In our ultimate retirement savings guide we covered why, how, and which financial instruments to invest in. We focused mostly on index funds and ETFs (exchange-traded funds). Due to their great diversification and low fees, it is considered the most suitable security for (passive) long-term investors. There you’ll find an overview of what to look at when choosing which funds to invest in.

Contents ↺

When you buy regularly, you’re less susceptible to make emotional decisions based on greed and fear. Emotions and fees are the biggest enemies of investors. While everyone needs to learn to manage their emotions in the markets themselves, I have pinned down the best low-cost brokers in the world. I focused on the ones that offer a great choice and low fees especially for investing in ETFs and secondly in stocks. Which ones are the most suitable for you, depends on a lot of factors—most importantly where you live and what your goals are.

If you keep your money in a bank account, you need to be aware of inflation risk. In the investing world, there are various other risks you have to understand in order to be a smart investor. I highly suggest considering all the risks before getting started. In the long run, having your money not invested is usually a higher risk compared to a well-diversified securities portfolio.

Let’s take a look at the best and most affordable brokers available to residents of the United States, Europe, United Kingdom, Oceania, and elsewhere. The guide is organized with brokers that primarily cater to a single region or country being listed under that heading, with brokers available across all, most, or several countries or regions being listed under World—so make sure to check out those, too.

United States

If you live in the US, you have access to a wide range of good brokers, many of which are very affordable and with a wide range of index funds and ETFs to trade—often for free.

Below I’ve listed some of the most popular.

M1 Finance

M1 Finance is basically a hybrid of a broker and a bank account. It aims to be the one place where you can manage all aspects of your financial activity (save, invest, spend, borrow).

You will be able to construct your investment pie made up of stocks (also fractional) and ETFs, add money automatically, and rebalance any time with one click. All of this, you can do for free. You can also choose among 80 ready-made portfolios if you don’t want to pick out individual equities yourself.

With M1 Finance, you can also execute separate buy/sell orders, but these will be performed during a certain trading window (for a basic account in the morning).

M1 Finance provides a checking account, a VISA debit card, and you can borrow money at low rates (2-3.5%) when your portfolio is at least $10,000. With Owners Rewards credit card, you will earn 1.5% to 10% cashback on eligible purchases.

If you have an M1 plus account, they will pay 1% both for keeping money in your checking account and spending it (cashback). The plus account fee is $125 per year.

Special offer: Until the end of March 2022, you can earn up to $500 with M1 Finance if you use this link to open an account (and click on the top banner). Then, you’ll only have to make an elibigle deposit within 14 days.

M1 Finance at a glance

Highlights

-

All your financial activities in one place

-

Free and automated investing in stocks and ETFs, free and easy rebalancing

-

Comes with a checking account and a debit card

-

Attractive borrowing rates

-

1% cashback and APY with an M1 Plus account

-

1.5%-10% cashback with Owners Rewards credit card on eligible purchases

Things to note

-

Minimum account balance $100 to get started

-

Only US markets

Fidelity

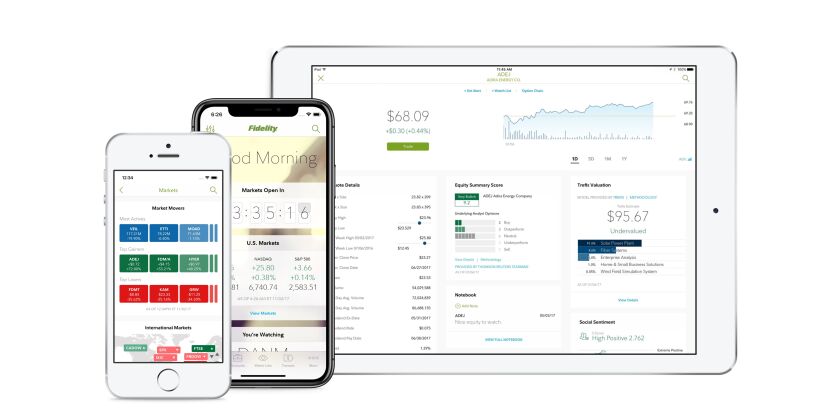

Fidelity is one of the oldest stockbrokers in the US (founded in 1946). Many people love their customer support, and they offer free ETFs and stocks trading in the US markets. They also have no account or inactivity fee, which is great.

The choice of available ETFs is somewhat smaller compared to the closest competitors (like Charles Schwab and Vanguard). On the other hand, unlike lots of other US brokers, they offer access to international markets.

They have a wide choice of bonds with very low fees if you would like to diversity into bonds and lower the risk of stock investing.

They offer 16 different base currencies, which can help you save on currency exchange fees if you trade on international markets.

Fidelity’s trading platforms are easy to use and have plenty of different order types. Their research tools for finding investing ideas and fundamental data about securities are highly regarded.

Fidelity has physical branches in many cities, so if that’s something you value then it might be a good choice.

Fidelity at a glance

Highlights

-

Free trading of US stocks and ETFs

-

Lots of bonds and mutual funds to choose from

-

Wide selection of base currencies

-

User-friendly platforms, great research tools

-

Extensive network of physical branches

Things to note

-

Choice of ETFs is not the widest

-

Account opening is a bit slow

-

Customer support is a bit hit-or-miss

Charles Schwab

If you already have and use their excellent checking account and want to minimize the number of financial accounts you maintain, then why not also use them for your investments?

In 2019 they removed all commissions for equities in the US and Canada.

They also have physical branches across the country—so if it’s important to you, check if they have a branch near you.

Charles Schwab’s platforms come with excellent research tools (investing ideas, analyst reports, fundamental data.)

Their services are targeted to US clients, however, residents of about 40 countries can open an account with them. However, their international accounts have a minimum deposit of $25,000 which may be more than you have available to invest at the moment. For alternatives with lower minimum deposit requirements, take a look at the world section of the article.

Charles Schwab at a glance

Highlights

-

Their own funds have very low expense ratios

-

Amazing checking account with free ATM withdrawals and no FTF

-

Extensive network of physical branches

-

Zero commissions for trades on US and Canadian exchanges

-

High-quality research tools

-

Great customer service

-

Also available to non-US residents

Things to note

-

Fund coverage could be better

-

High minimum deposit for non-US clients ($25,000)

Robinhood

Favorite among millennials, Robinhood was a free trading pioneer for ETFs and stocks on US exchanges. It has a straightforward and easily understandable app and website, and there are no hidden fees. It is not intimidating at all—an excellent option for beginners.

Their ETFs selection is a bit limited; they offer about 500 different ones. However, it has all the main ones, which should be plenty for most users.

They are focused on US markets, but some (currently about 650) global stocks are available through American Depositary Receipts (ADRs). An ADR is a certificate representing one or more foreign company’s shares and is issued by a US bank.

They also offer fractional stocks and ETFs—so that you can buy even expensive equities for as little as $1.

Some crypto coins are also available on Robinhood.

A year ago, they added the cash management feature. You can receive 0.3% interest annually on uninvested money or use it with a debit card (issued by Sutton bank). The account is free of charge, there is a decent selection of free ATMs, and Robinhood does not charge extra for foreign transactions with the card.

Robinhood at a glance

Highlights

-

Free buying and selling of ETFs, stocks, options

-

Can buy fractional stocks and ETFs

-

Easy mobile and web interface

-

Quick and free account opening

Things to note

-

Limited range, mostly US equities

-

Little possibility for customization

Ally Invest

Ally Invest is part of the long-standing Ally Group, which is listed in the US stock market.

If you already have an account in Ally Bank it could be an especially convenient option.

You can buy and sell shares and ETFs for free, which has become a norm in the US. However, only residents or citizens of the US can have an account with them. Also, it is not possible to trade in foreign markets.

Their ETF selection is pretty decent (about 2300), just like with Charles Schwab or Vanguard.

You can choose between a self-directed or a managed portfolio—both are free.

Managed portfolios consist of ETFs based on risk tolerance and timeframe. You don’t have to worry about diversification and rebalancing since it’s done automatically. 30% of the portfolio is kept in cash, and they pay 1% interest. While 30% could be good temporarily if you need liquidity, you might be missing out too much long-term for being out of the market. You can lower the percentage, but then you have to pay a small advisory fee.

Ally Invest at a glance

Highlights

-

Free trading of stocks and ETFs

-

A choice between self-directed and managed portfolios

-

Well-integrated with Ally bank—instant transfers

Things to note

-

Only U.S. markets are available

Europe

The broker market in Europe is very fragmented, and there are a lot of local brokers across the continent. I won’t be covering all of those in detail, but instead, take a look at some that can be used across most of Europe.

Note that tax reporting requirements for ETFs and index funds vary across Europe, and in some cases, it’s worth paying higher fees to a local broker in return for getting all the tax reporting done for you. This can be the case in e.g. Austria and Germany (not an exhaustive list).

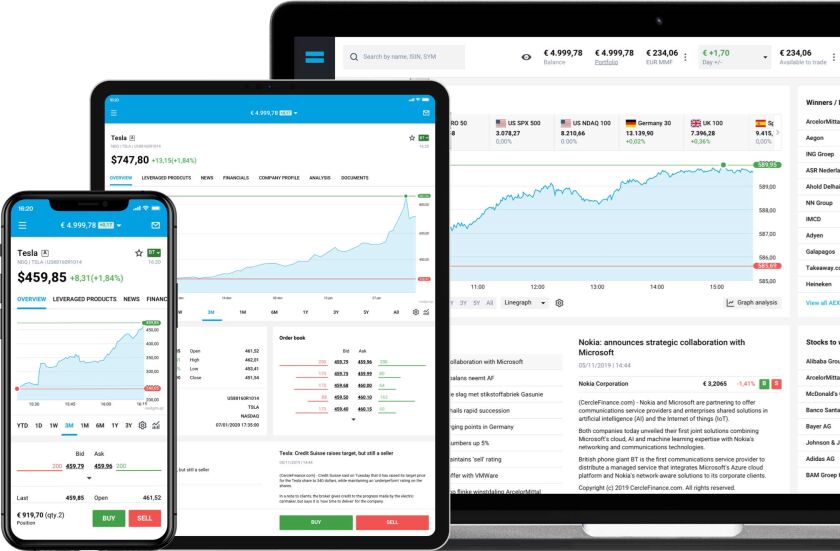

DEGIRO

If you have a bank account (or registered business) in one of 18 European countries, you can get an account with what must be one of Europe’s favorite discount brokers.

They have a range of ETFs that you can trade twice per month—once in each direction—for free (conditions apply, check DEGIRO’s site). The list of free ETFs varies a bit depending on which country account you open but you can see an example (for an Ireland account) here.

DEGIRO is also great for buying individual stocks, offering access to 50+ exchanges to choose from. There are no external handling costs for US , and in certain countries (FR, ES, PT, IT, DEN, SE), users can trade in their local exchange with no handling fees as well. Fees for other markets are a bit more, but also very reasonable. For advanced users, they provide options and futures for similarly low prices.

They also have the option to add crypto to your portfolio (except for UK customers), but be aware that you do not technically own the crypto yourself (i.e. buying through and exchange and having access to a crypto wallet), but rather through ETFs.

DEGIRO at a glance

Highlights

-

Low transaction costs for all available products

-

Long list of commission-free ETFs

-

Access to most important markets

-

User-friendly platform

-

Crypto through ETFs

-

No handling costs on US stocks

Things to note

-

May lend out your shares without compensation

-

Only one base currency

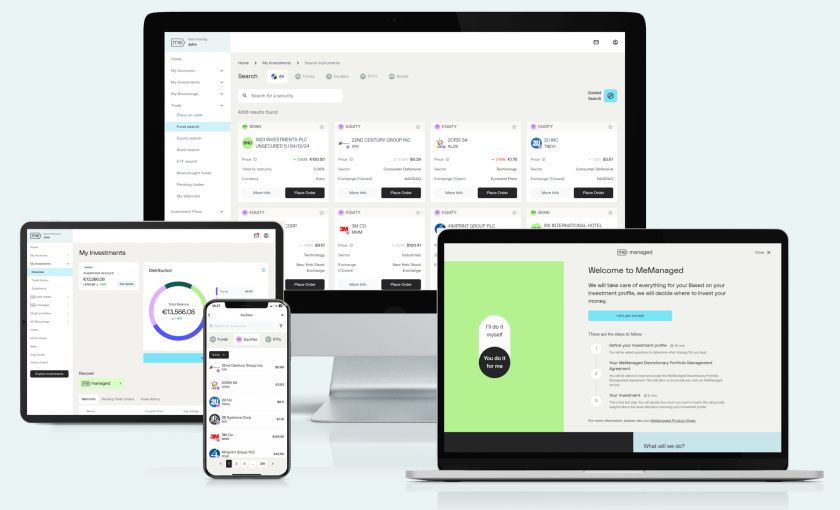

MeDirect

If you don’t have a bank account in any of the countries supported by DEGIRO (and don’t care to open one) you should consider MeDirect, a Maltese investment bank.

While their trading fees aren’t as low as DEGIRO (usually around 0.1% with a €10 minimum), they don’t charge any custody fees or inactivity fees, making them a good choice for someone with a buy and hold strategy who only invests occasionally (not necessarily monthly). Since May 2020 they also let you invest in mutual funds with no minimum fee, just 0.5% of the transaction, making it more attractive for those who place smaller orders.

You can open an account either online or in person at a branch in Malta and the process is very easy. Accounts are available to all EEA residents, except US persons (i.e. citizens and green card holders).

For a higher fee (typically 0.6% with a €30 minimum) you can instruct MeDirect to execute trades on your behalf. They will probably recommend that you invest in funds with a higher cost than index funds/ETFs, but if you insist they will still buy the low-cost index funds you ask for. For most of us, it probably makes more sense to trade ourselves, but if you want to automate the process (and avoid keeping track of short-term movements of your investments) it may be worth the extra cost.

As a bonus, they also offer decent banking features, such as debit cards and high-interest term deposit accounts.

Temporary offer: MeDirect is offering Nomad Gate readers a €25 welcome bonus when entering the following referral code when signing up:

Important: To qualify for the bonus, do the following within two months of opening your account: 1) Download and link the MeDirect app, 2) order a debit card (virtual or physical), and 3) use the card for at least five purchases totaling at least €300. Full T&Cs.

MeDirect at a glance

Highlights

-

Easy to open for EEA/EU residents

-

Easy to use

-

Possibility for managed/advisory accounts

-

No custody or inactivity fees

Things to note

-

Trading fees could be lower

Scalable Capital

Scalable Capital is known for having one of the most established robo-advisors in Europe and recently started also offering broker services.

Their uniqueness lies in making ETF savings plans—which are very popular in Germany—available for everyone with a SEPA account. The only exceptions being US persons and Swiss residents.

It works like this: You choose a certain amount that will be automatically pulled from your bank account and invested in your preferred ETF (or ETFs) every month. You don’t have to lift a finger.

Don’t worry if you prefer to trade more often or don’t want to use savings plans; they’ve got you covered too.

If you only use one ETF, it will be completely free of charge. For additional ETFs or manual trades, there’s a fee of €0.99, with subscriptions available that give you an unlimited amount of trades starting from €2.99 per month.

Scalable Capital at a glance

Highlights

-

Low costs

-

Offers free savings plans

-

Can buy fragmented ETFs with savings plans

-

Easy to switch between pricing options

Things to note

-

€250 minimum for trades, €25 for savings plans

-

Does not offer business accounts

-

Does not support multiple currencies, only euros

-

The online interface is in German

-

Only supports the gettex exchange (which mirrors Xetra) for free

-

Trading directly on Xetra is only possible for €3.99

LHV

If you’re one of the thousands of digital nomads with Estonian E-residency and an Estonian company, it might make sense to invest through LHV—especially when starting out.

If you’re already banking with them and are using Xolo (formerly LeapIN) for managing your business it’s especially attractive, since the amount of additional “paperwork” will be minimal on your part. (Xolo integrates with LHV and will import your transactions automatically.)

Trading with Baltic securities is free of charge but make sure you choose shares with enough trading volume.

Their transaction fees for investing in foreign equities used to be quite high compared to brokers but recently they have lowered their prices. Trades will cost 0,14% (with a minimum of €9). So, you’re better off investing in amounts starting from €1000 (to keep the fees reasonable). They are still not quite as affordable as typical discount brokers, but with their current rate of lowering their prices, soon they might be. They also have a management fee of 0,01% for holding foreign securities. For private persons, the management fee starts for portfolios over €50,000.

If you trade more frequently or have a larger amount already in your portfolio, it will likely be cheaper to use LHV Trader. It uses the Interactive Brokers platform. The fees are higher compared to investing directly through IB, but LHV provides tax reports suitable for Estonian companies or private investors.

If you are willing to make a bit more effort with tax reporting, consider using Interactive Brokers directly or other more affordable alternatives in this article.

LHV at a glance

Highlights

-

Good starting option for Estonian e-residents

-

Integrated with Xolo

-

Simple and fairly easy-to-use interface

-

Access to most important exchanges

-

Free trades on the Baltic exchanges

Things to note

-

High fees in most markets

United Kingdom

For the time being, all of the brokers covered in the Europe section accept clients also from the UK. However, in the light of Brexit, it may change in the future. We will make sure to keep this section updated with good options for Brits.

Stake UK

Stake is an established Australian broker, and the good news is that they have recently expanded their business to the UK. Stake is quite unique in Europe as they let you access the US markets, which means a broader range of ETFs with sometimes even lower fees than the ones traded in Europe.

It is a great choice for beginners or long-term investors looking for commission-free trading of stocks and ETFs. Even better—they do not charge any account or inactivity fees and their FX markup is reasonable.

You can read a more comprehensive review of Stake under the world section.

Special offer: Stake gives a free stock to all new UK users who open an account and fund it within 24 hours (with min $50).

Stake UK at a glance

Highlights

-

Unlimited free US stocks and ETFs trading

-

No inactivity fee

-

Account opening is easy and quick

-

Quality news from Bloomberg and CNBC

Things to note

-

Only available for residents of Australia, New Zealand, Brazil, and the UK

-

Only US market

-

Limited order types and no customization

-

Customer service could be better

-

0.5% currency exchange markup

Australia

There are fewer low-cost brokers in Australia compared to the US or Europe. However, there are a couple of good ones definitely worth mentioning, and most world-wide brokers also accept Australian residents as clients.

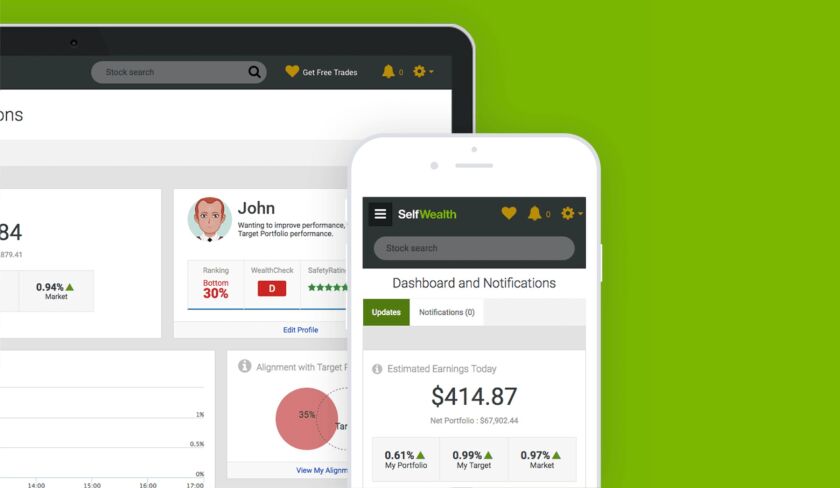

SelfWealth

SelfWealth is a low-cost online broker available only for Australian residents and focusing on the Australian stock market. Until now, trading on other markets has not been possible, but they launched trading on the US markets in late 2020.

They have a very simple fee structure—all the trades cost AU$9,50. Interactive Brokers or Saxo (will be covered below) are slightly cheaper for the trades in the Australian market unless they exceed AU$10,000 in a single trade.

When you buy US securities, there is a currency exchange fee of 0,60% when transferring to or from USD. You can’t transfer USD directly to SelfWealth.

If you are mostly interested in the US market, check out another Australian broker Stake in the world section. It offers Australians commission-free US stocks and ETFs trading.

The advantage of SelfWealth is that you can register the shares directly under your own name. It is a unique option for Australia. Most brokers either keep the securities under their name or use a custodian to hold these on your behalf.

SelfWealth at a glance

Highlights

-

A low-cost and simple fee structure

-

You can be the legal owner of your securities

Things to note

-

Only for Australian residents

-

Limited markets

World

There are increasingly more brokers who accept clients from all around the world. Some of them focus only on equities in the US markets, while others offer a wide range in various international markets.

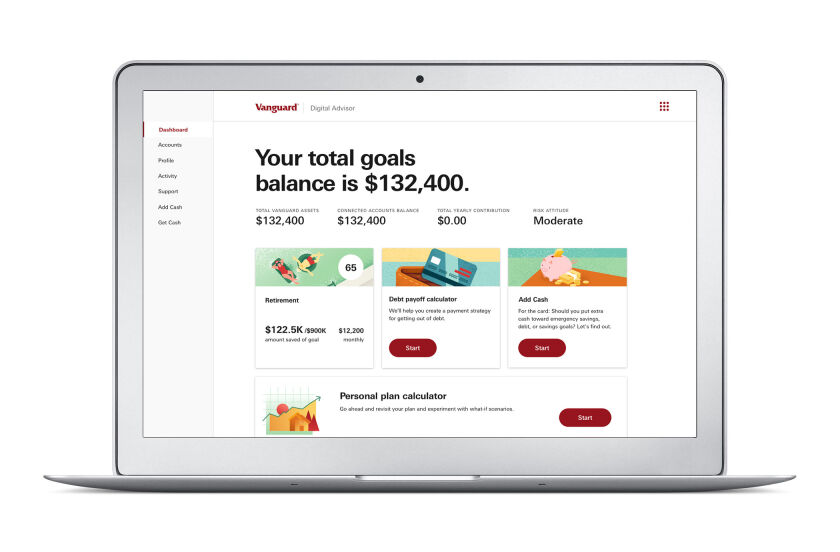

Vanguard

Vanguard is extremely well-liked in the investing community. They were founded by John Bogle and pioneered the index fund. To this day most people consider their index funds to be the best available.

They accept clients from the US, Canada, Mexico, most EU/EEA countries, UK, Australia, Hong Kong, Japan, and China.

You can buy their ETFs for free, but you have to pay the transaction fee for stocks. While they don’t charge any fees if you invest in their mutual funds, it usually requires a $3,000 minimum investment. They have no account or inactivity fees.

Vanguard at a glance

Highlights

-

Offers some of the best/cheapest funds on the market

-

No transaction fees for their own ETFs and mutual funds

-

Unique ownership structure aligning their interests with yours

-

User-friendly account opening

Things to note

-

Only US markets

-

No longer the undisputed winner of the price for all securities (but never far off)

Interactive Brokers

A very good, low-cost broker, available in most countries around the world. They also accept business clients, in case you’re saving up through a legal entity.

Interactive Brokers offers the widest range of financial instruments—covering almost 80 markets and 13,000 ETFs.

They have some of the lowest transaction costs in the industry. Previously though, you had to pay a $10 monthly inactivity fee, making it a bit more expensive or at least more suitable for those who have more invested already or invest on a monthly basis. Since July 2021 however, you no longer ned to worry about the $10 monthly minimum fee, making it one of the most competitive brokers out there.

There are also a few brokers covered below, who use Interactive Brokers securities clearing services, meaning you get the same choice of instruments with a different fee structure.

Interactive Brokers at a glance

Highlights

-

Available nearly worldwide

-

Access to most important markets

-

Very low trading costs

-

Extremely low currency exchange costs

Things to note

-

Not the nicest user interface

-

Lengthy and convoluted signup process (especially for businesses)

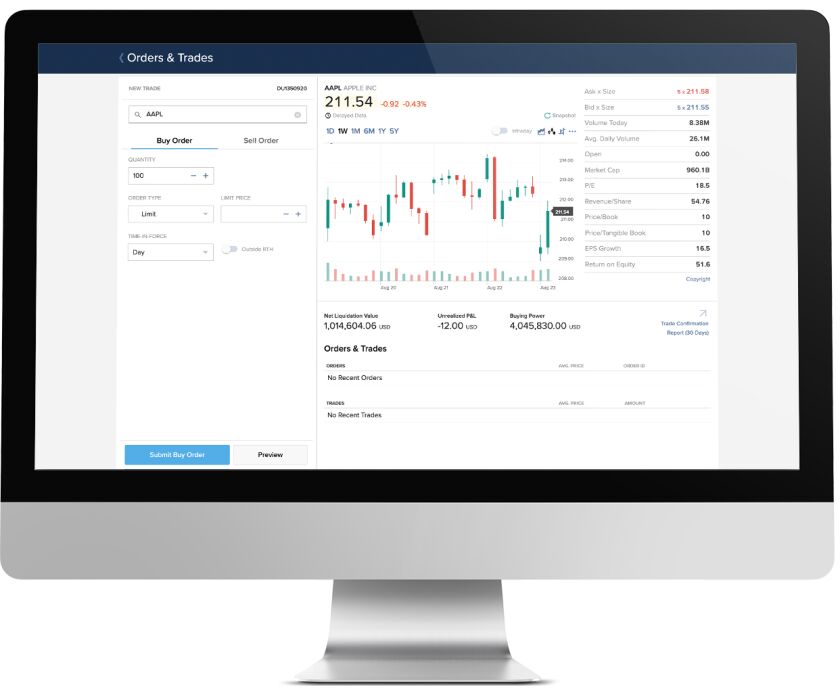

Zachs Trade

One of the brokers using Interactive Brokers securities execution services is Zachs Trade, with account opening availble globally for most countries.

You can choose between two web-platforms: Client Portal and Zachs Trader. The first one is easier and more user-friendly, and the second offers more advanced features.

Their desktop platform Zachs Trade Pro is super-advanced—even the most experienced trader should be happy with it. You can also use lots of news sources and fundamental data for free.

Even though their target market is active traders, it is also well-suited for buy-and-hold investors thanks to their low fees. The fees for US securities are about the same compared to Interactive Brokers, but transactions on other markets cost more with Zachs Trade.

Zachs Trade at a glance

Highlights

-

Available for most countries

-

No inactivity fee

-

Several base currencies (20)

-

Huge range of products, including about 13,000 ETFs

-

Many order types and very advanced platform

Things to note

-

Long and complicated account opening

-

2,500 recommended minimum to open an account

TradeStation US

TradeStation was founded in the 1980s by the Cuban-born Cruz brothers in an attempt to gain an advantage in trading. In 2001, they converted the company from trading software to an online securities broker.

They are US-based and offer only securities that are traded on home markets. Pretty much any country resident can open an account with them, and no US connection is necessary.

If you are a European investor, there is a distinctive reason to consider them—you can invest in low-cost ETFs listed on US exchanges. I haven’t seen that option with any other brokers since the beginning of 2020 when the PRIIPs key investor document requirement commenced.

The US residents can enjoy commission-free stocks and ETFs trading on their web and mobile platforms. For free buying and selling on their desktop platform, you need to make a minimum deposit of $2,000. International clients will have to pay $5 per trade and there is no minimum deposit required.

They also have an inactivity fee of $50 per year. This will be waived if:

- you make at least 5 trades during each 12-month period OR

- you keep your equity balance above $2,000

You can also open a company account with them, however, real-time market data is expensive for institutional clients. See the professionals column.

Deposits are for free, but wire withdrawals are expensive. You can use ACH (Automated Clearing House) withdrawals for free if you have a US bank account. Alternatively, they can provide you a list of online currency transfer service providers.

TradeStation US at a glance

Highlights

-

Access to ETFs traded on US exchanges for European investors

-

Available globally

-

Low fees

-

Great web and mobile platform, extensive market news, and fundamental data (from Yahoo)

-

Unusually wide range of crypto trading (7 pairs)

Things to note

-

Inactivity fee

-

Limited product range (US markets)

-

Wire withdrawals are expensive

TradeStation Global

TradeStation Global was born in 2018 when Tradestation International wanted to expand to Europe and joined forces with Interactive Brokers.

Residents of most countries can open an account with them—either individuals or businesses. There are some exceptions, like the US, Canada, Australia, Singapore, Hong Kong, and Japan.

Tradestation Global has a $1,000 deposit requirement in cash or stocks to open the account. If your account balance drops under $1,000 and you didn’t make any trades during the previous month, you will be charged $1.

They also have their own fee structure for trades, which is one of the cheapest I’ve seen. Interactive Brokers has a slight edge for US stocks, but transactions on international markets are significantly more affordable for both stocks and ETFs.

You can choose between Interactive Brokers’ or their own platforms. TradeStation Global’s web platform is suitable also for not so advanced users.

It looks like it could be one of the best global brokers out there. The only downsides are the not-so-smooth account opening process (performed by Interactive Brokers) together with the minimum deposit requirement.

TradeStation Global at a glance

Highlights

-

Available globally

-

Extensive range of products

-

Great transaction fees and no inactivity fee

-

Deposits and one withdrawal per month is for free

-

Lots of base currencies (22)

Things to note

-

Complicated account opening process

-

A minimum deposit of $1,000

Saxo Bank

Saxo bank is another worldwide broker. It was founded in Denmark in 1992 as an investment bank.

They accept customers from nearly all countries (exceptions are the US, Iran, Cuba, Sudan, Syria, and North Korea). But they have a pretty high minimum deposit requirement, which depends on your residency and account type. There is no required deposit for Denmark; the deposit for the UK is £500, which is the lowest. Around €1000-2000 is required for a few European countries, Australia, China, Hong Kong, and Singapore. The rest will have to deposit $10,000.

Saxo bank offers low fees compared to banks, but not quite as low as TradeStation Global, Interactive Brokers, or DEGIRO. The product range is good—almost 40 markets with plenty of stocks and ETFs.

It has powerful, user-friendly platforms and offers great research and educational tools.

Saxo Bank at a glance

Highlights

-

Available worldwide

-

Great research (investing ideas) and platforms

-

Good product range

-

26 base currencies

Things to note

-

High minimum deposit for most countries

-

Not the lowest fees

TD Ameritrade

Residents of around 100 different countries can open an account with TD Ameritrade. The countries that are not accepted include Canada, Australia, South Africa, the UK, and the EU.

TD Ameritrade is an American broker with a long history; it was founded in 1971 in Warren Buffet’s hometown. In late 2020, it got acquired by Charles Schwab Corporation. They are running as independent brokers for now, but the plan is to integrate fully in 2-3 years.

It is suitable for all investors’ levels, offering plenty of educational materials, research tools, and fundamental data. Their desktop platform Thinkorswim is considered one of the best.

It offers plenty of different account types—joint, business, retirement, among others.

It is possible to trade a wide range of financial instruments: stocks, ETFs, funds, bonds, derivatives, forex, crypto. Customers can even benefit from social trading and robo-advisory. On the flip side, the available markets are limited to the US.

Thanks to the popularity of free trading, they have removed all stock and ETF transactions fees.

TD Ameritrade at a glance

Highlights

-

Free trading of stocks and ETFs

-

Several account types, including joint, business, retirement, college savings, etc. accounts

-

Covers the full range of equities (including funds, forex, crypto)

-

One of the best desktop trading platforms available

-

Great customer service

Things to note

-

Only the US markets

-

Only available for residents of the US, Canada, and some Asian countries

Firstrade

Firstrade has a long history of 35 years and has survived several financial crises—therefore a pretty safe option.

If you are happy investing only in the US markets and want commission-free trading, Firstrade could be a great choice. Account opening is available globally with a couple of exceptions (e.g., Canada, Australia).

There are no account fees, including inactivity fees. However, you have to pay a fair amount for wire withdrawals if you can’t use ACH payments.

It has user-friendly platforms with great research tools, like ETFs and stocks screeners, detailed fundamental data, heatmaps, and an economic calendar.

On the negative side, customer support channels are limited; responses are slow and not always accurate.

Firstrade at a glance

Highlights

-

Available globally

-

No fees for most financial instruments (stocks, ETFs, mutual funds, options)

-

No inactivity or account fees

-

Good platforms with great research tools

Things to note

-

Only the US markets available

-

Only USD as a base currency

-

Customer service could be better

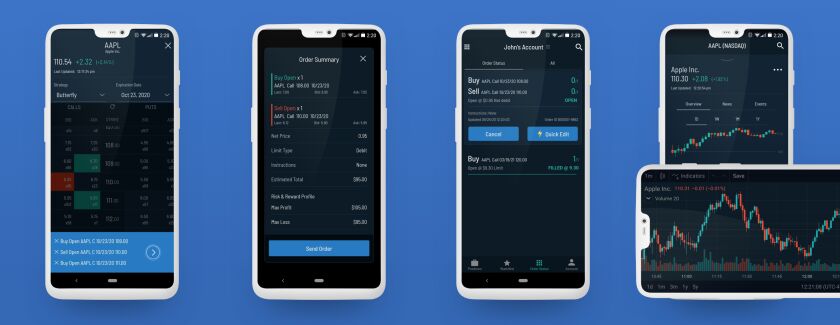

Stake

Stake is an Australian broker founded in 2017. Their accounts are also available for residents of New Zealand, the UK, and Brazil.

It provides the option to buy and sell about 3000 US stocks and around 1000 ETFs free of commission.

There is no account opening or inactivity fee. They charge currency exchange markup when depositing and withdrawing money since they only have USD as the base currency. It is 0,5% for UK customers and 70 bps (about 0,7%) for Australians.

Stake is good for beginners and for buy-and-hold investors. It doesn’t offer other financial instruments apart from stocks and ETFs, and order types and customization is limited. However, it does provide some search tools and quality news.

Stake at a glance

Highlights

-

Unlimited free US stocks and ETFs trading

-

No inactivity fee

-

Account opening is easy and quick

-

Quality news from Bloomberg and CNBC

Things to note

-

Only available for residents of Australia, New Zealand, Brazil, and the UK

-

Only US market

-

Limited order types and no customization

-

Customer service could be better

-

0.7% currency exchange markup

Trading 212

An increasingly popular broker specializing in so-called “CFDs” (an instrument I wouldn’t recommend unless you know what you’re doing) through their product Trading 212 CFD. Instead, just disregard this part of the product and sign up for Trading 212 Invest, where they offer over 10,000 no-commission ETFs and stocks. They also have fractional shares if you would like to buy smaller pieces of expensive stocks.

There is an option to automate your investing. You can create a pie consisting of ETFs and stocks, set a regular deposit amount, and an investment horizon. Then, just watch your funds grow. It is easy to rebalance the slices of the pie with just a couple of clicks.

Trading 212 Invest has no inactivity, deposit, or withdrawal fees.

Trading 212 at a glance

Highlights

-

Available nearly worldwide

-

Commission-free ETFs and stocks investing

-

Fractional shares

-

Relatively user-friendly

-

Free debit/credit card topups

-

No inactivity, deposit or withdrawal fees

Things to note

-

Not available for US citizens or residents

-

Not the best selection of markets

The content of the article is intended to be used only for informational purposes. Before investing, it is essential to do your own analyses based on your individual situation. Also, keep in mind that past performance is not a guarantee of future return, nor is it an indicator of future performance. The value of your investments is likely to fluctuate over time, and you may gain or lose money.

Hope you liked the article and found it useful!

If you would like me to include any other good brokers, let me know in the comments.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.