The Dutch bank bunq is one of several mobile-only banks to appear in the last few years in Europe. While the slightly higher sticker price than many of their competitors might be off-putting, the bank’s unique philosophy might still persuade you to open an account.

📆 2025 Update: While the general principles outlined in this article still holds true, bunq has updated their pricing plans since I wrote it—including adding a very useful free plan. I have not yet rewritten the article to reflect these changes, so please check out the new and improved pricing here.

Table of contents

Why bunq?

The bunq philisophy: Bank of The Free

How to Open an Account

FAQs

Why bunq?

While bunq is primarily developed for users in the Netherlands, they already have a robust pan-European fan base.

So why would you open a bunq account, rather than with one of their many competitors?

There’s quite a long list of reasons:

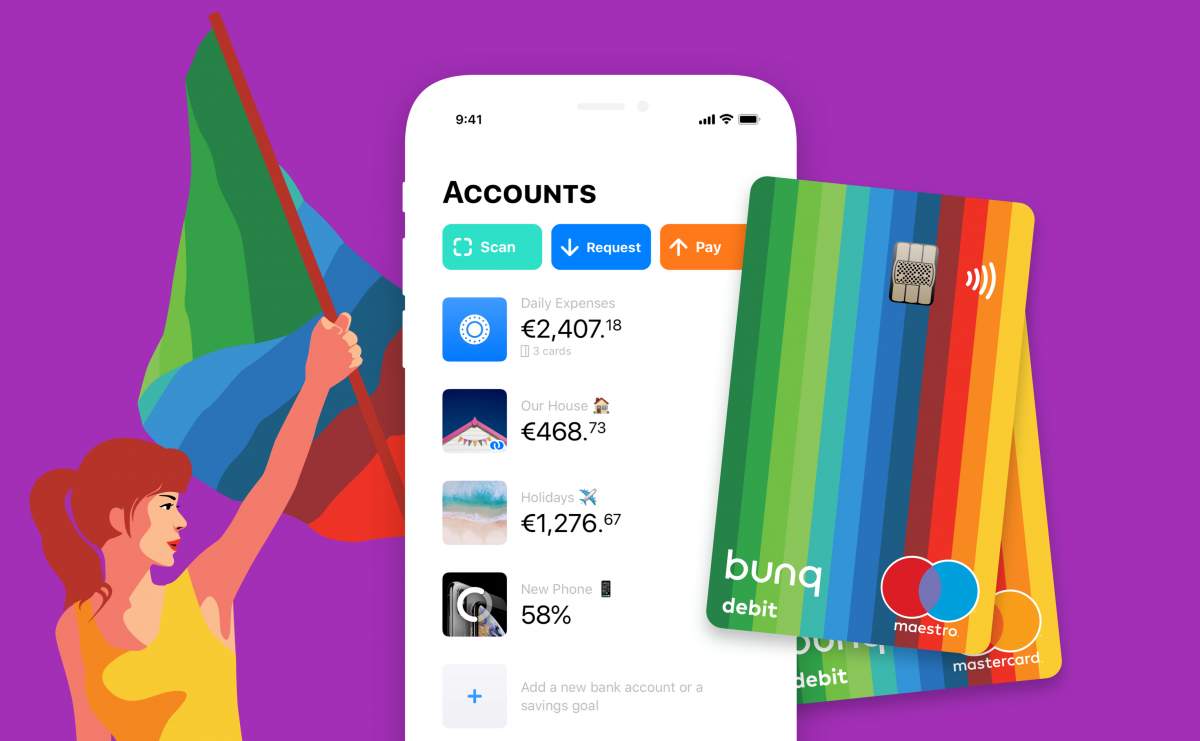

- Their mobile app experience is excellent! 👏

- It literally only takes a few minutes to open an account. 🚀

- They have a European banking license, meaning that your deposits up to €100,000 are insured in case the bank ever fails. 🏦

- If you live in the Netherlands, you’ll find features such as iDEAL useful. 🇳🇱

- One of the few fintech banks which offer shared accounts (aka +1). 👫

- They offer both Mastercard and Maestro—the latter is useful in parts of central and western Europe (The Netherlands especially, and also Germany). 💳

- They offer the cheapest metal card in Europe. 🏅

- It’s one of few Dutch banks that let you sign up without a BSN number (Dutch ID number). 🆔

- Like N26, they also have a built-in Wise integration for non-SEPA transfers. 🌏

- They already support 6 languages: 🇬🇧🇳🇱🇩🇪🇪🇸🇮🇹🇫🇷

- Loads of small, innovative features:

- One card, two PINs. Use the same card for two accounts depending on which PIN you enter. 🔢

- Invoice scanner 🧾

- Savings goals, round up transactions, etc 🐷

- Dedicated business accounts

However, there are also some significant drawbacks:

- They do offer a free plan, however it is very limited, so you will most likely need to go for their easyBank plan for 2.99€ per month.

- No included travel insurances or other significant perks that could help justify the monthly price. 🛫

Whether you choose bunq or one of their competitors (like N26) is likely to come down to two things:

- Are you living in the Netherlands? If so, bunq—with their iDEAL support—has a leg up on the foreign competition.

- If you feel strongly about the bunq philosophy or not.

What is this philosophy? Read on to find out…

The bunq philosophy: Bank of The Free

The bunq team has a very singular focus: Provide the best possible checking account experience, with no bullshit.

So they offer you a simple proposition: your monthly payment covers their costs, so they don’t need to resort to shady business practices to make a profit.

That means they won’t sell your usage data to third parties, nor will they invest your savings into shady corporations to make a quick buck.

To drive home this point, they even launched a pretty dark marketing campaign called “Truth, Lies, and Banking”.

So, what they are talking about when they say bank of “The Free” isn’t free as in beer (gratis), but free as in speech (libre).

If that resonates, then maybe bunq is the bank for you.

How to open an account

- Click here, and then enter your phone number (from one of the currently supported countries)

- Click the unique invite URL you received via text message and download the app to continue the signup

- Select your type of account. Usually Personal unless opening for a business.

- Enter your name, gender, and date of birth.

- Enter the same phone number as before and your email address.

- On the next page, enter a 6-digit login code.

- Finally, follow the instructions in-app to verify your identity.

Frequently Asked Questions

Where is bunq available?

How do I verify my identity with bunq?

What ID cards are accepted when opening a bunq account?

Can I open a bunq account from abroad?

What is included in my paid bunq membership?

What happens if I switch to the free plan?

Does bunq offer metal cards?

Who can open a business account?

How do you open a business account?

Can I have both a Mastercard and a Maestro card?

If you open a bunq account while living in a supported country, can you keep it if you move elsewhere?

Can you access bunq from your computer?

Are there any promo codes available for bunq?

Is bunq free to use?

Are my deposits insured?

Does bunq support SEPA instant transfers?

Can I get a free Maestro card for use in the Netherlands?

Where is bunq available?

While bunq’s banking license is valid in all of the European Economic Area, they restrict bank account openings in some countries, presumably for risk management reasons.

They only guarantee that bunq accounts works smoothly in the countries where they have officially launched:

| Officially launched | ||

|---|---|---|

| Austria 🇦🇹 | Belgium 🇧🇪 | Denmark 🇩🇰 |

| France 🇫🇷 | Germany 🇩🇪 | Greece 🇬🇷 |

| Iceland 🇮🇸 | Ireland 🇮🇪 | Italy 🇮🇹 |

| Netherlands 🇳🇱 | Norway 🇳🇴 | Portugal 🇵🇹 |

| Spain 🇪🇸 | Sweden 🇸🇪 | United Kingdom 🇬🇧 |

Still, they also say that their account is available in most of the EEA. I went ahead and tested which countries they currently accept signups from (curiously, they didn’t want to provide me this data). These are the other countries that seem to work:

| Seems to work | ||

|---|---|---|

| Bulgaria 🇧🇬 | Finland 🇫🇮 | Luxembourg 🇱🇺 |

That leaves 13 EEA countries that they don’t currently support:

| Currently blocked | ||

|---|---|---|

| Croatia 🇭🇷 | Cyprus 🇨🇾 | Czech Republic 🇨🇿 |

| Estonia 🇪🇪 | Hungary 🇭🇺 | Latvia 🇱🇻 |

| Liechtenstein 🇱🇮 | Lithuania 🇱🇹 | Malta 🇲🇹 |

| Poland 🇵🇱 | Romania 🇷🇴 | Slovakia 🇸🇰 |

| Slovenia 🇸🇮 |

Bunq is also not available in Switzerland 🇨🇭 yet, as it’s not an EEA country.

Business accounts are only available in a handful of countries at the moment.

How do I verify my identity with bunq?

If you already have a Dutch bank account, you can verify your identity by setting up an iDEAL transfer.

If you already have a bank account in Austria, Belgium, Germany, Italy, Netherlands, or Spain, you can verify your identity by completing a SOFORT transfer.

If you don’t have either, you can verify your identity by snapping some selfies and photos of a supported ID document in the app.

What ID cards are accepted when opening a bunq account?

If you can’t verify your identity with an iDEAL or Sofort transfer, you can verify it using an ID document.

From the EEA, the following identity documents are all accepted:

- Driver’s licenses

- ID cards

- Residence permits

- Passports

| Accepted non-EEA passports | ||

|---|---|---|

| Australia 🇦🇺 | Brazil 🇧🇷 | Canada 🇨🇦 |

| Chile 🇨🇱 | China 🇨🇳 | Colombia 🇨🇴 |

| Hong Kong 🇭🇰 | Indonesia 🇮🇩 | India 🇮🇳 |

| Israel 🇮🇱 | Japan 🇯🇵 | Korea 🇰🇷 |

| Morocco 🇲🇦 | Monaco 🇲🇨 | Malaysia 🇲🇾 |

| New Zealand 🇳🇿 | Singapore 🇸🇬 | Switzerland 🇨🇭 |

| Turkey 🇹🇷 | United States 🇺🇸 | Uruguay 🇺🇾 |

If you are from a non-EEA country that’s not on the list above but live in the EU/EEA, you can also use your residence permit to verify your ID.

Can I open a bunq account from abroad?

If you’re traveling abroad, but have an address in one of the supported countries, you can open a bunq account while you are abroad. You only need your phone, ID, and a good internet connection.

What is included in my paid bunq membership?

- 25 bank accounts with individual IBANs

- Free SEPA transfers

- Three debit cards (can be a mix of Mastercard and Maestro)

- 10 free ATM cash withdrawals every month (extra withdrawals are €0.99 each)

- No foreign exchange fees (you get the official Mastercard rates)

At least your membership doesn’t come with a contract so you can cancel at any time. You can also try out bunq easyMoney for free for one month.

What happens if I switch to the free plan?

If you switch to the free plan all your cards will be deactivated, as well as Android Pay and Apple Pay. You’ll also lose access to the API (so you can’t use third-party services with your account), and you can’t open additional bank accounts.

You can still use your account to make and receive European (SEPA) bank transfers for free.

Update: As of June 2019 you can no longer switch to a free bank account-only plan.

Does bunq offer metal cards?

Yes, they do! It’s called the bunq Metal card and comes included with the bunq easyGreen plan or if you prepay for your bunq easyMoney plan for 24 months. It can also be ordered separately for €129. That’s a good price for a metal card in Europe, however it doesn’t come with any additional benefits beyond those already included in your subscription.

Who can open a business account?

You can register your sole proprietorship (personal business) in the Netherlands 🇳🇱, Germany 🇩🇪, Austria 🇦🇹, Italy 🇮🇹, France 🇫🇷, Spain 🇪🇸 or Ireland 🇮🇪.

In addition, German 🇩🇪 (incl. GmbH) and Dutch 🇳🇱 legal entities are also supported.

Only the director of the company can open the account.

Only active companies are supported at this time. If more than 50% of the company’s income is passive, it won’t qualify.

Dutch companies are only supported if all shareholders are resident in the Netherlands.

How do you open a business account?

The signup flow is similar to the one for personal accounts. Start by clicking here, and then select Business.

You will be asked for the business’ tax ID or registration number:

- Italy 🇮🇹: numeroRI

- France 🇫🇷: SIREN or SIRET

- Germany 🇩🇪: e.K./e.Kfm/e.Kfr or Handelsregisternummer

- Netherlands 🇳🇱: KvK number

You also need to give some additional information about the UBOs (ultimate beneficial owners) of the company, as well as copies of the major shareholders’ ID documents.

Can I have both a Mastercard and a Maestro card?

Yes, it’s included with easyMoney and higher plans. With the €2.99 easyBank plan you only get one card for free, but for a few euros extra per month you can add a second card to this plan, too.

If you open a bunq account while living in a supported country, can you keep it if you move elsewhere?

It depends. If you move permanently outside the EU/EEA (meaning more than 6 months straight), bunq may at their own discretion close your account or ask you to clarify your situation.

Can you access bunq from your computer?

Unfortunately not, bunq is only available from your iOS or Android device.

Are there any promo codes available for bunq?

Unfortunately not anymore! After November 13, 2019 bunq no longer offers any promo codes or referral bonuses. However, if you sign up from this link you will get a free 30 day trial of bunq easyGreen.

Is bunq free to use?

Yes and no. You can have a simple bank account for free, but if you want an actual bank account with a debit card, you’ll have to pay the €2.99 for bunq easyBank, €8.99 per month for bunq easyMoney or €17.99 for bunq easyGreen.

Business accounts start at €9.99/mo.

Are my deposits insured?

Yes, your deposits up to €100,000 are fully insured by Dutch National Bank’s (DNB) deposit guarantee scheme in accordance with EU regulations.

Does bunq support SEPA instant transfers?

Yes, they do! You can send transfers of up to €10,000 to any participating bank in the SEPA network in only a few seconds, day or night, weekday or weekend, holiday or not.

Can I get a free Maestro card for use in the Netherlands?

Are you a frequent visitor to the Netherlands and want a Maestro card to use there since Visa/Mastercard acceptance is very low? Sadly, bunq no longer offers this for free. You’ll need to sign up for the €2.99/mo easyBank plan to get a Maestro card (but if you choose this you won’t get a Mastercard). With higher plans you get both cards included.

The only easy way to get a free Maestro card is to sign up for a free N26 account with a German, Dutch, or Austrian address, then top it up with at least €100.

I hope this article answered all the questions you had about bunq. If not, feel free to ask below, and I’ll answer as best I can!

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.