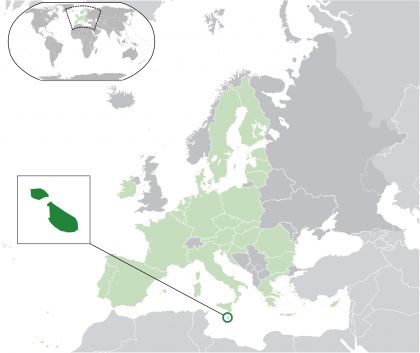

Jurisdiction guide: Malta 🇲🇹

This tiny island in the middle of the Mediterranean is an increasingly popular place for digital nomads, expats (especially in e-gaming and gambling), and crypto currency investors to base themselves.

Note: Below this introduction to Malta you’ll find all our articles and guides about Malta.

Fact box 🇲🇹

- Population: 493,559 (2019)

- Area: 316 km2

- Capital: Valletta

- GDP/capita (PPP): $48,246 (2019)

- Government: Unitary parliamentary constitutional republic

- Language: Maltese, English

- EU member, part of Schengen Area

- Currency: Euro

- Time zone: Central European Time (UTC+1)

- Average days of sunshine: ~300 per year

- Human Development Index: #28 (2019)

There are many things that draw people to Malta:

- Great weather all year round (warm summers, mild winters), more than 3,000 hours of sun per year

- Some interesting residency programs with tax benefits for people moving to the country—especially for HNWIs and others with a location-independent income streams (dividends, pensions, etc)

- The tax system for non-domiciled residents (e.g. no tax on foreign income not remitted to Malta)

- Easy access to the rest of Europe thanks to Malta being part of the Schengen Area (with no internal border controls)

Malta can also be a beneficial jurisdiction to incorporate a business. If you own the business through a holding company abroad (Cyprus is popular for this) then you can reduce the corporate income tax to just 5% (normally 35%).

(Source: Wikimedia—CC BY-SA 3.0)

Moving to Malta

Malta can be a perfect home base for digital nomads and perpetual travelers (PTs). In addition to the generous non-dom tax regime, and Malta’s EU and Schengen status (which let you come and go as you please), residents can also do most interactions with the government online. Except, annoyingly, changing your registered address.

Immigrating to Malta is super simple if you’re an EU/EEA citizen through the “Ordinary Residency” scheme. As long as you can take care of yourself you’re allowed to move here. Unless you’re planning on taking up local employment in Malta, you’ll most likely register as self-employed or economically self-sufficient. The latter means that you have at least €14,000 in savings or a low amount of fixed income (e.g. a pension).

For non-EU citizens there are several immigration schemes to choose from:

- Global Residency program with flat tax of 15% on remitted income

- Residency/Citizenship for Exceptional Services by Direct Investment (aka the “Golden Visa”)

- Highly Qualified Person program with 15% flat tax on local income up to €5 million, and nothing above that

- High Net Worth Individual Residence program

- Malta Retirement program

Banking in Malta

Malta has long been a popular banking jurisdiction (both for individuals and corporations) with a good reputation, and a competent banking regulator who’s up to the task.

Opening a Maltese bank account has in some ways become harder in recent years, with banks requiring more and more documentation, references, etc. This is all part of what keeps Malta’s banking sector reputable. However, there are still some quick and easy account opening options if you know where to look.