existing companies

-

Has excellent reviews and offers great customer service

Things to note

-

They don’t support e-commerce companies (e.g., dropshipping, Amazon FBA). They also don’t offer their services to businesses requiring a license in Estonia (cryptocurrency, gambling, financial services, travel agencies, etc).

Special offer: Xolo is currently giving Nomad Gate’s readers €100 credit when signing up through this link.

Companio

Founded 100% by e-residents, it now has employees from all around the world, communicating in various languages. They offer an interface for opening and managing your company, which can be integrated with Wise, LHV, Stripe, Revolut, Payoneer, Paypal, Paysera, and Leopay. They have a promotion for already existing e-residency companies—they’ll refund the first three months of charge if you remain their client for at least a year.

The pricing depends on the number of accounting documents processed per month, so you’re not fixed to a specific plan—some months will cost more and some less. Up to 20 accounting documents will be €79, 20-40 will be €99, 40-200 will cost €149, etc.

They do also offer Companio Virtual for a fixed monthly price of €29 but this will just get you a legal address, person of contact and a mail forwarding service–no accounting, you’ll have to do that by yourself.

Additionally, they have plenty of useful materials available on their website regarding setting up an Estonian company and running it.

Companio at a glance

Highlights

-

Available for most types of companies (multi-shareholder, e-commerce, crypto, MOSS businesses, travel agents, etc)

-

Monthly subscriptions include all the services you need and flexible pricing depending on the number of invoices

-

A wide range of payment providers to choose from, including an Estonian bank (LHV)

-

They provide software for opening and managing your business. You get an invoicing tool, accounting reconciliation, integration with multiple payment/banking solutions, an overview of your revenue and expenses, etc.

-

Support in multiple languages: English, Spanish, French, Russian, Ukrainian

Things to note

-

The cheapest pricing option is limited to a maximum of 20 invoices per month

-

Crypto companies are not accepted

Special offer: Companio is offering Nomad Gate readers a €50 discount, if you register your business through this link

Enty

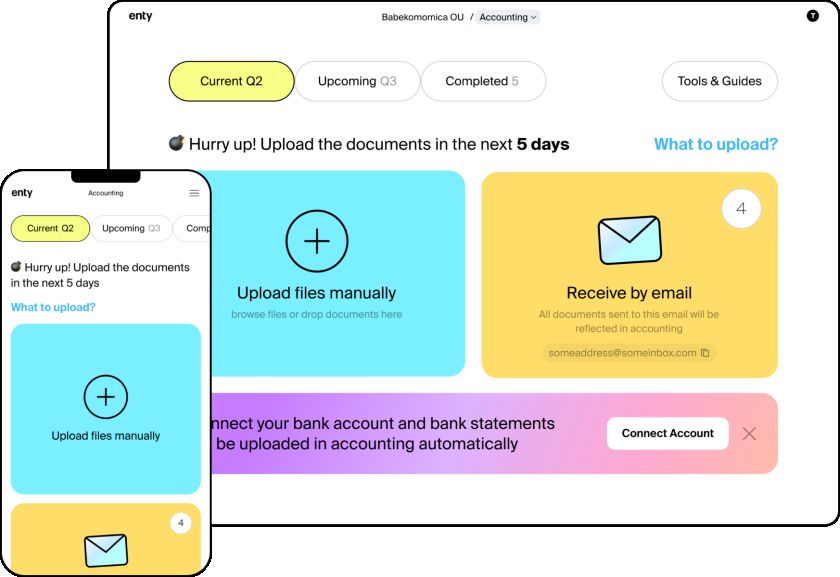

Enty’s idea is to have all company-related admin done through one system, including invoicing, virtual secretary, contract management, and HR.

The company incorporation for e-Residents is €350 €315,

and there’s an extra charge for additional shareholders. However, they offer the possibility to add extra physical directors or/and shareholders and even legal entities as shareholders.

In case you already have an Estonian company, and you’re not happy with your current service provider, you can onboard with Enty for free.

They have 4 main monthly packages available to choose from:

- Lite—the price is

€33€29.70/mo and it’s meant for companies that have their own bookkeeping. Additionally to the legal address and contact person, you can use their software for generating invoices and contract, and use their information guides. - Standard—comes with a small amount of accounting document processing. Up to 30 per year for

€51€45.90/mo and up to 60 for€68€61.20/mo. It has all the features from the Lite package, plus annual report and 1-hour consultation with an accountant every year. - Pro—this package starts from

€93€83.70/mo which includes bookkeeping for up to 15 documents per month, monthly VAT return and 1-hour consultation with an accountant every month. - E-commerce—similar to Pro, but it’s for companies in the e-commerce field. The price starts from

€110€99/mo and includes 5 accounting documents per month.

Special offer: Enty offers 10% off incorporations and subscriptions if you use the following promo code during registration:

You can save 15% on the package prices if you go for a yearly billing option. Also, they offer a free package to explore their platform features where you can do the company transfer and add a bank account.

Enty can also help you with a wide range of legal issues (corporate, personal data, securities law, migration law, crypto, etc), trademark registration, and applying for a startup visa.

Enty at a glance

Highlights

-

Software for managing everything company-related from a single platform

-

Accepts all types of companies

-

Full range of legal support (for additional fees)

-

Free onboarding for existing companies

Things to note

-

Their legal address & contact person service is more expensive compared to most competitors, but it includes access to information guides and possibility to generate invoices.

-

Their standard accounting package includes a smaller than usual amount of documents being processed

e-Residency Hub

e-Residency Hub started in 2017 and has gained a lot of popularity since then. They charge a one-time fee of €295 for company registration and offer five different plans based on clients’ needs:

- The Ultralight plan is €10/mo and gives your company a legal business address and a contact person with mail forwarding. Out of all the service providers covered in this article, it’s the cheapest option, but it is only available for the first six months.

- The Micro plan at €59/mo includes accounting for up to 10 invoices per month and an annual report. It’s meant for very small scale businesses, and you can only have one bank account/wallet/payment gateway and one currency. They also provide you with accounting software to keep track. Their official banking partners are Wise, Payoneer, and LHV bank, but they can also work with other payment providers.

- The Lightweight plan at €79/mo is suitable when your company is starting to grow into a serious business. Accounting services include two bank accounts/wallets/payment gateways, two currencies, and up to 15 invoices per month. Also, payroll management for three Estonian employees is available with this plan.

- The Standard plan at €99/mo is basically the same as Lightweight, but it offers processing of 40 invoices/payments per month.

- Packages for physical product sellers and SaaS providers start from €175/mo.

They also have pretty good educational articles and FAQs relevant to e-residents on their website.

e-Residency Hub at a glance

Highlights

-

The cheapest option for obtaining a legal address & contact person and reasonable prices for monthly packages

-

All necessary services in one monthly subscription

-

Partnered with Wise, Payoneer, and LHV bank

-

Accounting software included in the package

-

E-commerce companies are accepted

Things to note

-

Crypto companies are not accepted

-

Only 10 accounting documents with the cheapest plan

Comistar Estonia

Comistar started its operation in 2013—with their initial focus being offering tax advice to Scandinavian companies. At the end of 2017, they turned their attention to e-residents and especially blockchain companies. You can even pay in bitcoin for some of their services.

They cover both solopreneurs and multiple shareholder companies across a broad range of businesses, including companies selling physical products, companies that need a license to operate, and so forth.

Since they also work with more complicated and regulated businesses, their onboarding fee is higher than average at €470.

Comistar offers three different pre-made accounting packages, plus an individual tailor-made plan.

- Their cheapest plan, S, costs €45/mo and is meant for companies that have a very low volume of accounting documents (up to 6). It includes a legal address and a contact person, annual report, tax compliance, VAT/EURI/VIES/OSS registration. You can only have one bank account connected with this option.

- For the most popular plan, M, pricing starts at €89. You can have multiple bank accounts, some Estonian payroll processing, and the volume of accounting is limited to 15 bills.

- If you need more accounting documents processed, or you have more complicated company structures (e-commerce, crypto & fintech companies, investment firms, funds, public limited companies, etc), you’ll need to look at their L and XL plans.

Additionally, all of the plans give you access to informational and educational tools about e-Residency and growing your company, as well as a free biweekly e-Residency newsletter with regulatory updates and advice. On top of that, their banking marketplace and legal templates cover the most common business needs (employment contracts, shareholder decisions, etc).

For an additional fee, they offer more complex tax advice and a wide range of legal services (shareholder agreements, mergers and acquisitions, share transfer options, privacy policy, several types of legal agreements, etc). They also offer licensing services, including crypto and fintech companies, and setting up AML/KYC procedures as well as recruiting AML officers.

Comistar at a glance

Highlights

-

Accepts pretty much all types of companies

-

Several monthly subscriptions to choose from depending on the needs of your company

-

Direct integration with Wise and Revolut

-

Educational tools and a newsletter

-

Wide range of legal and licensing services

Things to note

-

Usually not the cheapest option for solopreneurs offering digital products/services

-

Their mid-priced plan is more restrictive with the number of accounting documents compared to most competitors

Special offer: Comistar is currently offering Nomad Gate’s readers a free 30-minute tax consultation (normally an extra €75) with your onboarding. Just tell them the code “NomadGate” when getting in touch.

The e-Residency service providers above offer all-inclusive monthly packages; the ones below from here charge separately for different services.

1Office

1Office are a team of experienced accountants, lawyers, and tax advisors that have helped over 4000 companies from various industries with their business services. While they are based primarily in Estonia, they have seven offices in Europe and also cover business services in the other Baltic countries, as well as Finland, Sweden, Ireland, and the UK.

Company formation comes at €305 for e-residents, or €465 if the company has multiple shareholders. An additional €180 needs to be paid for virtual address and contact person for one year. You’ll also get access to their self-service platform where you can create and send out invoices, track your expenses, get an IBAN account, etc.

In case you already have a company and only want a virtual address, it costs €290 per year, which is more expensive than most other offers available.

Their accounting package starts from €75 per month, and they also offer legal and tax consultations, secretarial services, and filing annual reports.

1Office at a glance

Highlights

-

Has long expertise in the market across several industries (including crypto)

-

Flexible accounting options, from self-accounting to a dedicated accountant.

-

Straightforward managing system through their platform My1Office

Things to note

-

Slightly more expensive than main competitors

Special offer: For our readers, 1Office are offering a 10% client discount on their starting packages. Just use the coupon code NOMADGATE through the e-shop.

Dalanta

Dalanta is a small company that provides only the most essential e-Residency services: incorporation, legal address & contact person, and accounting.

They don’t currently charge anything for company registration, you only have to pay the €265 state fee. However, you’ll also have to order one year of authorized contact person and legal address for €124 + VAT which is actually one of the cheapest options available. If you pre-pay for 5 or 10 years, you can save even more.

You can choose between hired bookkeeping or doing your own accounting. Using their accounting software with unlimited sales and purchase invoices is €15 per month, bookkeeping starts from €59/mo. The minimum price doesn’t include any accounting document processing—these will be for an additional fee. Also, the annual report will be €75 extra.

Dalanta at a glance

Highlights

-

Free company registration service and cheap virtual office & contact person

-

Legal address and contact service packages for 5 or 10 years to escape the inflation in prices

Things to note

-

Not many additional services

-

Only service businesses accepted for accounting (no e-commerce, physical products, crypto companies)

Special offer: Dalanta will give 5% off their incorporation and address & contact person package for Nomad Gate readers with the code “nomadgate”.

Sunny Business Services

Sunny is one of the first registered e-residency service providers with several years of experience. They offer their services in English, German, Spanish and Russian. Additionally to incorporation and accounting, they also provide translation and IT services.

Their company registration service comes at the price of €279 which includes the state fee. They support multiple different companies including digital services and e-commerce with physical products. Companies in the venture capital, trading and crypto mining fields are only accepted when done for your own benefit.

Their pricing for accounting depends on the type of company and sales turnover rather than the amount of accounting entries. All of their plans include an unlimited number of accounting documents, so it might be a good option if you have a lot of small invoices. The most affordable plan costs €69 per month, and is meant for companies that offer traditional services or physical products offline, and the sales turnover is not more than €5,000/mo.

The accounting plans include annual report and salary compliance, as well as a virtual office & contact person. However, for VAT or EURI registration as well as a higher sales threshold, you will need to sign up for their Start-Up Advanced package for €99 per month. You can also get a LEI code for investing and trading from them for €99 per year.

Sunny at a glance

Highlights

-

Good pricing for company registration and virtual office & contact person

-

You can get additional services (LEI-code, translations, IT services, liquidation, etc) through the same company

-

Unlimited accounting documents

Things to note

-

The accounting plans are limited by sales turnover

-

No crypto companies (outside trading or mining for your own) accepted for accounting and incorporation

Special offer: Sunny gives a free 1-hour consultation call (valued at €99) when using this promo code:

B2baltics Consulting

B2baltics is a small company striving to give their customers personal and easy service with inexpensive prices.

B2baltics has an attractive free starter package which includes assistance in registering a company, getting a bank account and/or VAT, and first month of virtual office. You only have to pay the state fee of €265.

Their virtual office services come in at €12.50 per month.

If you’re migrating from another service provider they charge €70 for the setup, which includes the €25 state fee for changing the business address and three months of virtual office.

Accounting services start from €16/mo for non-VAT companies and €20/mo for VAT registered companies. But keep in mind that this price doesn’t include any accounting entries. The pricing for bookkeeping depends on the amount of accounting documents, who enters the data in their system, and the company being VAT registered or not. For example, 21-50 entries for a company with VAT number and data being entered by B2baltics will be €81 per month. For a more exact estimate for your company, you can calculate the pricing here.

The annual report will cost extra, starting from €80 + VAT.

They have some additional services, like Estonian phone number and virtual secretary, as well as (legal) consulting. They also have a package for company liquidation for €250.

B2baltics at a glance

Highlights

-

Free company registration pack that includes first month of virtual office

-

One of the cheapest prices for virtual office service

Things to note

-

Limited types of companies accepted

-

Informational articles on their website are only available after you purchase company registration or switch over package

Aaroni Accounting Services

Aaroni Accounting Services has a long-standing history of providing accounting for companies since 2008.

For e-residents, they offer a legal address & contact person package for €150 (+ VAT). Company incorporation comes at the price of €325 (+ VAT).

Their accounting services pricing is entry-based, but it is also possible to negotiate a set monthly fee. The minimum cost is €39 per month which includes up to 63 accounting entries. If your company has more than that, the price will be calculated per entry. For example, for a non-VAT taxable company with 25 bank lines, 3 sales invoices, 22 purchase invoices, 0 salary equals 100 entries, and will cost €60. You have to pay an additional €50 for an annual report for small business or €30 for a micro business, but it is not much. Have a look at their e-Residency page for more specific information.

Aaroni Accounting Services at a glance

Highlights

-

Has been providing accounting services for a long time

-

Entry-based pricing could be a good option if the volume of accounting documents varies a lot month to month

-

Affordable pricing for accounting

Things to note

-

A small range of services

Magrat

Magrat was established in 2009, and it seems to focus on having personalized long-term relationships even if it means having less clients in total. Magrat’s team is highly international, being able to communicate in 10 different languages.

Magrat offers assistance to company incorporation for e-residents for €190 €180.50.

In addition, you’ll have to pay the state fee of €190 €180.50.

The contact person service is €200 €190

per year. They offer legal address together with a physical work place from €150 €142.50

per month.

Minimum accounting package starts from €120 €114,

but in reality the charge will be higher, as you’ll have to pay extra for each accounting entry. Also, the annual report is not included in the price. The price for the annual report depends on the size of the company and starts from €170 €161.50

for micro enterprises.

Special offer: Magrat offers 5% off any service if you use the following promo code during checkout:

They offer a wide range of different services (auditing, tax, legal advice, relocation services, web design & hosting, even personal asset management or rental of living and work spaces). Basically, if you’re looking for any service related to opening and managing an Estonian company or relocation to Estonia, you’re highly likely to find it here.

Magrat at a glance

Highlights

-

Has great customer reviews

-

Offers a large range of services (auditing, tax, legal advice, relocation services, web design & hosting, personal asset management, etc)

Things to note

-

The pricing for typical services for e-Residency companies is more expensive compared to others

-

Minimum price for accounting does not include any accounting documents processing, also annual report is charged extra

-

Additional €120 for the initial set-up of the accounting system

Unicount

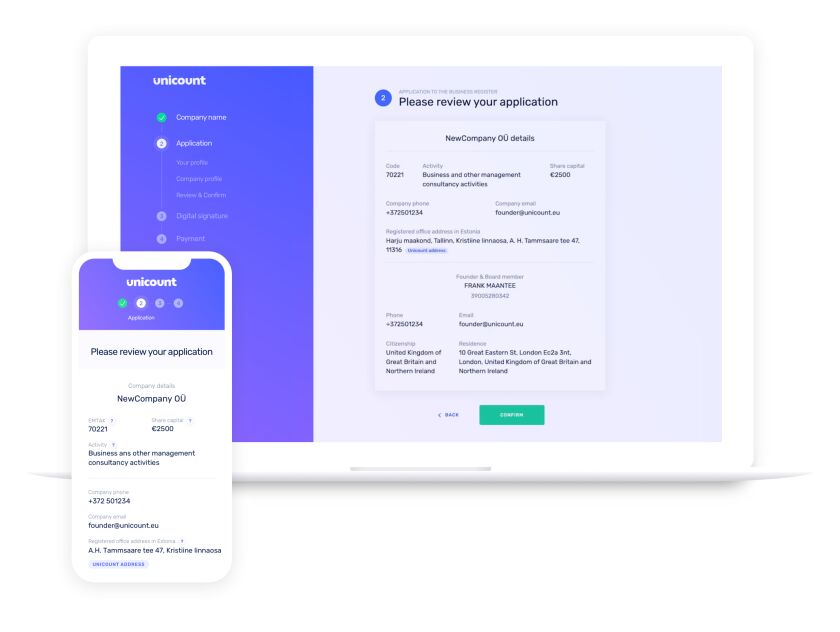

Unicount was founded in 2018, and provides company formation and virtual office for new or existing companies following self-service principles. You can use their self-service portal to register a company for €290 €261

(which includes the €265 state fee). Annual virtual office subscription is needed to use the online formation service.

Special offer: Unicount offers their incorporation package for

€290€261 by using this link

The Estonian Business Register API only allows you to register companies with one physical person founder for now. There is no one founder limitation when registering a multiple shareholder company directly through e-Business Register with Unicount virtual office. Also no restrictions when you want to switch your virtual office service provider.

For annual virtual office, they charge €199 per year including VAT. Contact person service is available for free within this fee for those e-residents who would like to register an Estonian company to a foreign registered office address.

Unicount offers accounting services starting from €99 (+ VAT) per month. It includes processing of 15 accounting documents. Annual report is not included in the monthly accounting fee, you’ll have to pay an extra €199 for that.

Additionally, Unicount has a good knowledge base on their website for e-residents covering all the main aspects of starting and running your Estonian company.

Unicount at a glance

Highlights

-

User-friendly website with self-service portal for very fast company formation (according to them, it can be done in 5 minutes)

-

You can use Smart-ID for incorporation in any device

-

Useful articles for e-residents available for everyone

Things to note

-

Accounting service starts at higher price point compared to many competitors, but it includes more accounting documents than average

-

Annual report is relatively pricey

To sum up, the market leader Xolo has an excellent offer for most service-focused companies with lots of experience, convenient interface, and processing of unlimited accounting documents. Due to the recent changes, they also accept pre-existing companies and firms with multiple shareholders to become their clients.

However, they still filter out e-commerce businesses, and companies that require a special license. So, if your business is in one of those fields, there are plenty of alternatives to choose from—as you could see—regardless of whether you prefer an all-inclusive monthly package or to pay for various services individually.

We would love to hear about your experiences with any of these service providers (or ones that we haven’t mentioned), so please let us know in the comments below.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.