⚠️ Important: We have now published a new version of this guide which reflects the changes of the October 2023 law. If you’re applying now, please refer to that guide instead.

⚠️ 2023 update: The Portuguese government announced that investments in real estate (including funds investing in real estate) as well as capital transfers will no longer qualify for the Golden Visa. However, for the time being (most likely until late September/early October) it’s still possible to submit applications. See here for the latest updates

⚠️ October 5, 2023 update: The last day to submit Golden Visa applications under the old rules will be tomorrow, October 6, 2023. From October 7 the new law will apply. This article has not yet been updated to reflect the new rules!

The Portuguese Golden Visa program is one of the most popular both in Europe and the world, and for good reasons:

- You can choose from a range of relatively affordable investment options that will give you both permanent residency and citizenship in 5-6 years.

- Visa holders are only required to spend an average of 7 days per year in Portugal to qualify for renewal and eventually citizenship.

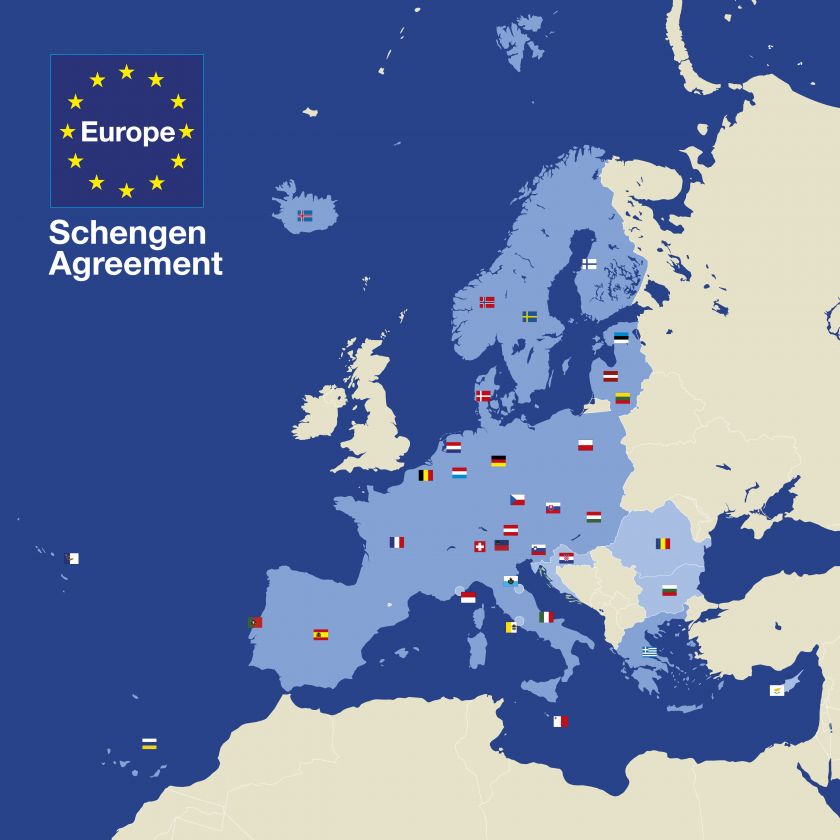

- While a “Golden Visa resident” of Portugal, you will have visa-free access to the European Union’s Schengen area.

- Once you become a citizen, you can live and work anywhere in the EU/EEA and get the world’s 4th best passport for nomads and global citizens.

- The program is NOT blacklisted by the OECD, unlike many other Golden Visa programs.

- Portugal can also offer favorable tax benefits for newcomers, with potential exemptions on some worldwide income.

- Portugal is a safe and stable country with an excellent and affordable quality of life, good healthcare and education options, well-connected airports, and the best climate in continental Europe.

As far as Golden Visa programs go, the Portuguese program is also relatively accessible. These are the best options for most people:

- Real estate investments starting at €280,000 (although more commonly €350,000 or €500,000).

- A €500,000 investment into a private equity or venture capital fund.

- Even an entrepreneurial option with no fixed minimum investment.

Already looking to get things started?

Table of Contents ↺

- History of the Portuguese Golden Visa

- Requirements for obtaining the Golden Visa

- 2022 Golden Visa changes

- 2023 end of the Golden Visa program

- The application and renewal process

- How to prepare and apply for the Portuguese Golden Visa

- Getting a NIF and opening a Portuguese bank account

- Identifying and making your investment

- Transferring the investment amount

- Gathering documentation

- Submitting the application

- Frequently Asked Questions (FAQs) about the Portuguese Golden Visa Program

- Webinars

There’s now a lot of content out there about Portugal’s Golden Visa program, so why did I write this article?

Unfortunately, the information you find when searching about the Portuguese Golden Visa is often unreliable, biased, or out-of-date.

If you know anything about my other writing, it’s likely that I love getting super nerdy about topics that most people find both complicated and perhaps even boring. Stuff like international taxation, banking, and residency programs.

Topics such as the Golden Visa in Portugal, where most of the available information is biased and incomplete information published by advisors and law firms who want you to hire them to get the full picture, are really among my favorites to explore.

This extensive guide about the Portuguese Golden Visa was first published back in 2018 and has continuously been updated and expanded over time. Over the years, I’ve enlisted the help of several the most experienced lawyers in the Golden Visa field.

If you still have questions after reading this guide and exploring our community forum (shoutout to the amazing members there who has helped form this guide!), please let me know and I’ll do my best to find and share the answers to your remaining questions!

That said, I want to make it clear that I’m neither a lawyer nor a financial advisor, and no information in this article is to be taken as legal or financial advice. Do your own due diligence before taking any action.

By signing up for certain services through links or introduction forms in this article you help support my work as I may get a small referral fee. In any case, I will only recommend products that I believe are the best fit for my readers. Read more about this policy here. If you find any helpful products or services not mentioned here, please reach out so I can consider including those, too.

With this lengthy intro out of the way, let’s get started!

History of the Portuguese Golden Visa

Established in 2012, Portugal’s Golden Visa Program—officially the residence permit for investment activity (ARI)—enables non-EU/EEA citizens to obtain a special residence permit in exchange for a 5-year investment in Portugal.

What’s unique about the Golden Visa permit is that the investor only has to spend about seven days per year in Portugal to maintain the residency, while still reaping all the benefits of being an EU resident—including visa-free travel in the entire Schengen area.

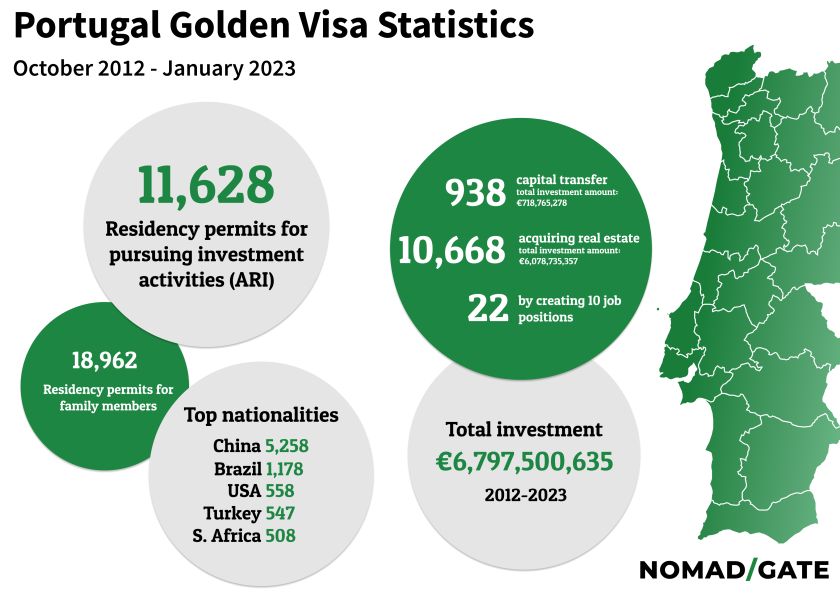

While the program has benefited more than 11,628 foreign investors so far, it has also been beneficial for the Portuguese economy. As of January 2023, the total investment into Portugal as a direct result of the program has reached a whopping €6,797,500,635. That’s more than six billion euros.

Despite this, the current Socialist government of Portugal has announced the end of the program. The details aren’t clear yet, but since the party has an absolute majority in the parliament, they can push through any regulation they want, as long as it’s constitutional. To stay in the loop as things unfold, sign up for my Golden Visa newsletter here.

By far the leading share of Golden Visas have been issued to Chinese nationals (although their share has been declining recently), followed by Brazilian, South African, Turkish, and Russian citizens. In the past few years it has also been extremely popular with US citizens, with the US even taking the top spot in November of 2021.

Requirements for obtaining the Golden Visa

Who is eligible for the Golden Visa?

Any third-country national—meaning anyone except Portuguese and EU/EFTA citizens—can apply for the Golden Visa after completing a suitable investment into Portugal.

The investment can be made as an individual or through a legal entity meeting certain requirements.

You will also need to meet the (minimal) physical presence requirements mentioned below.

Which requirements do you need to meet?

- Maintain the investment for a minimum period of five years.

- Spend a minimum of 14 days in Portugal during each two-year period after being issued your first residency card.

What are the available investment options?

Your investment needs to meet at least one of the following requirements:

- Transfer of capital of at least €1,500,000.

- Creation of at least 10 jobs. The entrepreneurial option.

- Purchasing real estate with a value of at least €500,000, excluding residential properties in some metropolitan and coastal areas including Lisbon, Porto, and most of the Algarve. The traditional option.

- Purchasing real estate with construction completed at least 30 years ago or located in an urban rehabilitation area, with the execution of rehabilitation works. The minimum investment is reduced to €350,000 (again, only in certain areas).

- Transfer of capital of at least €500,000, invested in research carried out by public or private scientific research institutions that are part of the national scientific and technological system.

- Transfer capital of at least €250,000, as investment or support for artistic production, or recovery or maintenance of national cultural heritage.

- Transfer capital of at least €500,000, destined to acquire units in investment or venture capital funds aimed at providing capital to companies that meet certain requirements. The low-maintenance option.

- Transfer capital of at least €500,000, to incorporate or increase the share capital of a company with a registered office in Portugal, together with the creation of five permanent jobs, for a period of three years.

For more details about the requirements, click here.

2022 Golden Visa changes

The Portuguese Golden Visa program was updated on January 1, 2022. This guide is already reflecting the new rules, but if you’d like to learn more about what changed and the impact on existing and future investors, read my guide to the 2022 Golden Visa changes here.

2023 end of the Golden Visa program

The program is unfortunately coming to an end in 2023. As I write this (February 22, 2023), the details are severely lacking. The government is currently soliciting public feedback on a range of ideas presented in an affordable housing package, which includes ending the Golden Visa program—supposedly to fight property speculation.

Due to the ruling party having an absolute majority, there’s little doubt that the program will indeed close. What is unclear is what the deadline will be for submitting your application. However, for the time being the program remains open, and if you submit you application now you will be processed in accordance with the rules in effect at the time.

So how much time do you have to apply if you want to get in before the program closes? It’s hard to tell, but these are the steps that need to happen before the law changes:

- The public feedback period runs until March 10

- The Council of Ministers will vote on a draft law on March 16, which will then be brought to the parliament

- The draft law will be discussed further in a special parliamentary committee, which will suggest changes to the draft

- The new version will then be discussed and voted on in the parliament

- Once approved by the parliament, the law is sent to the president, which may object to the law for political or constitutional reasons—in which case the law either goes directly back to the parliament or to the constitutional court for their ruling

- Finally, if (or when) the president is satisfied that the law meets all the requirements, he’ll promulgate it

- While not yet certain, it’s possible that there will be a transition period before the new law takes effect (which has been the case with prior amendments)

I’ve heard from lawyers that the parliamentary process usually takes about two months, and the signing by the president takes another one to two weeks (if everything is OK with the law). But there are no guarantees, so let’s say that it may take anything from weeks to months after March 16 for the program to actually end for new submissions.

What should you do if you want to get in before the program ends?

Beyond deciding on and finalizing your investment, at a minimum you need a Portuguese tax number and bank account, as well as a criminal background check from your home country. If you are serious about getting in before the program closes, you should start these processes today.

Depending on the investment you choose, it may only take a few days from actually making the investment until you get your application submitted and “locked” in the immigration agency’s (SEF) system—meaning it’ll be reviewed according with the rules in place on that day.

In other words, if you start preparing today, you can be ready to make your investment once there’s a bit more clarity about how the final law will look like. You don’t need to commit your capital until then.

Read more here:

- Can you make an investment that is refundable in case you don’t manage to submit the application in time?

- What can you do to shorten the time to application submission?

- Which providers can get your Golden Visa application submitted the quickest?

⚠️ Webinar alert

Portugal Golden Visa - New Rules and an Eligible Open-ended Fund

Hosted by: Optimize Investment Partners

📼 Watch webinar replayInsider Secrets: Navigating the New Portuguese Immigration Landscape

Hosted by: The Lakhani Group

📼 Watch webinar replay

The application and renewal process

The initial application is now submitted online, including copies of the supporting documentation. After the request is approved by Serviço de Fronteiras e Estrangeiros (SEF), you will have to appear in person for an interview.

Initially, the interview would take place in the district where the investment was made. Nowadays, however, SEF will allow you to book the interview in any district of your choice. This change has helped reduce the waiting time overall, especially in the more popular districts such as Lisbon and Faro.

Usually, you complete the application through your lawyer, and it usually takes up to 2-3 months for pre-approval. It is technically possible to do everything on your own, but I wouldn’t recommend it.

2023 Update: As per January 2023, pre-approvals are currently taking about a year (caused by various issues, including COVID delays and a huge number of applications at the end of 2021), up from a normal processing time of about three months. SEF has just announced automatic online renewals, which hopefully will let them clear the backlog more swiftly going forward, leading to quicker processing for applications in 2023 onwards.

Some time after pre-approval SEF will provide access to an online calendar with available dates to do your in-person biometrics appointment.

If you want to bring along your family members, their application is submitted simultaneously. An application fee of €539.66 is paid for the main applicant and each member of the family.

When your application is approved you pay a residence permit issuance fee of €5,391.56 for each applicant. After ten to twenty days, you should receive your residency card valid for two years.

Year 1-2

Your residence card will allow you to live and work in Portugal, plus travel freely within the Schengen countries (you also need to bring your passport), without applying for any visas.

In the first two years, you must spend at least a total of fourteen days in Portugal.

To renew your residence permit and receive a new residence card, you need to go through a renewal application process between 30-90 days before your current residence card expires.

As of 2023, the renewals are now online (they used to require another in-person SEF appointment), with no further biometric appointments needed. You still need to pay another application fee of €539.66 per person, and once again, the residence permit fee of €2,696.29 per person.

Year 3–4

Your new residence card is valid for two years, and you again need to spend at least fourteen days in Portugal during this period to qualify for further renewals or citizenship.

At the end of the period, you'll go through another renewal process.

Year 5+

After the fifth year, you can apply for permanent residency or citizenship (you can choose which one). If you don't want to apply for either, you can continue renewing your Golden Visa every two years (at the end of year 6, year 8, and so on).

How to prepare and apply for the Portuguese Golden Visa

While the process isn’t very complicated, it does involve gathering a lot of documentation—both in Portugal and in your country of origin. It will be beneficial to work with a native Portuguese speaker if you don’t already know the language.

The steps for the initial application look something like this:

- Get a Portuguese fiscal number (NIF) and open a local bank account.

- Identify and make your investment (and make sure to consult a local lawyer before finalizing anything)

- Gather all required documentation from your country of origin (at most three months before submitting your application).

- Have it all legalized and translated into Portuguese.

- Gather necessary documentation in Portugal (your lawyer can help with this)

- Fill out and submit the application for the Golden Visa (typically through your lawyer).

- Pay the processing fee.

- Wait until you hear back from SEF with a preliminary approval.

- Pick a date, time, and place where you will meet in person for your biometrics appointment.

- Bring along the originals of the documentation that was submitted with the application to your in-person appointment.

- Wait for final approval.

- Get your residence card.

-

Repeat a substantially similar process at the end of year 2 and 4 for the renewals.2023 update: SEF opened a system for automatic online renewals in January 2023, making renewals much easier going forward.

All of these steps can be completed remotely (with the help of a lawyer), except for the biometrics appointment—you will have to travel to Portugal for that.

Let’s take a closer look at some of the steps.

Getting a NIF and opening a Portuguese bank account

I won’t go into details on how in this article since I already explained it in great detail in two other articles (how to get a NIF and how to open a bank account in Portugal as a non-resident).

The reason why you need those things is that you need a Portuguese bank’s confirmation that you have transferred the funds and made your investment. You need a Portuguese fiscal number (NIF) to open the bank account.

It’s not too complicated and can be done in less than a day. To get a NIF as someone without a fixed legal address in the EU/EEA, you will need a Portuguese representative for the tax authorities. This can be your lawyer.

Your lawyer can also help you apply for a NIF remotely, and there are also some banks that allow remote account opening.

Identifying and making your investment

So far I’ve glossed over the fact that to make a suitable investment, you also need to find one.

While initially nearly all Golden Visa investors chose to invest in real estate, that is gradually changing as more investment options have been made available (such as investment funds).

Another option that can be interesting for an entrepreneurial person is the creation of 10 jobs in Portugal. This Golden Visa route has no fixed minimum investment amount.

An art investment is the most affordable option, and while potentially lucrative it remains somewhat unproven. Do let me know, however, if this is something you’re considering or want to learn more about.

The low-maintenance route: Investment funds

If you have been following my writing for a while you know that I am a big proponent of utilizing (primarily index) funds for growing your wealth over time. While the investment funds available for Golden Visa applicants have more traditional cost and management fee structures than passive index funds, I still think it’s the one of the best routes to the Portuguese Golden Visa for most people.

Since 2018, the option to invest in a fund that meets certain qualifications has gained popularity. Previously the minimum investment amount was €350,000, but as of 2022, it is set at €500,000.

While the investment amount is now higher, I think it’s still a great option for many people. You won’t have to actively manage your investment and potential returns can in many cases be higher than with a direct real estate investment. It has proven to be a popular alternative to the more popular real estate option for many Golden Visa investors. It has several advantages:

- It’s a much more diversified investment than purchasing one or a few individual properties.

- You don’t have to scout and look for properties.

- You save lots of time and frustration by not having to deal with all the paperwork involved in acquiring real estate and getting the real estate purchase approved for the GV. You also don’t need to submit any Portuguese tax returns (nor is there any withholding tax), nor do you need to spend any time managing your investment.

- You’ll also save lots of money on fees, taxes, etc. Just transaction fees, taxes, and refurbishments that lose their value after a few years can add up to 20% or more for a normal real estate investment meant for short-term rentals.

A five-year GV investment in real estate at the €350,000 level realistically would cost about €460,000 including taxes, fees, transfer costs, furniture investments, and lawyer fees, etc. A €500,000 real estate investment can in many cases turn into a €600,000+ investment all fees and taxes included.

However, buying into an investment fund at the €500,000 level would likely only cost a bit over €530,000—the bulk of the €30,000 “markup” being made up of the actual Golden Visa fees themselves. So, while not cheaper than discounted real estate investments, it is certainly a worthwhile option to consider, especially if you care about potential returns.

While the real estate market in Portugal is starting to mature and is looking less and less like a good deal, with an investment fund you can get exposure to completely different industries or just a less saturated part of the real estate market (e.g. retail, commercial and industrial rather than short-term holiday homes)—making it at least just as likely of having a good return than buying real estate directly.

The list of funds that are available changes over time (as subscription periods close and new funds are introduced). Annoyingly there’s no official list of funds that qualify, however, I have taken it upon myself to do the research needed to create such a list.

To do so I reached out to the managers of every single private fund that’s regulated by CMVM (Portuguese Securities Market Commission), and met in person with dozens of them to learn which funds are available to Golden Visa investors, now and in the future.

In general, we can place the funds into one of three main categories (although some may fit into more than one):

- Funds specifically designed for Golden Visa investors. These funds are designed to make life easy for Golden Visa investors by having a matching length or option of early withdrawal (often 6-7 years), accepting €500,000 or lower investments, and often assisting with and/or overseeing the Golden Visa process itself. They are often (though not always) exposed to the real estate market, typically low to medium risk profile and accordingly low to medium expected returns. Often with a focus on preserving the investors’ capital and paying some sort of yearly dividends.

- Traditional venture capital (VC) funds. Typically invested in early-stage tech companies with global potential. Sometimes higher minimum investments than €500,000, fixed fund length of 10+ years, higher risk for higher potential rewards. The goal is to maximize the capital gains at the exit, not yearly dividend payments.

- Traditional private equity (PE) funds. Typically invested in more traditional markets and/or financial instruments, sometimes with a focus on yearly dividends. Sometimes higher minimum investments than €500,000, fund length of 10+ years, often medium to high risk, with expected rewards accordingly.

Due to Portuguese regulations, I’m not able to include a lot of details of the individual funds directly in the article, so if one or more funds sound interesting just click the learn more button next to it to get an introduction to someone who’s authorized to provide all the details you need (including fund prospectus and more).

Currently available funds

As mentioned, the list of qualifying funds open for investment varies constantly. You’ll find the currently open funds below:

-

Pela Terra II

Strategy of purchasing, holding, and cultivating large orchards, with a long term focus on organic transition and soil health.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€200,000

Subscription deadline

November 1, 2025

Duration

8 years

-

Iberian Net Zero

Focuses on renewable energy, energy efficiency and clean mobility.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€150,000

Subscription deadline

February 2026

Duration

8 years

-

Optimize Portugal Golden Opportunities

Invests in equities and bonds (corporate and sovereign) listed in regulated markets and that have a daily quotation.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€1,000

Subscription deadline

Open-ended

Duration

Open-ended

-

Portugal Liquid Opportunities

Investment in public equities with >60% allocation to the largest Portuguese listed equities and <40% allocated to Oxy Capital’s proprietary international listed equities strategy.

Minimum investment This is the minimum investment needed for the specific fund. The total investment across funds in order to qualify for the Golden Visa still needs to be at least €500,000

€100,000

Subscription deadline

Open-ended

Duration

Open-ended

You can also click here to learn about all 39 available funds

I’m always on the lookout for other funds to include, so if you find any promising ones, please let me know and I will investigate them.

NOTE: Unfortunately, US citizens and residents are not able to invest in all funds (due to FATCA complications). I have clearly marked the funds that are available to US citizens and residents here.

Investment Fund Webinars

From time to time some of the funds host webinars for Nomad Gate readers.

Combining Energy Transition with Portugal’s Golden Visa—A Stable, Secure and Sustainable Path to Residency

Hosted by: Emerald Capital Fund

📼 Watch webinar replayChoosing the Right Investment: A Dive into Closed-Ended and Open-Ended Funds

Hosted by: Lince Capital and Optimize Investment Partners

📼 Watch webinar replayPortugal’s Golden Visa in 2025: Why Farmland Is a Smart Move for Investors

Hosted by: Terra Verde Capital

📼 Watch webinar replayPortugal’s Golden Visa and NHR 2.0: The Best Tax Strategies for Expats

Hosted by: FRESH Portugal

📼 Watch webinar replayGolden Visa 2025: What's New & Why Invest in Impact Funds

Hosted by: Insula Capital

📼 Watch webinar replay

The traditional route: Direct real estate investment

A real estate investment might also make sense. Particularly if you plan to buy a property where you intend to live yourself or if you prefer the tangible nature of a property investment.

Buying property in Portugal is open to anyone, with no restrictions on your nationality or residency. You’ll still need to get your Portuguese tax number first.

There are a few different “levels” of property investments available to you, depending on factors such as location and project type:

- €500,000 level: This is the default level. Any property (or combination of properties) costing at least €500,000 will let you and your family qualify for a Golden Visa. While it’s the highest entry price, you’re more likely to find properties at a fair value at this level than the lower ones.

- €400,000 level: Essentially the same requirements as for the €500,000 level, except that the property needs to be located in a low-density area. Less likely to find a good deal since this is quite a high ticket price for these areas.

- €350,000 level: At this level, you can make a reduced investment in return for completing rehabilitation works on a property that was built at least 30 years ago or is located in a special rehabilitation zone. This level requires significantly more paperwork to get approved, and you’re less likely to find a good deal.

- €280,000 level: Essentially the same requirements as for the €350,000 level, except that the property needs to be located in a low-density area. It can be quite a challenge to find a good deal at this level.

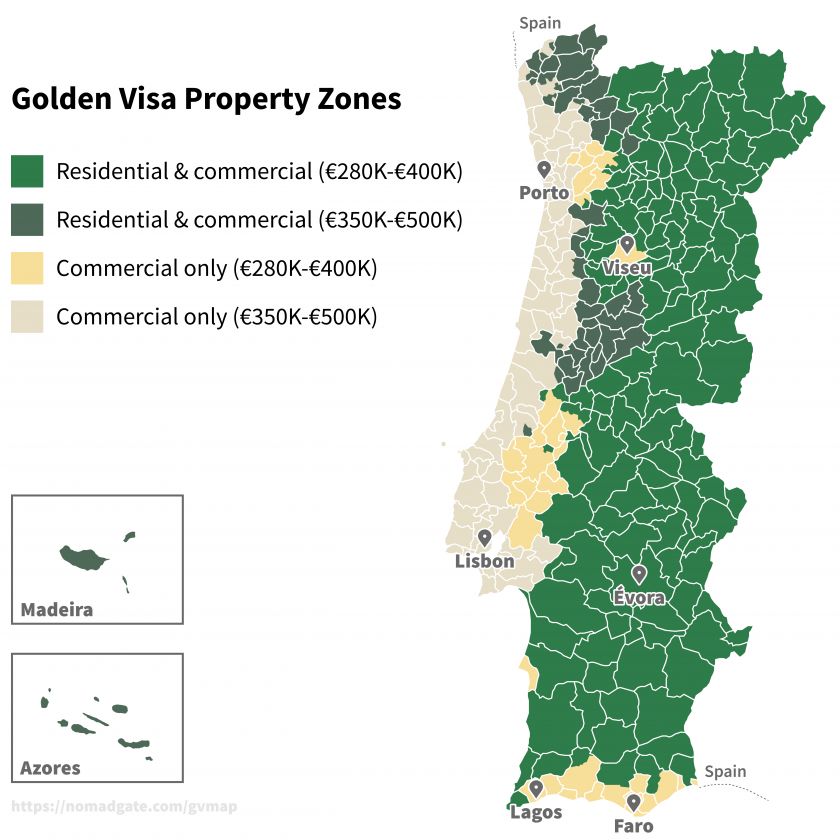

As previously mentioned, residential properties in Lisbon, Porto and along most of the coast (and even in some inland areas) do not qualify for residential real estate investments. Only interior regions do, in addition to the autonomous regions of Madeira and the Azores. Commercial real estate however qualifies all over Portugal still, including hotel investments, some types of touristic apartments, and other commercial real estate.

For even more detailed information exclusively on Portuguese real estate investments qualifying for the Golden Visa, see our Portuguese Golden Visa Property Guide.

We made a handy map so you can see what investments can be made where, taking in consideration low vs. high density areas, and interior vs. non-interior regions.

✨ New feature: We just launched a new Portuguese Golden Visa real estate search engine where you can input any address in Portugal and it’ll tell you whether it’s low- or high-density and whether residential investments are allowed or not.

To get a sense of the market, you can always start out looking at the websites of real estate brokers (agências imobiliárias), such as:

Keep in mind that in Portugal, brokers usually work for the seller. While you don’t pay them a fee directly (it’s covered by the seller and based on sales price), they are incentivized to sell properties for as much as possible.

You can also take a look at aggregator websites. In many cases, they can put you in touch with the sellers directly. Here are some examples:

Just be aware that many listings you’ll find on these sites are no longer available, even though they’re still listed. Generally, the properties worth buying move very fast. Still, these sites can be useful for getting a general sense of what’s available in the market and at approximately what price.

Since typical Golden Visa investors aren’t experts on the Portuguese real estate market themselves and usually don’t know all the laws, regulations, or even the language, most decide to either:

- Buy a property directly from a real estate developer working with Golden Visa investors (typically off-plan), or

- Work with a buyer’s agent to help source a property from across the real estate market

Both paths come with their own benefits and potential pitfalls, so let’s take a closer look at each.

Buying directly from a developer

There are quite a lot of real estate developers targeting Golden Visa investors, and to be honest, most of them are probably not worth your time. It’s not uncommon to see properties marked up significantly compared to what they would fetch in the local market. This is especially the case for €280,000 level properties, and to a certain extent with €350,000 level properties. But it may happen at any level.

But that doesn’t mean there are no good options in this category, particularly if your aim is capital preservation and a smooth Golden Visa process, and not necessarily maximizing your return.

In particular, there are some developers that offer “guaranteed buybacks” when you’ve completed the 5-year Golden Visa process (and sometimes also fixed annual income) that may be worth considering. To be clear, I’d be cautious with most of these buyback schemes, too. After all, the guarantees are only as strong as the companies backing them.

In many cases, developers will set up a dedicated company for each development (often referred to as a single purpose vehicle or just SPV for short), and ideally the buyback should be offered by their main Portuguese corporation, not this SPV. Either way, you should have your lawyers check the solidity of the company offering the guarantee.

Another thing to look for in projects offering these kinds of guarantees is whether they are using any leverage in the development. If they use a lot of leverage (bank loans) to finance the developments, you’ll have increased risk that the developer or the SPV defaults before it comes time to execute the buyback. Or even if there’s no default, having no leverage means the developer has an easy way out of a cash flow crunch if more investors ask for a buyback at the same time than they had budgeted for—they can simply get a bank loan with the real estate development as collateral.

The final thing to consider is the track record and reputation of the developer. Do they have a history of delivering value to investors in Portugal or perhaps even internationally? Do they have a good reputation which they are incentivized to protect? Both will make it easier to trust a developer to execute well and take good care of their investors.

Mercan Group

Mercan is one of very few real estate developers we’ve found that checks all the boxes I outlined above. If you are someone who first and foremost wants…

- to protect your capital,

- make a predictable return while holding the investment, and

- a smooth Golden Visa process

…then you should take a closer look at their offering.

Mercan is a Canadian company with more than 30 years experience in the migration and property development industries, with a long history with both the Canadian and U.S. immigration by investment programs. They were also the first developer to offer a project qualifying for the €350,000 level in Portugal, and to date have about 50% of this market segment.

They usually have one or two hotel investments available, often one at €350,000 and the other at €280,000 level. Locations vary, but in the past they have included places like Porto, Lisbon, Algarve and Alentejo. They’ll cover the purchase taxes for you, and offer to buy back your units once you’ve received your permanent residency or citizenship. In addition, they offer up to 3% fixed annual income depending on the property.

Since these are commercial real estate projects, they qualify for the Golden Visa, despite some being in non-interior regions.

When making an investment with Mercan, they and their partner law firm will take care of the entire process for you: From applying for a tax number, opening bank accounts, submitting your application, and accompanying you to your SEF biometrics appointments, they take care of everything.

Temporary offer: If you contact Mercan through the link above between July 1 and September 30, 20252023 you get a 20% discount on their partner’s legal fees.

Webinar Alert: Portugal Golden Visa Program - What's New in 2024

Hosted by: Mercan Group

📼 Watch webinar replay

You can also find additional off-plan projects by several popular real estate developers here:

Torre Santo António

A unique palace resort 1h from Lisbon flanked by a 5-star resort with high end amenities, contact with nature, relax and comfort. Geometrically designed gardens, magnificent swimming pool, chapel, stables, a wine cellar, lakes, streams and a vast agricultural area. Inside the palace, splendid rooms with uniquely detailed fireplaces, painted ceilings and 19th-century tile panels. The origin of the property goes as far as the medieval time.

Investment Amount: €350,000 · Exit: Guaranteed buyback · Annual Income: 4.5% for the first 5 years (total of €78,750 paid 30 days after deed). 3% from the 5th year onwards (€10,500).

Hotel Londres

A unique option of fully operating 4-star hotel since 1959 with good occupancy rate. Located in Estoril, between Lisbon and Cascais. The hotel will undertake some enlargement works, adding new rooms, a brand new rooftop with a swimming pool and amazing ocean view, as well a new conference room.

Investment Amount: €350,000 · Exit: Guaranteed signed buyback after 7 years · Annual Income: 3% for 5 years, paid upfront after 3 months signing the contract (€52.500)

The Society

Beautiful piece of architecture in Lagos—a town with much to enjoy (health, wellness, food, golf & nature). This 4-star hotel with 26 free-hold units with finishings reflecting traces of the Arabian occupation is only a 5-min walk from the beach.

Investment Amount: €280,000 - €317,000 · Exit: Buyback guarantee at original price · Annual Income: 3% fixed for 4 years, 5th year onwards fixed income + performance bonus. 30% profit share at the sale of the building.

Green View

Modern apartments (from 78 sqm to 137 sqm)—full of natural light, high-end finishings, and great views of Covilhã. A city with vibrant energy, full of heritage, culture, nature, and a glimpse of modernity. Fresh air from the mountains in the heart of Serra da Estrela Natural Park—perfect for enjoying thermal waters and practicing outdoor activities.

Investment Amount: From €280,000 · Exit: Market value · Annual Income: 3% to 4% fixed for five years

Rossio Palace

A historical palace in a prime urban property surrounded by a pristine natural park in Portugal, being converted into a Nordic-designed Deluxe Hotel. Facilities include private kitchens, private and communal gardens, a lounge area, a spa, and a heated swimming pool. IMT is paid by the developer.

Investment Amount: €280,000 · Exit: Market value · Annual Income: 4-6% flexible return

Globo Hotel

Globo Hotel will receive the recognition of an international brand, 3 stars Wyndham Days Inn with 60 rooms after the expansion. Located in Mirandela, north-east of Portugal.

Investment Amount: €280,000 · Exit: Guaranteed buyback · Annual Income: 5% for 6 years. €30,000 dividend paid 15 days after signing the deed.

The Oasis

A boutique aparthotel located in the centre of the beautiful old town in Oeiras. The Oasis is just a 20 minute train ride from the centre of Lisbon, and 5 minutes from Carcavelos, Lisbon's main beach. The hotel is built around a beautiful 200m2 garden, which contains a co-working space exclusively for guests. A fixed, inflation adjusted lease is in place with a highly reputable pan European operator, guaranteeing an annual yield for investors.

Investment Amount: €350,000 · Exit: Market value (100% profit shared between fraction owners) · Annual Income: 3.5%

If you’re looking for existing and newly built properties from Portuguese developers who don’t specifically target Golden Visa investors, I’d recommend taking a look at the buyer’s agents below. You’ll likely come out way ahead with their help compared to going it alone.

Using a buyer’s agent

If you’re looking to buy a regular property for either your family or for investment purposes, I highly recommend hiring your own independent broker or buyer’s agent. Having someone working for you—someone who usually doesn’t get a cut of the sales price and only has your best interests in mind—that’s one of the best investments you can make.

While it will often cost you some euros on top of the purchase price, you are likely to save much more by finding a better property at a better price.

Here are some options that have been popular with our readers:

11Pier

11Pier is a boutique real estate advisory that aims not only to help you find a suitable property for Golden Visa purposes, but helping you maximize your investment returns, manage rentals, and much more. As they themselves put it: They manage the entire real estate investment process, from A to Z.

They do not get any commissions from the real estate transactions, their services are paid on top in a way that aligns their incentives with you, the investor.

Pearls of Portugal

Another popular option is Pearls of Portugal. They can help you find the best possible real estate in Portugal. They work on a fixed fee schedule (meaning they work for you, and not the seller), and you only pay if you actually go ahead with a purchase.

If you already found some potential properties, they can also help you evaluate your options, accompany you to viewings, negotiate the price on your behalf, and much more.

Special offer for Nomad Gate readers: Pearls of Portugal will cover the legal costs of the transaction, plus another €500 discount off their service fee.

Learn more about Pearls of Portugal

Property Finder Portugal

Property Finder Portugal is one of Portugal’s leading relocation agencies and property finders. They are leaders in sourcing D7 and other visa-compliant accommodation and have also helped several Golden Visa clients finding their dream properties anywhere in Portugal.

Learn more about Property Finder Portugal

The entrepreneurial option: Portuguese company with 10 employees

While starting and running a company in Portugal for 5 years doesn’t seem like an easy route to get the Golden Visa—it has the benefit of not imposing a minimum investment amount, meaning you may get away with a smaller upfront investment than the other options.

This option has been available since the beginning of the Golden Visa program but has understandably not been as popular as investing in real estate or an investment fund. After all, the whole point of the Golden Visa is to get residency and eventually citizenship in Portugal without having to spend a lot of time in the country to manage your investment.

For some time there was a company who offered this option as a service (at a total upfront investment of €125,000—split between service fee and capital contribution), where they would set up and run a simple company on your behalf. Unfortunately, after COVID-19 happened they no longer offer this option.

Of course, if you are a business owner or entrepreneur in your home country, and need to build out a European operation (e.g. customer support, tech team, etc), you may want to consider basing it in Portugal so you can qualify for the Golden Visa program that way.

Transferring the investment amount

Once you’ve identified your investment and opened your bank account in Portugal, you’ll need to transfer the investment amount to your Portuguese account. Since by most standards this is a very large international transfer, it often pays to shop around for the best rate.

It’s unlikely that just going to your regular bank and asking them to set up an international wire transfer to Portugal will be very economical, as most banks may charge a “hidden” FX markup of several percentage points. After all, a 3% markup on a €500,000 transfer is €15,000…

Luckily, there are better options! One of the most popular options is to use Wise, which are known for their easy and relatively quick transfer process and transparent rates (no hidden FX markup). Depending on which currency you transfer from you may end up paying around 0.5% on top of the mid-market rate. Still, you can likely do even better for a transfer this large.

If you prefer a concierge style transfer where you can negotiate a competitive fixed rate for the transfer ahead of time, you should check out RegencyFX. Their initial quote might not be the best, but if you let them known that you are comparing rates with multiple providers they should come down to one of the best offers you’re likely to get from a dedicated foreign exchange company.

Finally, if you want the absolutely best possible rate and don’t mind jumping through some hoops to get it, you’re unlikely to find any better provider than Interactive Brokers. Their markup is only 0.002%. No, that’s not a typo. However, as they are primarily an investment broker (and probably one of the best in the world at that), they might frown upon you only using their services to exchange currency. So I’d recommend placing some investments with them as well. There are some gotchas to not accidentally delay your transfer for up to a couple of months, so I’d recommend reading this forum thread for all the details.

Gathering documentation

Here are the things you always need to gather for your application:

- A valid passport

- Evidence that you are legally present in Portugal (your visa, entry stamps, etc.).

- Proof that you are covered either by the Portuguese public health system or that you have private primary health insurance that will cover you for the length of your residency in Portugal (or for a shorter period, but with automatic renewal).

- Your criminal records from your country of origin, and/or from the country (or countries) where you have been living for more than a year. It’s essential that the extract of the criminal records are issued within 3 months of the online application, and are certifiably translated into Portuguese.

- Completing a form authorizing SEF to get an extract of your Portuguese criminal records.

- A sworn statement declaring that you will comply with all the minimum investment requirements (amount and 5 year period).

- Documents showing a good standing with the Portuguese Tax and Customs Authority and Social Security system. These can at most be issued 45 days prior to your online application.

- A receipt showing that you already paid the application processing fee.

- Specific documentation relating to your investments (see below).

Again, all documentation (unless otherwise noted) needs to be issued within 90 days before the date you submit your online application.

Anything issued by a foreign entity has to be legalized (e.g., with an apostille if your country of origin has signed the Hague convention).

Moreover, anything that’s not in Portuguese needs to be translated and certified.

For anything you need to collect in/from Portugal, your lawyer can help you out a lot, including the documentation relating to your investment.

What type of additional documentation you will need depends on your chosen form of investment. Click each investment type for more information:

- Capital transfer of an amount equal to or above 1 million euros

- The creation of at least 10 jobs

- Acquisition of real estate property of an amount equal to or above 500 thousand euros

- Acquisition and execution of works of real estates, on the amount equal to or above 350 thousand euros

- Capital transfer on the amount equal to or above 350 thousand euros for investing in research activities

- Capital transfer on the amount equal to or above 250 thousand euros for funding/supporting the arts or restoring/maintaining the national cultural heritage

- Capital transfer of the amount of 350 thousand euros for the acquisition of units of investment funds or venture capital funds

- Capital transfer of the amount equal to or above 350 thousand euros for the establishment/reinforcement of a commercial company with its head office in Portugal

- Family reunification

Submitting the application

The easiest and safest option is to let your lawyer handle and guide you through the application process.

However, if you insist on doing it yourself, these are the steps:

- Go to the SEF application registration form

- Fill it out, and upload all the supporting documentation (legalized and translated). Make sure that everything is correct to avoid extra costs and wasting precious time. If you have a lawyer, have him or her look over everything before submitting.

- Once SEF has analyzed the application and the documentation, pay the application processing fee(s).

- A few weeks after the payment, you may select a date and location for the personal interview (it’s done through an online calendar on SEF’s website). If you’re not already based in Portugal, you should make sure to pick a date when you and your family (if applicable) can all travel to Portugal.

- Show up for your interview on the agreed date and time. Make sure to bring the original versions of all the documents you submitted online as part of your application.

- Wait a few months until SEF notifies you that your residence permit can be issued. At this point, you pay the remaining application fee (€5324.60 per person).

- Shortly thereafter you can pick up your residence card(s).

Frequently Asked Questions (FAQs) about the Portuguese Golden Visa Program

FAQs ↺

- What are the advantages of the Golden Visa?

- Should I apply for the Golden Visa or choose an alternative way for residency?

- How much does it cost to obtain the Portuguese Golden Visa?

- Which investment funds are available for Golden Visa investments?

- Can I spread my fund investment across several funds?

- If the investment fund is shut down before getting full residency, what happens to the application?

- Can I make the investment through a limited company?

- How long is the wait/processing time for the Portuguese Golden Visa?

- Can the Golden Visa application be done remotely or in an embassy/consulate?

- When do I have to travel to Portugal?

- What happens if there are COVID-19 restrictions when I have my biometrics appointment?

- Does the visit for biometrics count towards the required time spent in Portugal?

- Should I work with a lawyer to obtain the Portuguese Golden Visa?

- Should I avoid certain firms offering Golden Visa services?

- Can I bring my family with me when issued a Golden Visa?

- Do dependent children need to stay dependent during the whole Golden Visa process?

- Should all supporting documentation be translated into Portuguese?

- Do I have to pay taxes in Portugal?

- Do I have to register and pay Social Security contributions in Portugal?

- How long does it take before I can acquire Portuguese citizenship and passport?

- Do I need to learn Portuguese before getting my citizenship?

What are the advantages of the Golden Visa?

In short, you can:

- Enter Portugal without a special visa

- Live and work in Portugal

- Bring your family with you

- Apply for permanent residency and/or Portuguese citizenship after five years

- Access the Portuguese healthcare and education system (on the same basis as Portuguese citizens)

- Travel freely in the entire Schengen Area

The Schengen countries include Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

The EU members Bulgaria, Croatia, Cyprus, and Romania, are all required to join the Schengen area in the future, but as a Portuguese resident, you can already travel there visa-free.

Should I apply for the Golden Visa or choose an alternative way for residency?

The benefit of the Golden Visa is that you can get Portuguese permanent residency or citizenship without having to live in the country most of the year. It’s as if your investment is spending the time in Portugal instead of you for 5 years. It is also the only option if you are not ready to move to Portugal yet, but want to start the clock so to speak towards permanent residency or citizenship. On the other hand, if you are ready to move and want to spend the next five years in Portugal, then alternative ways might be cheaper (but not necessarily simpler). Take a look at our comparison of the D7 and Golden Visa for more details.

Webinar Alert: Portugal’s D7 vs Golden Visa - which one to apply for?

Hosted by: Property Finder Portugal

📼 Watch webinar replay

How much does it cost to obtain the Portuguese Golden Visa?

We have an article dedicated to the taxes and fees for the Portuguese Golden Visa, which we regularly update with information specific to each individual option. Nevertheless, to give you the “tl;dr” version:

You will need to pay a €539.66 application fee when submitting your application per family member, followed by €5,391.56 per person for the initial issuance of the Golden Visa.

The two renewals (at the end of year 2 and 4) are charged at €2,696.29 each, per person. You will also need to pay the €539.66 application fee again for each family member.

This means that currently you will need €12,403.12 per person for the application and permit fees for the whole process, including both renewals needed for permanent residence. These rates may increase very slightly every year to keep up with inflation.

| How often | Amount | |

|---|---|---|

| Application Fee | Initial application and each renewal | €539.66 per person |

| Residence Permit Fee | Initial application | €5,391.56 per person |

| Residence Permit Renewal Fee | Each renewal | €2,696.29 per person |

In addition, comes the cost of hiring lawyers, as well as any costs of legalizing and translating the supporting documentation.

Which investment funds are available for Golden Visa investments?

Exactly which funds are available varies over time. You can find all active funds on the website of the regulator, however, most of these are not open for subscriptions or do not meet the requirements.

I already know of several funds that qualify, which you can learn more about here.

New funds eligible for Golden Visa investors are continuously being launched. If you would like to receive updates regarding this, leave your email in this form and select that you want to hear about funds launching in the future, I will let you know as they become available.

Can I spread my fund investment across several funds?

Yes, to my knowledge people have successfully submitted their Golden Visa application investing into more than one fund, and received pre-approval. That siad, it is certainly much more straightforward to invest the whole €500,000 in a single fund, which will ease SEF’s efforts to frame it within Golden Visa rules. If you want to go for several funds, it’s a good idea to ask your lawyer first to get a confirmation from SEF stating that it is acceptable.

If the investment fund is shut down before getting full residency, what happens to the application?

In that case, you would have to move your investment into another fund under the same Golden Visa category.

Can I make the investment through a limited company?

Yes, you can make your investment through a legal entity, however it must be a company with a single owner (empresa unipessoal) registered in Portugal. You can’t make an investment through an investment or holding company that has more than one owner or member of the company.

How long is the wait/processing time for the Portuguese Golden Visa?

It varies over time. It used to be around five months but COVID-19 has impacted the waiting times significantly. At the moment, you should allow around 9-18 months.

Can the Golden Visa application be done remotely or in an embassy/consulate?

The application itself is submitted online, but you need to travel to Portugal for biometrics after your application is accepted. Currently, it is not possible to do biometrics in an embassy or a consulate.

When do I have to travel to Portugal?

First time for biometrics about 6-12 months after submitting your initial application. It depends on how long your application is processed and on the waiting times for the appointment.

After doing biometrics and getting your first residency card, you will need to spend 14 days in Portugal during the next two years. You will then need to have another appointment for biometrics for the renewal of residency cards.

After receiving your second residency card, you will have to spend again on average 7 days per year in Portugal.

How do I schedule my biometrics appointment?

Currently, it takes at least several months to get a biometrics appointment after SEF application approval.

There has been some confusion and frustration in the past with SEF appointments, however it seems things have started to become more organised.

SEF will now issue an email, in chronological order, to investors (or their lawyer) when they are pre-approved and can go ahead and schedule their appointment. Investors or lawyers can no longer look for appointments until SEF gives permission to book one.

Once the email has been sent, the applicant will have 10 days to book an appointment in an allocated month.

What happens if there are COVID-19 restrictions when I have my biometrics appointment?

First of all, for the latest information on travel restrictions in Portugal, please check the SEF website.

However, if at the time of your appointment, you are unable to travel to Portugal freely due to COVID, you can contact your lawyer of SEF to issue a letter for essential travel. In this case, you also need to have proof of a negative test result performed within 72 hours prior to departure, without which you cannot board.

If you are a legal resident, you can travel to Portugal freely from any country, although you may still need to show proof of a negative PCR test.

Does the visit for biometrics count towards the required time spent in Portugal?

Only time spent in Portugal after getting your first residency card counts. Therefore, the first biometrics visit is not included in the 14 days you need to spend in Portugal during the first 2 years. However, the time spent in Portugal during the second biometrics visit for the renewal of your residency card counts towards the 14 days required for the first 2 years.

Should I work with a lawyer to obtain the Portuguese Golden Visa?

I would definitely recommend that you do. You’re making a sizable investment to gain Portuguese residency (and eventually citizenship), so I wouldn’t recommend taking any chances during the application process. While the lawyer fees aren’t insignificant, they are much cheaper than making some formal error, making a bad investment, or one that ends up not qualifying.

Many law firms charge upwards of €4,000-€6,000 for the primary applicant. There are also cheaper options, but it’s worth asking if certification of documents, translations into Portuguese, and/or tax representation is included. The application for dependents is cheaper and averages often between €1,000-€2,500. The renewals of Golden Visa for the main applicant (at the end of year 2 and 4) average around €2,000-€2,500.

Expect to pay up to €20,000-€30,000 in lawyer fees for a family of four (for the initial application and the two renewals) when hiring one of the more expensive firms.

If you need help finding experienced and well-priced Portuguese lawyers, here we have compiled a list of the most popular legal service providers among Nomad Gate readers.

Should I avoid certain firms offering Golden Visa services?

While this might be a leading question, the answer is definitely YES!

Some firms are taking advantage of Golden Visa applicants by offering investment options (typically in real estate) that both look nice on paper and meet the minimum investment amounts. What they fail to mention, however, is that they are selling it far above the current market value.

It’s not uncommon to see firms offering properties to Golden Visa applicants for the convenient sum of €500,000 that in reality is barely worth €400,000-€450,000.

That’s how these firms might offer you a great “deal” on their legal or advisory fees. However, in reality, you’re paying much more than you would if you sourced the investment independently and used an independent law firm for your application process.

You should also consider hiring an independent buyer’s agent to make sure you make the best possible real estate investment. You’ll find several experienced buyer’s agents here.

Can I bring my family with me when issued a Golden Visa?

Yes, you can! You can bring your spouse, as well as your kids (as long as they are younger than 18 at the time of application, or enrolled in studies and being supported by you). In certain circumstances, you can even bring your parents and/or in-laws, as long as you can demonstrate that you are supporting them.

Do dependent children need to stay dependent during the whole Golden Visa process?

Any dependents need to meet the same criteria on each renewal application, not just on the initial application.

Should all supporting documentation be translated into Portuguese?

Yes, anything that’s not in Portuguese needs to be certifiably translated (in addition to being legalized). Not even documents issued in English are accepted.

It can be a good idea to do this in your country of origin, but it’s also possible to get it done in Portugal.

Do I have to pay taxes in Portugal?

Legal residency and tax residency are independent concepts, and you don’t necessarily become a Portuguese tax resident by utilizing the Golden Visa.

Even if you don’t become a full tax resident in Portugal, you will probably have to pay tax related to your investment in Portugal.

In either case, becoming a tax resident in Portugal can be quite lucrative, especially for the first ten years thanks to the Non-Habitual Resident tax scheme

According to PwC, you will become tax resident in Portugal if you fulfill either of these conditions:

- Spends more than 183 days, consecutive or not, in Portugal in any 12-month period starting or ending in the fiscal year concerned.

- Regardless of spending less than 183 days in Portugal, maintains a residence (i.e., a habitual residence) in Portugal during any day of the period referred above.

Do I have to register and pay Social Security contributions in Portugal?

No, it is not required. Although, if you don’t, you have to cover many health care costs yourself. In that case, it might be prudent to get private health insurance instead.

How long does it take before I can acquire Portuguese citizenship and passport?

Due to a change in the Portuguese Nationality law in 2018, the required period of residency before you can apply for Portuguese citizenship has been reduced from six years to five years.

While the application for citizenship may take a while, once granted the application for a Portuguese passport generally only takes about six working days. Per 2018, an ordinary passport costs €65 and is valid for five years.

Do I need to learn Portuguese before getting my citizenship?

Yes, currently that is a requirement (though there are ongoing discussions about removing it). You’ll need to pass a test at the A2 level (the second-lowest level), so it’s not very hard to pass.

There are plenty of good ways of learning online, and I’d recommend spending your required time in Portugal practicing further.

You can take the Portuguese language test at any time before you apply for the citizenship or permanent residency. A potentially useful tip is to take the language test abroad (not in Portugal) as those tests seem to be graded more favorably.

If you prefer a more structured approach to study, Portuguese Connection Language School has offered classes for foreigners since 2015 online and offline. They have both private and group lessons. They are the only private school whose A2 level test is valid for permanent residency, and they also offer preparation for A2 level citizenship exam (CIPLE).

Special offer for Nomad Gate readers: Portuguese Connection will give 10% off on group classes, if you contact them through this form and mention the code NOMADGATE.

What happens if I can’t renew my residency in time or have a gap in my renewal?

If this is the case, it’s okay as the gap won’t have any impact on your legal residency. In fact, the required term necessary for citizenship or permanent residency starts from the date that you were first issued a visa. Any residency gaps will only impact your ability to travel within the Schengen Zone.

Golden Visa Webinars

From time to time Nomad Gate will host webinars together with partners.

Combining Energy Transition with Portugal’s Golden Visa—A Stable, Secure and Sustainable Path to Residency

Hosted by: Emerald Capital Fund

📼 Watch webinar replay

Choosing the Right Investment: A Dive into Closed-Ended and Open-Ended Funds

Hosted by: Lince Capital and Optimize Investment Partners

📼 Watch webinar replay

Portugal's HQA® Program & IFICI Tax Regime (NHR 2.0)

Hosted by: Empowered Startups

📼 Watch webinar replay

Portugal’s Golden Visa in 2025: Why Farmland Is a Smart Move for Investors

Hosted by: Terra Verde Capital

📼 Watch webinar replay

Portugal’s Golden Visa and NHR 2.0: The Best Tax Strategies for Expats

Hosted by: FRESH Portugal

📼 Watch webinar replay

Golden Visa 2025: What's New & Why Invest in Impact Funds

Hosted by: Insula Capital

📼 Watch webinar replay

Invest in Solar, Embrace the Future—Secure Your Golden Visa in Portugal

Hosted by: STAG

📼 Watch webinar replay

Changes to the processing of the Portuguese Golden Visa applications

Hosted by: Liberty Legal

📼 Watch webinar replay

You can access recordings from previous webinars, plus be notified of new ones.

Q&A

If you still have some questions about the article or the Golden Visa, feel free to post them below.

We will try to answer as much as we can, and may even add your question (along with our answer) if we think it will benefit others.

The usual disclaimer: Nothing in this article is to be considered legal advice. It is merely a best effort representation of the information I have gathered through countless hours of online and offline research into the subject. If you want definitive answers to specific questions, please consult your lawyer. If you don’t yet have a lawyer, click here to see the most popular law firms among our readers.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.