⚠️ October 7, 2023 update: The Portuguese government decided that from this date onwards, getting a Golden Visa through real estate is not possible anymore. This change also includes funds investing (directly or indirectly) in real estate.

⚠️ March 26, 2024 update: As of now, it still needs to be determined what exactly is considered a fund investing in real estate. The article below will be updated when the exact regulations for the new law are produced and published. For now, please be extra careful investing in any funds that invest (directly or indirectly) in real estate.

With the elimination of the real estate route, investment funds have become by far the most popular way to get a Portuguese Golden Visa. Is this the right route for you, and how do you choose the most suitable fund(s)? Hopefully, this article answers some of your questions.

Table of Contents ↺

- Eligible investment funds for Portugal’s Golden Visa

- Understanding Portuguese Golden Visa investment funds

- Types of Portuguese Golden Visa funds

- Portuguese Golden Visa investment funds’ fees

- Questions to ask yourself when choosing a fund

- Questions to ask fund managers/advisors

- Taxes related to Portuguese Golden Visa funds

- Extra considerations for US investors

- Documents required to apply for the Portuguese Golden Visa via fund investment

- FAQ

It’s quite a challenge to grasp all the important nuances, even for those researching Golden Visa eligible funds for a while. For the newcomers, it can be pretty overwhelming to learn the ins and outs of a foreign country’s financial system and make sense of the various investment fund options. This article is our most complete guide on this topic, and it should give you a good starting point to continue your analysis.

We were the first independent site who started writing about the Golden Visa investment fund route and did the required digging to list (and update) the eligible funds. Yeah, you read that right—there’s no official list you can look up to even know which funds are eligible.

Don’t worry, we’ll come back to the specific “venture capital” funds you can invest in for a Portuguese Golden Visa—but first let’s take a step back and give you the required knowledge to understand the options.

If the whole Golden Visa topic is new to you, check out our Portuguese Golden Visa guide to learn more about the process and other eligible investment options.

Eligible investment funds for Portugal’s Golden Visa

Which investment funds qualify for the Portuguese Golden Visa?

The law defines the investment funds route to Golden Visa as follows:

Capital transfers of EUR 500,000 or more, intended for the acquisition of holdings in non-real estate collective investment schemes, constituted under Portuguese law, whose maturity at the time of the investment is at least five years and at least 60% of the value of the investments is made in commercial companies with their registered office in Portugal.

Based on this, five essential conditions need to be met to qualify for the capital transfer path for Portuguese Golden Visa:

- The fund needs to be approved and regulated by CMVM (Portuguese Securities Market Commission).

- 60% of the fund’s capital must be invested in companies with headquarters in Portugal.

- The investor has to buy fund units for a minimum of €500,000.

- The investment needs to be kept during the whole Golden Visa process until permanent residency or citizenship is acquired, which takes at least 5 years (in reality, often 6-7 years).

- The fund may not, directly or indirectly, invest in real estate.

Currently available funds for Portuguese Golden Visa

We have kept this list of Golden Visa-eligible funds continuously up to date as new funds get approved and older ones reach their subscription deadline or target amount. In addition, we have met personally or via video call with all of the fund representatives to do some basic due diligence from our side. However, we are not financial advisors or lawyers, so make sure to also do your own research and consult professionals when necessary.

For the funds in the list that need some real estate to operate their main (non-real estate) business, we have obtained confirmation from fund managers together with a legal opinion that they still qualify. But be extra careful with these, as the official rules are still somewhat unclear.

-

Pela Terra II

Strategy of purchasing, holding, and cultivating large orchards, with a long term focus on organic transition and soil health.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€200,000

Subscription deadline

November 1, 2025

Duration

8 years

-

Iberian Net Zero

Focuses on renewable energy, energy efficiency and clean mobility.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€150,000

Subscription deadline

February 2026

Duration

8 years

-

Optimize Portugal Golden Opportunities

Invests in equities and bonds (corporate and sovereign) listed in regulated markets and that have a daily quotation.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€1,000

Subscription deadline

Open-ended

Duration

Open-ended

-

Portugal Liquid Opportunities

Investment in public equities with >60% allocation to the largest Portuguese listed equities and <40% allocated to Oxy Capital’s proprietary international listed equities strategy.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€100,000

Subscription deadline

Open-ended

Duration

Open-ended

You can also click here to learn about all 39 available funds

Statistics of Portuguese Golden Visa funds route

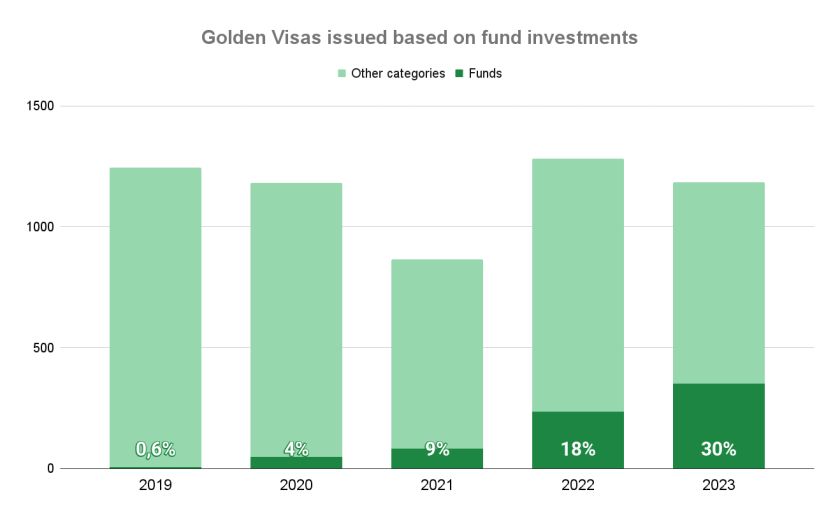

When we first published our Golden Visa guide in 2018 and highlighted the capital transfer (investment funds) option as something that hasn’t received the deserved attention, no Golden Visas were issued via this route yet. There was very little information available, and only 3-4 funds accepted Golden Visa investors. Since then, the popularity has increased rapidly, with about 30% of Golden Visa residency cards issued under the funds category in 2023 (until Sep 30, as the official statistics are only published until then).

Regarding the numbers, these are final approvals, not applications. Currently, the waiting time from applying to receiving the residency card is up to 18-24 months due to backlogs that started during Covid-19 times.

The previously most popular Golden Visa category, real estate, was eliminated in Oct 2023 as part of a law trying to ease housing problems in Portugal. Due to that, the investment funds route is now getting the most applications.

Understanding Portuguese Golden Visa investment funds

In general, investments funds are defined as a way of investing money alongside other investors that have three main advantages:

-

being able to use professional investment managers aiming to get better returns and more accurate risk management;

-

benefit from economies of scale, i.e., lower costs;

-

increased asset diversification.

In Portuguese, an investment fund in general is called a fundo investimento.

CMVM (Portuguese Securities Market Commission)

The Portuguese Securities Market Commission (CMVM) was established in 1991. Its role is to supervise and regulate the financial instruments market as well as the agents that operate in them and promote investor protection. It’s part of the European System of Financial Supervisors (ESFS). For example, in the US, the Securities and Exchange Commission (SEC) is performing a similar function.

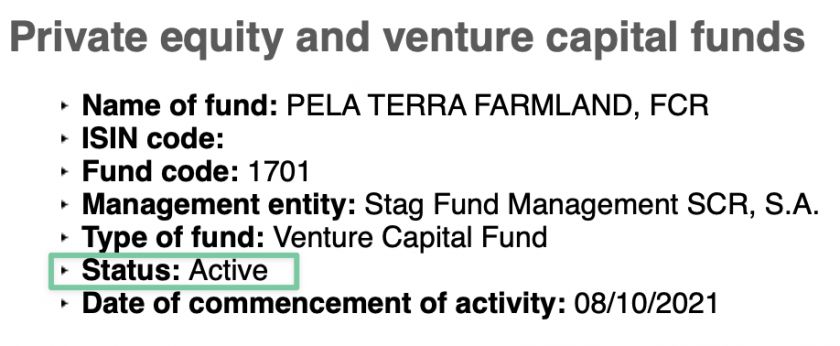

What is a fundo de capital de risco (FCR)?

The vast majority of funds eligible for Golden Visa investment are classified as fundo de capital de risco (FCR). In English, both venture capital and private equity funds would fall under this classification. It does not refer to risk capital/hedge funds, even though the name sounds similar. You can see all of the FCRs approved by CMVM here under “Venture capital funds” category. Most of these, however, aren’t eligible, don’t accept Golden Visa investors, or are simply closed for new investors.

How are the FCRs regulated in Portugal?

The FCRs are governed by Law 18/2015, of March 4 and their management regulations document.

According to law, FCRs must have a minimum committed capital of €1 million to become active. However, a fund can choose to raise the amount of the first close higher if they wish. Once the fund has reached its first close, the status on the CMVM website will be changed from “authorized” to “active”, and the activation date is added (see below). The overall targeted capital by funds usually falls between €20-50 million (with a few exceptions being around €100 million).

A fund is managed in accordance with the rules dictated by its management regulations. It’s a document detailing the investment strategy, fund term, subscription period, unit amounts and prices, arrangements applying in the event of incomplete subscription, complete fees, distribution policy, etc. It will also state the management entity, depository bank, and fund auditor.

It’s usually 20-30 pages long, and all potential investors can request this document to read before subscribing to a fund.

Fund manager vs fund advisor

When researching funds you may come across entities described as variations of fund managers and advisors.

A fund manager is a financial institution registered with the CMVM whose main objective is to oversee the fund’s investment strategy and activity and ensure compliance with regulations.

Management entities must perform their activities to protect the legitimate interests of investors and treat them fairly. They are also responsible for drawing up the management regulation document and ensuring that invested funds meet KYC and anti-money laundering laws.

Having a manager is a must to get approval for the fund, but many funds also have an advisor.

A fund advisor usually brings expertise in a specific area (technology startups, renewable resources, etc.). In many cases, they are the originators of the idea and overall fund strategy and are in charge of finding the specific investment opportunities. Each investment nonetheless needs final approval from the fund manager.

Types of Golden Visa funds in Portugal

Investment funds, in general, can be grouped in various ways (by asset type, investment sector, risk profile, etc.). Golden Visa eligible funds could be divided into 3 main groups:

- Private equity (PE) funds (fundos de capital de risco—FCR)

- Venture capital (VC) funds (fundos de capital de risco—FCR), and

- Mutual funds (fundos de investimento mobiliário).

Private equity funds

Private equity funds typically invest in companies that can demonstrate positive cash flow and have a good outlook for expansion within Portugal or international markets. Common sectors are healthcare, industrial, IT, renewable energy, hospitality, education etc. Some are focused only on one field, while others invest across several sectors. Their typical strategy is to take a controlling interest in an operating business and increase the value by being involved in a company’s management. Typically, private equity funds have a medium to high-risk profile with a similar expected yield. PE funds lifecycles vary from 6-10 years.

Highlights:

- Typically lower risk compared to venture capital (higher downside protection)

- Several industries to choose from: renewable energy, healthcare, hospitality, logistics, manufacturing, agriculture, etc. Many funds also invest across several sectors.

- In many cases there are some dividend payments

Things to note:

- Often the track record of the advisors are more relevant to consider than that of the fund manager, which often means less available objective data

- Expected returns could be lower compared to venture capital funds

Venture capital funds

Venture capital funds focus on early-stage startups with global potential before these companies become profitable. Therefore, venture capital is riskier but also has a higher expected return. The most typical sectors are tech, AI, e-Commerce, life sciences, clean energy, etc. These funds typically don’t pay out annual dividends; instead, they focus on maximizing return at the exit. Risk profile is high risk and high expected return. Fund term is typically on the longer side, 8-10 years.

Highlights:

- Higher potential upside than other fund types

- Possibility to invest in early-stage unicorns

Things to note:

- Typically more downside than other fund types

- Your investment is typically locked in for longer compared with other fund types

- Can be difficult to evaluate the funds without industry expertise

Mutual funds

Unlike private equity, mutual funds invest in companies traded on the stock market. The main goal is often to beat the PSI-20 index that tracks the performance of the 20 largest national companies by market capitalization (the Portuguese equivalent of S&P 500 index). Since mutual funds invest primarily in the same companies as PSI-20 (with varying percentages), the overall return usually doesn’t drastically deviate from the index. Some mutual funds invest up to 40% in foreign equities or bonds for diversification and potentially higher returns, one of these is Portugal Liquid Opportunities.

Mutual funds don’t have a predefined fund term, meaning that investors can exit anytime. However, you would lose your Golden Visa in that case. You can see available mutual funds in Portugal here under Securities investment funds (Fundos de investimento mobiliário). Most of these are unsuitable for Golden Visa investors, but here’s a small list of those accepting Golden Visa investors.

Highlights:

- More flexible process for entering and exiting the fund (since it’s traded on an exchange)

- Typically no performance fees, but there are exceptions

- Performance can be publicly tracked on a daily bases

Things to note:

- Very few funds to select from

- Mostly invested in energy and utility companies, telcos, financial services, and former monopolies such as the Portuguese postal services (CTT)

- Performance of publicly traded companies have historically been weak in Portugal

- Strongly influenced by general stock market movements

Portuguese Golden Visa investment funds’ fees

Typically, there are fees involved with all three steps: setup, management, and investment exit. However, a few funds have 0% for one of these fees, which could sometimes mean that the others are relatively higher. So, it’s always important to consider the combination of all three.

It’s important to note that most if not all fees are not charged on top of your investment, but charged to the fund. This means the fees still reduce your overall return on investment, but they are already baked into the fund’s forecasted returns and won’t necessitate any additional outlays by the investors.

Subscription/setup fee

This is a one-time fee paid together with the investment made into funds. It can be charged as a percentage of the capital invested (usually 1%-3%) or a fixed amount. It covers the fund setup costs and fundraising (marketing, administration, etc.), compliance, KYC, and more. Setup fee is the only fee that can be charged as an extra on top of the €500k investment amount; however, in most cases, it’s deducted from the investment amount. Therefore, it’s worth clarifying in each individual case how the fund representatives charge this fee, and some funds don’t charge any setup fee.

Management fee

The management fee is an annual fee paid by the fund to the management entity, usually calculated monthly or quarterly from the fund resources. Typically, it’s between 1%-2.5%. It covers the overhead costs of daily operations, including salaries for management company personnel, regulatory compliance, and monitoring of the existing investments.

Some funds have a minimum fixed management cost per year, which makes the percentage higher if the fund doesn’t reach its capital target. It’s important to check with the fund representatives how much money they need to raise to achieve the advertised management fee. It’s also not uncommon to initially have a higher management fee while acquiring assets, and it drops during the investment management years.

Performance fee

Fund return is usually the most exciting aspect both for fund managers/advisors and investors. The performance fee is the cut of investment returns that the fund does not distribute to investors. Performance fees vary widely depending on strategy, asset type, and whether the fund distributes annual dividends.

Performance fee often has a hurdle rate, under which 100% of the profits belong to investors. The average hurdle rate for funds in our list is between 5-7% per annum, but it can also be less or more.

The hurdle can be with a catch-up or without. The catch-up means that once the fund return reaches the hurdle rate, all the profits will go to fund representatives until they have received their performance percentage of overall return. After that, the profits are split with investors.

Since it might be difficult to grasp, I’ll give an example. Fund X reached maturity with a 15% total annual return, and they didn’t distribute any dividends. The fund has a 20% performance fee with a 5% hurdle with catch-up. The distributions at the fund maturity will be paid in the order of the below steps:

1. Return of investors’ capital

100% of investors’ original investments are paid back.

2. Hurdle/preferred return

100% of profits up to 5% IRR (hurdle rate) are distributed to investors.

3. Catch-up

100% distributions go to the fund’s general partners until they’re “caught up” to 20% going back to the first euro of the profits.

4. Remaining distributions/carried interest

The remaining 10% will be distributed 80/20 in favor of the investors.

If a fund has a hurdle rate but doesn’t have a catch-up mechanism, they would skip step 3.

We can also look at how the profits would be distributed at varying levels of return for the same fictional fund:

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

|---|---|---|---|---|---|

| Fund annual return | -5% | 0% | 5% | 6% | 10% |

| Investor annual return | -5% | 0% | 5% | 5% | 8% |

| Manager* annual return | 0% | 0% | 0% | 1% | 2% |

If the fund didn’t use a catch-up mechanism the results would have looked like this:

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

|---|---|---|---|---|---|

| Fund annual return | -5% | 0% | 5% | 6% | 10% |

| Investor annual return | -5% | 0% | 5% | 5.8% | 9% |

| Manager* annual return | 0% | 0% | 0% | 0.2% | 1% |

*Manager may here also refer to fund advisor—this varies per fund.

Typical fees for different types of Golden Visa funds

Private equity and venture capital fund management fees usually range between 1.5% and 2%, while setup fees are typically 0-3%. Performance fees vary greatly, but generally, these are around 20-25%, with a hurdle rate between 5-8% annually.

Mutual funds’ annual management fees are, on average, 1.5%- 2%, but they could be lower in some cases. They usually have a 1-2% setup fee and generally no performance fee.

Questions to ask yourself when choosing a fund

When considering different funds, the first step is to understand what you are looking for and narrow your focus. The below questions will help you get started with this.

- Which strategy do I prefer? Is capital preservation or maximizing potential return more important? How much risk am I willing to take?

- Which sector do I want to invest in (tech companies, farmland, healthcare, renewable energy, education, wine industry, etc.)?

- Is it important that it’s an ESG fund?

- How long can I keep my capital locked in?

- Do I want to invest only in one fund or further diversify the investment? Most funds require a minimum investment between €50,000-€250,000, so you can split your investment between several funds.

Questions to ask fund managers/advisors

Once you have a better idea of what’s important for you, I’d recommend reaching out to request a presentation and set up meetings with funds you’re interested in. I’ve listed some of the questions you might want to ask from the fund representatives.

- What are the credentials and track records of the fund’s managers and advisors in the specific field?

- What are the fund’s investment strategy and risk profile?

- How diversified is the fund (how many companies, real estate projects, etc. does it invest in, and how different are they)?

- How much leverage do they use for investments?

- What is the target fund size, and how much have they raised so far? Have they reached their first close? What is their contingency plan if they don’t raise as much funding as expected?

- How much “skin in the game” do the managers/advisors have (how much have they invested themselves)?

- What is the expected target return per annum?

- Does the fund distribute dividends (how often and how much)?

- What are the fees (subscription fee, management fee, performance fee)? Is the subscription fee additional or included in the investment amount? Does the stated management fee assume a specific fund size (will the percentage be higher with a smaller size)? Does the performance fee have a hurdle?

- Do they provide annual PFIC information statements (for US investors)?

- If the fund has any real estate exposure, what is its strategy for qualifying for Golden Visa investment? Also, ask to see an official legal opinion about the fund’s eligibility for a Golden Visa.

- What is the exit strategy for investors? Is it possible to exit before the fund term ends?

Taxes related to Portuguese Golden Visa funds

Portuguese non-residents are generally exempt from paying taxes from dividends and capital gains in Portugal on fundos de capital de risco funds (unless your fiscal residency is in a country that Portugal considers a tax haven). But, unfortunately, it doesn’t mean that you’re entirely free from taxes as you will have to declare and pay these in the country of your tax residency.

If you decide to become a Portuguese tax resident, you’ll have to pay 10% of withholding tax on distributions.

Extra considerations for US investors

US persons are US citizens and other tax residents (either Green Card holders or by Substantial Presence Test). Therefore, they are subject to declaring their income (unless under the minimum threshold) in the US, even if they are primary tax residents somewhere else.

FATCA (Foreign Account Tax Compliance Act)

To work with people with connections to the US, investment funds and banks need to consider FATCA regulations.

FATCA is a US federal law that requires foreign financial institutions to report the assets and identities of US persons to the US Department of the Treasury. It also requires US persons to declare their foreign financial assets annually over a certain amount to the IRS on form 8938.

An important factor to consider is that some FATCA compliant banks will open a regular bank account but won’t offer custodian services to US persons (e.g. Millennium BCP). Currently, we know three banks in Portugal that offer remote account openings and can hold investment fund units for US investors—Bison, BiG, and Atlantico Europa.

Be aware of the PFIC treatment!

The good news is that the majority of Golden Visa eligible investment funds welcome US persons as investors. However, you need to be aware of how so-called PFICs (Passive Foreign Investment Companies) are taxed by the IRS.

A foreign investment fund is considered a PFIC if either income test or asset test is met:

- Income test—75% or more of the corporation’s gross income is passive income

- Asset test—50% or more of the corporation’s average assets produce or could produce passive income.

Most foreign investment funds (either private equity, mutual funds, or others) are usually by default classified as PFICs for tax purposes. As a result, these are taxed at the highest federal income tax level, not depending on a person’s overall earnings. At the time of writing, it’s 37%, and both dividends and capital gains from the fund are taxed at that level.

The worst part of PFICs taxation is known as “excess distribution”. It happens when an investor receives a distribution from a PFIC that is significantly greater than usual (more than 125% of the last 3 years average). This is a likely case with a lot of closed-ended funds, as investors receive a share of the profits in the end. IRS will not only apply the usual tax on the “excess”, but will assume this represents unreported distributions in previous years which had not been taxed. Therefore, the IRS adds an interest for late payment on top of tax which can get very costly.

There are two ways to get a more favorable tax rate—a QEF election and the mark-to-market accounting method. Both of these need to be elected on IRS form 8621 starting from the year of acquisition and extending annually. It’s one of the most complicated and time-consuming tax forms, so it’s highly recommended to use an expert for this.

QEF election

The QEF election allows the shareholder to treat the sale of fund units as capital gains rather than ordinary income, taxed at a much lower rate. This is similar to the taxation of US mutual funds, except that dividends are not considered qualified dividends and will be taxed with federal ordinary income rates.

A fund needs to provide an annual PFIC information statement so that investors can make the election. The statement must include the investor’s proportional share of ordinary earnings and net capital gain or enough information to calculate the share for a specific tax year.

Mark-to-market

The mark-to-market accounting method calculates a gain and loss annually to mirror the changes in the value of the fund units. This method is only possible with marketable securities, so only with mutual funds.

The most important things to remember

- Make sure the Portuguese bank you open an account at is FATCA compliant and that they can provide custodian services to US investors.

- You need to file IRS form 8621 annually starting from the first year of investment; otherwise, you will likely be subject to high-interest penalties. It’s highly recommended to use a qualified expert for this.

- It’s best to do the QEF election in the first year and annually after that. (It’s possible to make the election in a subsequent investment year, but it becomes more complicated).

- Ask if the fund provides a PFIC annual statement—for it to be valid, the statement needs to be issued by the PFIC and signed by the authorized representative.

If you’d like to dig deeper into this topic, check out our dedicated forum thread.

Documents required to apply for the Portuguese Golden Visa via fund investment

General documents required to apply for Golden Visa

- Passport or other suitable travel documents

- Evidence of legal entry and stay in Portugal

- Adequate health insurance (issued at least three months prior)

- Clean criminal record from the country of residence

- Document authorizing a criminal records check in Portugal

- A written statement confirming that the applicant will comply with minimum quantitative requirements and maintain the investment for at least five years

- A statement from Portuguese tax and social security authorities verifying no debt or confirmation that the applicant is not registered with these authorities

Additional documents required for the investment funds route

- Statement from a Portuguese financial institution confirming an international transfer equal to or more than €500,000 into a bank account under the name of the main applicant

- Certificate from a fund manager of the units purchased, free of any liabilities

- Declaration from the fund manager proving that the fund qualifies for Golden Visa investment (at least five years lifetime, at least 60% invested in Portuguese companies, and a suitable capitalization plan)

- If the investment is made under a single-member limited company (Sociedade Unipessoal por Quotas), then an excerpt from the commercial registry (Registo Comercial) is needed showing that the investor is the proprietor of the company

What are the advantages and disadvantages of investing in a Portuguese Golden Visa fund?

To evaluate the advantages and disadvantages of fund investments, let’s compare it to the other popular routes to qualify for the Golden Visa.

The two most likely alternatives to investment funds will be jobs creation by opening a company (the entrepreneurial route), and donation for supporting artistic production or national cultural heritage (the philanthropic route).

You can read more about all the available investment options here.

Advantages

Diversification

Fund investment offers broader diversification into several companies. There are also rules in the management regulations document limiting the percentage of raised capital that can be invested into a single project. It’s also possible to split the required €500,000 into several funds if someone wants additional diversification.

If you go the entrepreneurial route of starting a company that employs 10 people, you’ll potentially lose your entire investment if the company goes belly up.

When making a cultural donation, you’re typically just supporting a single organization, and you won’t see your capital again.

Choice of industries

Funds invest in various industries, which give a wider choice (real estate, agriculture, early-stage technology startups, healthcare, blockchain, industrial, ESG-focused companies, etc.).

Easy management

Funds are managed by CMVM-regulated entities, whose main roles are to oversee the fund strategy, identify and approve investments, and protect investors’ interests. This is a very hands-off investment option compared to starting or being involved in a company.

Cultural donation is obviously a different story, where there is no follow-up necessary after transferring the money.

Easy exit

When the fund lifetime is over, there is no need to find a buyer for your investment. It’s the responsibility of the fund manager to successfully divest the assets. Some funds also allow investors an earlier exit if they receive their citizenship/permanent residency before the fund’s end date.

As a company owner, it is up to you to either keep the business running or liquidate the company. If the company is not yours, then you should have negotiated a pre-approved exit strategy.

Likely higher return

Many funds target overall returns between 7-10% per annum.

Philanthropic donations also include cultural investments (although we’re not currently aware of any such qualifying projects), such as independent film production. However, many of these initiatives struggle to break even, so it’s best to assume you might not get anything back from the funds “invested.”

The running costs of a company with at least ten employees are likely significant, as is the time you’ll likely have to put in to manage the business.

While the business may be successful, When considering both the time and capital put into the company, it’s not unlikely that you’ll be better off letting someone else do all the hard work.

Disadvantages

Higher capital outlay

Pursuing the fund route, there is no option to invest less than €500,000.

On the other hand, in the case of the entrepreneurial route there’s no fixed minimum (nor maximum!). With a cultural donation the amount is usually €250,000—but here we’re talking about a donation rather than an investment, so it’s not really comparable.

Lock-in period

The lifetime of some funds is longer than it takes to receive Portuguese citizenship/permanent residency. Therefore, if someone needs to exit the fund as soon as possible, it’s better to choose one with a 6-7-year term than one with a 10-12 year term.

Profit share

In return for having someone else manage the investments, you will have to share the fund’s earnings with its management entities.

The best funds have fee structures that incentivizes the management team to maximize your return, and often the fund manager doesn’t get a share of the final profits unless they hit a certain “hurdle rate”.

If you decide to open your own company, you will not have to share the profits (but will have to pay the salaries for at least ten people). With donations, there’s generally no return, so nothing to share.

Risk of investment funds not reaching needed capital target

At least 39 funds currently accept Golden Visa investors, and CMVM continuously approves new ones. While it’s good to have a choice, it also poses a risk. Not all of these funds will be able to raise as much capital as they hope from Golden Visa investors—meaning it’ll be hard for the funds to be as profitable as hoped, given that a larger chunk of the investment will be eaten up by management fees.

It’s not necessarily a disadvantage in general (at least not for the best funds) but something to be aware of, and it should make one more careful with the due diligence to make sure you invest in a fund that’s raising enough to be profitable.

FAQ

Table of Contents ↺

- Which investment funds are eligible for the Portuguese Golden Visa?

- Who can apply for the Golden Visa investment funds option?

- Is it possible to get citizenship in Portugal through an investment fund?

- How much do I need to invest in a Portuguese Golden Visa investment fund?

- How did the Portuguese Golden Visa changes in 2023 affect the investment fund option?

- Should I enlist the help of a financial advisor to choose the Golden Visa fund?

- Where can I find a lawyer for the Golden Visa in Portugal?

- Can I invest in more than one Golden Visa fund?

- Is it possible to use a company to invest in a Portuguese Golden Visa fund?

- What happens to my Golden Visa if the fund units’ value drop below the minimum required investment amount?

- Can I change my investment from one fund to another during the required 5-year Golden Visa program period?

- What is the best way to transfer money for Golden Visa fund investment?

- Where can I find more information about Portuguese Golden Visa investment funds?

Which investment funds are eligible for the Portuguese Golden Visa?

These are the prerequisites for a Portuguese investment fund to qualify for Golden Visa:

- it needs to be approved by CMVM (Portuguese Securities Market Commission);

- 60% of the fund’s capital needs to be invested in companies with headquarters in Portugal.

Here you can see the list of qualifying funds, which we regularly update as new funds get approved, and older ones reach their subscription deadline.

Who can apply for the Golden Visa investment funds option?

Anyone eligible for a Portuguese Golden Visa can also apply for the investment funds category, which means anyone at least 18 years old who is not a citizen of EU/EEA country.

Is it possible to get citizenship in Portugal through an investment fund?

Yes, you can apply for Portuguese citizenship (or permanent residency) five years after you have received your Golden Visa residency permit. To qualify for the citizenship, you have to:

- keep your invested fund units throughout the 5-year period;

- spend the minimum required time in Portugal (an average 7 days per year);

- pass an A2 level Portuguese language test.

How much do I need to invest in a Portuguese Golden Visa investment fund?

The minimum investment amount to qualify for the Portuguese Golden Visa through fund investment is €500,000.

How did the Portuguese Golden Visa changes in 2023 affect the investment fund option?

Since October 2023, any fund directly or indirectly investing in real estate no longer qualifies for a Golden Visa. If a fund has any real estate exposure (due to needing it for its non-real estate-related operations), ensure its strategy aligns with the new regulations.

Should I enlist the help of a financial advisor to choose the Golden Visa fund?

You could if you feel more comfortable that way. Just keep in mind that financial advisors might have a limited list of funds they work with, and typically they receive incentives for referrals, meaning that they may or may not prioritize your best interests. So be careful to make sure the advisor’s incentives align with yours.

Where can I find a lawyer for the Golden Visa in Portugal?

It’s highly recommended to work with an experienced immigration lawyer to guide you through the initial application and onwards. If you don’t have one yet, here you’ll find some options that our readers have used and recommended for Golden Visa process.

Can I invest in more than one Golden Visa fund?

Yes, it’s possible to split your investment into several funds. The main benefit is broader diversification, and the downside is more paperwork and potentially a bit higher fees (as some fees may be fixed, not a percentage of the invested amount).

Is it possible to use a company to invest in a Portuguese Golden Visa fund?

Yes, but only if it’s a single-member limited company registered in Portugal (Sociedade Unipessoal por Quotas). It can’t be a foreign company, and it can’t have more than one owner.

What happens to my Golden Visa if the fund units’ value drop below the minimum required investment amount?

The fluctuations in the price don’t affect your ongoing Golden Visa application or renewals as long as the number of fund units (which originally cost at least €500,000) remains the same.

Can I change my investment from one fund to another during the required 5-year Golden Visa program period?

I don’t know any specific cases where this has been done, but it’s theoretically possible to move your investment from one fund to another. What matters is that it stays under the same Golden Visa category and that you own the required amount of fund units (as valued by their acquisition cost) at any given time.

What is the best way to transfer money for Golden Visa fund investment?

Our readers have often preferred using Wise or Interactive Brokers over traditional banks for currency exchange and money transfer as these offer faster and more reliable transfers and better rates. If you’d like to research more about different transfer options, check out this forum thread. Even though it’s focused on transferring an investment from the US to Portugal, most of these option are also available in other countries.

Where can I find more information about Portuguese Golden Visa investment funds?

You can contact the fund advisors/managers here to receive a presentation about the funds that interest you. If you wish, you can then schedule an introductory call with them.

We also host webinars about Portuguese Golden Visa investment options. You can sign up for the upcoming ones or request a recording for the ones that have already taken place.

Also, feel free to join current and potential future Golden Visa investors in our forum—it’s a good place to get answers to additional questions you might have. If you have already invested in a fund or are seriously considering investing in a specific fund, you can also join dedicated investor groups.

We’d like to say a special thanks to Lucian Daniliuc for taking photos of the CMVM building for us.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.