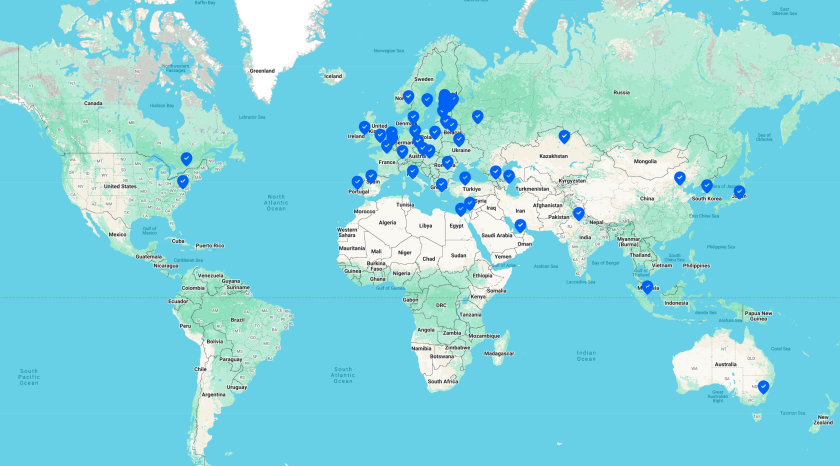

The internet seems to have been buzzing a lot about Estonia in the last few years, and a lot of it is due to the innovative new e-residency program that was launched in a limited form in December 2014, and has been rolling out additions and improvements ever since.

Yet, there has been a certain degree of confusion of what the e-residency is and isn’t, and what you can and cannot do as an e-resident of this progressive Baltic country.

Instead of relying on press releases, shallow news articles or random speculation from internet-commenters, I have gone through the process of obtaining an e-residency as well as actually traveling to Estonia to go through the process of opening a bank account as an e-resident and learn more about the program first-hand.

I’ve since gone through the process of registering an Estonian business, and opening banks accounts for it both in Estonia and abroad.

In this extensive article I go into detail of why you might or might not want an Estonian e-residency, how it can make it really convenient to bank and run a business in Estonia, some basic tax implications, and lastly, explaining the process of obtaining e-residency.

I will not go through the actual process of opening a business—I’ll save that for another article that will be published soon. Although registering and managing a business in Estonia is quite straightforward, using a service provider like Xolo (formerly LeapIN) to deal with regulations, accounting, and a mandatory business address is affordable and well worth it.

Special offer: Xolo is currently giving Nomad Gate’s readers €100 credit when signing up through this link.

But first of all, there are a lot of misconceptions surrounding the e-residency. Let’s just get a few of the glaringly obvious ones out of the way right now.

What the Estonian e-residency is not:

- IT IS NOT an actual residency. It does not give you any rights to stay in Estonia, the EU or the Schengen zone whatsoever. Nor any other social rights in Estonia or anywhere else.

- IT IS NOT a way to avoid paying tax in your actual country of residence.

- IT IS NOT a citizenship, and you will never receive any consular support from the Estonian government for holding an e-residency.

- IT IS NOT a travel document. It is not a picture ID. It can not be used as a form for identification in the “real world.”

Currently, it’s an electronic form of identification allowing you to log into online services in Estonia such as government portals and online banks. Under EU eIDAS, some member states may accept it for certain online public services, but it is not universally accepted across all EU systems.

You can also use it to legally sign documents electronically within the EU and increasingly also elsewhere.

Table of Contents ↺

Basically, it’s a digital identity card accepted by many banks, services, and the Estonian government. In the future it will be accepted as online identification in all EU countries.

So why would you need an e-residency then?

Well, most people wouldn’t.

But it can be very useful if you want to either bank or run a business in Estonia. Or if the e-residency just resonates ideologically with you and you want to show your support. That’s a completely valid reason too.

Reasons to bank in Estonia

Here are just a few reasons for why you might want to bank in Estonia:

- You live there or spend a significant amount of time there

- You have friends, family, or customers there

- You want a euro account or a multi-currency account (which many Estonian banks offer)

- You want to diversify your assets as part of an internationalization strategy

- You want access to modern banking that you can manage from anywhere

- You want to place (some of) your assets in a country where the government isn’t consistently running huge budget deficits

- You want to do your banking in English, Estonian or Russian

- You want to incorporate a business in Estonia, for example to access the EU market

- You have an e-residency card and want to use it for something

The challenge of opening a bank account in Estonia, even for e-residents

If you just get on a plane to Tallinn, walk into a bank branch and expect them to open an account for you without any fuss, you are bound to be disappointed.

The e-residency does not give you a right to open an account with any bank in Estonia.

You read that right. As long as you are not an actual legal resident of Estonia, no bank has any obligation to open an account for you whatsoever.

Due to fairly strict Anti-Money Laundering (AML) rules, it is unlikely that you will be able to open an account if you can not demonstrate a strong connection to Estonia. Basically, you need to demonstrate why you want to bank in Estonia, and most of the reasons listed above will not cut it.

However, the following reasons are considered valid by most banks in most cases:

- You live in Estonia long-term

- You are Estonian (but may currently live elsewhere)

- Your parents are Estonian

- You’re employed by an Estonian company

- You own or manage one or more businesses that are physically located in Estonia

- You own property in Estonia

In short, unless you’re part of the lucky sperm club or have strong investment or business ties with Estonia, it will be a bit more challenging to open a bank account, no matter if you’re an e-resident or not.

Luckily there are ways for the rest of us. I traveled to Estonia to explore options. Through this boots on the ground-approach I learned a whole lot, which I will share in the next few paragraphs.

Also read: The Ultimate Guide to Banking for Estonian E-residents

Choosing a bank

Several major Estonian banks (e.g. LHV, SEB, Swedbank) accept e-residency login for parts of their services, but access and terms vary. But to be honest, the banks that currently support it is likely the banks you would want to bank with anyway.

Both SEB and Swedbank are fairly large, world-class, Swedish banks with large-scale operations in Estonia. LHV is a mid-sized, modern Estonian bank with roots as an investment firm. LHV is actually the bank used by Wise for all their SEPA transactions in euros.

SEB and Swedbank both have branches scattered throughout the country, while LHV only has three branches in total, in Tallinn, Tartu and Pärnu. While that might seem like a disadvantage at first, I actually perceive it as a big plus.

First of all, it gives them a lower overhead which results in cheaper banking for you. While they in 2018 started adding some fees for non-residents (and e-residents are still considered non-residents), they are still more affordable than the two Swedish banks. They are also used to dealing with their customers remotely, even their Estonian ones.

If you want to manage your bank relationship 100% remotely, the latter point is a big plus. As long as you’re an e-resident, you only ever have to step foot in an LHV branch once. Even if you want to open a business account at a later date, as long as you are already a customer you can handle everything electronically from anywhere in the world.

The only caveat is that if you want a debit card with your account, you might have to come back to pick that up a week or so after the account opening has been approved. In my case, I did not have any need for yet another debit card denominated in EUR, especially since I already have the fantastic debit card from N26 in Germany (which surprisingly is accessible to most people if you know what you’re doing).

If you require a debit card and don’t have the time to stick around in Tallinn, I would recommend that you contact LHV up-front to see if it’s possible to have the card ready for you pick up when you come in to verify your ID (generally they can do it).

Still, the biggest plus with LHV and the definite deciding factor for me for which bank to open an account with was that they allowed me to open one. With SEB and Swedbank, if you do not meet any of the criteria listed above (or potentially deposit a huge amount of money), they will not open an account for you.

Swedbank used to be more willing to open business accounts as long as you had already registered a business in Estonia, but that has been changing in the last year.

SEB will consider opening an account for you and your business as long as you have large clients that you work closely with in Estonia.

LHV, on the other hand, accepted one more reason for opening an account in addition to the above list. Critically it’s a reason anyone can give. It does not require having any prior ties to Estonia at all, nor does it require any huge investments of time or money.

“I wish to invest in the Estonian and Baltic stock market.”

That’s it.

It might have something to do with their history as an investment firm, and the fact that they offer some great investment options. Or maybe they are just a little bit more flexible than the two giants, because that is what it takes to succeed as a smaller player? I’m not sure, but at the end of the day, it doesn’t really matter.

TIP: Xolo has a partnership with LHV, so if you open your company through them (which is included in their ongoing pricing) they will help you open up an account with LHV. As far as I know they have a ~100% success rate. And if you’re for some reason unhappy with Xolo’s services, you can cancel anytime.

Special offer: Xolo is currently giving Nomad Gate’s readers €100 credit when signing up through this link.

The fintech alternative

As of January 2019, it is no longer required to have an Estonian bank account to confirm that you paid the share capital of your company, so you are free to choose any bank or electronic payment institution in the EU/EEA (such as Wise Business) if you prefer that over traveling to Estonia to open a “real” bank account.

Why you might want to set up a business in Estonia

Businesses registered in Estonia are by default considered to be tax resident in Estonia.

If you are running the business from a different country where you are personally tax resident, please consult the relevant tax treaties and talk to a tax professional to see if the company might be considered resident in your home country instead.

The tax burden in Estonia is far from the highest, but also not quite a tax haven either, especially after recent tax increases. The VAT in Estonia is 24% since 1st July 2025, and personal and corporate income tax rates are 22% at the time of writing, but will increase to 24% in 2026. It used to be straightforward 20% tax for all of these three, but the government has decided to increase defense spending.

Note that there are social taxes totaling around 35% for employees and directors that perform their services within Estonia.

The social taxes will not apply to someone living outside of Estonia and not performing any actual work within Estonia, with one exception. If you spend a large portion of your time on board member duties you will typically pay yourself a board member salary in addition to a regular employee salary. In case you don’t already pay social taxes somewhere in the EU, you pay social tax on the part of your salary you label as being for the board member duties, in addition to Estonian income tax. You’ll typically get credits for these taxes where you live (check the relevant treaty for specifics).

Luckily, you’re not legally required to pay a board member salary—especially if you do all the work outside Estonia, and you spend most of your time working on the actual business (like developing your product, freelancing, consulting, getting clients, etc). There has been some confusion regarding this, but as of the end of 2018, the Estonian Tax Board has confirmed that you do not need to pay yourself a board member salary in the above situation.

And even if you do opt for paying some board member salary, you can pay proportionally to how much time you spend actually managing the company instead of working for the company. So if you only spend 8 hours per month managing the company (which is likely if you use a service such as Xolo to manage most of your accounting and reporting), and 152 hours actually working on the business (creating products, working for clients, etc), then it could make sense to pay about 5% of your salary as a board member salary.

Overall Estonia has an average tax burden, so if low tax is all you care about there are better options. If you care about cash-flow, easy day-to-day remote management in English and a generally business-friendly environment, Estonia might be for you.

One exception is if you are resident in a country that does not tax salary income from abroad. In that case you can pay yourself a salary completely (or nearly) tax-free. Just make sure the Estonian company won’t be considered tax resident where you’re resident. This will often be the case if you’re a nomad or perpetual traveler with a primary tax residency in a country with territorial tax or another favorable tax scheme (such as Malta and even Portugal).

How does Estonia’s 0% tax on undistributed profits actually work?

Estonia’s tax system is quite unique due to one small quirk that makes it especially attractive to growing businesses that reinvest profits into further growing the company: The corporate tax is only paid on distributed profits. So as long as profits are reinvested rather than being distributed to shareholders through dividends, no corporate tax is owed. You still need to pay the tax whenever the company actually do decide to distribute profits (unless paid as salary, not dividends), however.

This makes this option great for someone who’s personal tax situation is less than ideal at the moment, since you can reinvest the profits into for example index funds or other investments now, then start cashing out more from the company once you have moved your personal tax residency to a more tax-friendly country—particularly one that does not tax salary and/or dividends from abroad.

To be clear, when profits eventually are distributed as dividends, the 22% tax (24% from 2026) is paid by the company (as corporate income tax) not the person receiving the dividends. There’s no dividend withholding tax in Estonia.

In most cases, the receiving person (legal or natural) needs to pay dividend or income tax according to taxation rules in its relevant country of residence.

I think a quick example will make this crystal clear: If an Estonian company decides to distribute €10,000 of its profits to a natural person resident in Country X (a country with a 25% tax on dividends), this is the tax that will be paid by the company and the individual:

- The Estonian company pays €2,200 in corporate income tax on distributed profits

- There’s 0% withholding tax on dividends

- The individual resident in Country X then pays 25% of the remaining €7,800 (€1,950). The individual ends up with €5,850 after tax.

However, if the person receiving the dividend is a resident nowhere or resident in a country with territorial taxation (e.g., Panama), in many cases, no other tax than the Estonian corporate income tax will need to be paid.

To read up more on the tax situation for legal and natural persons in Estonia, check out PwC’s excellent tax summary.

A step-by-step guide to acquiring Estonian e-residency

The whole process can be done in about a month, without having ever to visit Estonia. The application process is online, and the card will be sent to an Estonian embassy near you where you can pick it up.

- Go to the e-residency website and fill out the application. You will need a scanned copy of your passport, a passport photo, as well as a Visa or Mastercard to complete the payment. You will also select which embassy or consulate the card should be shipped to or if you want to pick it up in Tallinn, Estonia.

- You should receive an email about two weeks later with the result of your application. It may take longer if they have a lot of applications to process at the moment.

- If your application is approved, you can expect your e-residency card to arrive at your specified embassy or consulate around 2 weeks later. This may also vary a bit depending on location. You will be notified via email and asked to set up an appointment to pick up the e-residency card within their opening hours.

- At the embassy, you will need to show your ID document (typically your passport), sign a couple of forms and be fingerprinted.

- Activation is automatic within ~24 hours after pickup. If card isn’t functioning properly, see the troubleshooting section below.

- Congratulations, you are now an Estonian e-resident!

How to use your e-residency card

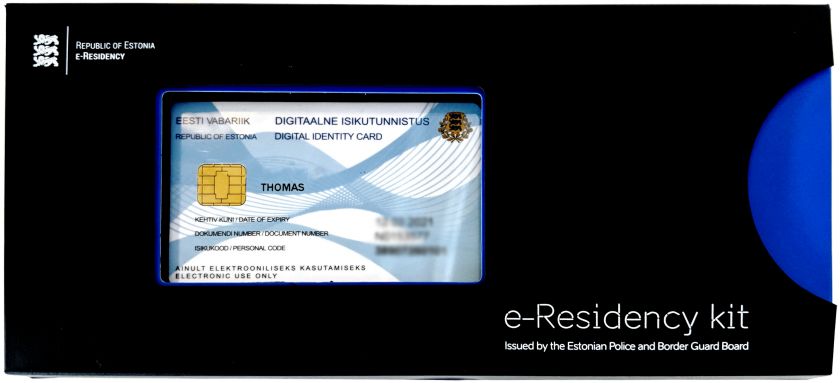

After collecting your welcome pack at the embassy, you are probably anxious to start using your new e-residency card.

You should find the following items in your welcome pack:

- Your e-residency card

- A small, collapsible card reader

- Your PIN codes

- To start using your card, unfold the card reader and insert the e-resident card into the reader (chip first). Do not connect the card reader to your computer just yet.

- Download and install the DigiDoc4 application and the web browser components from the installation site.

- After installing the software, make sure the DigiDoc4 client is closed. Insert the card reader with the ID card into your computer.

- Before attempting to use the card, you can check if it has been activated (it can take about 24 hours from you pick up your card). To do so, go here and enter the document number (the letter N followed by 7 digits). As long as it returns the status Document N0123456 is valid you are good to go.

- Verify that the ID card is working correctly by logging in to for example eesti.ee. You will be asked for a PIN code, which is the PIN1 listed in your welcome pack.

If you encounter any issues logging in, try restarting your browser and computer. If it still does not work, have a quick look at the troubleshooting section below.

You can change the PIN1 and PIN2 codes in the DigiDoc4 application, which can also be used for digital signing of documents.

Troubleshooting

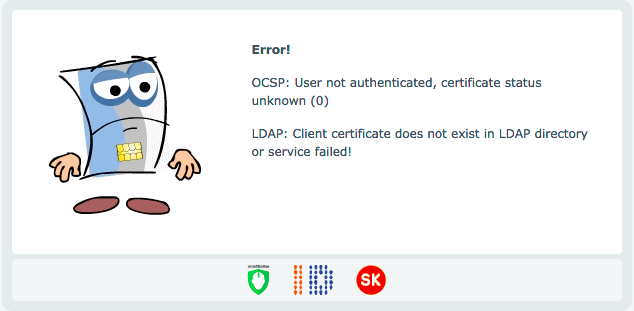

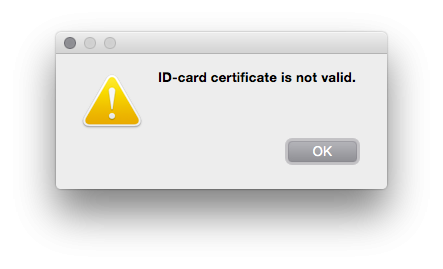

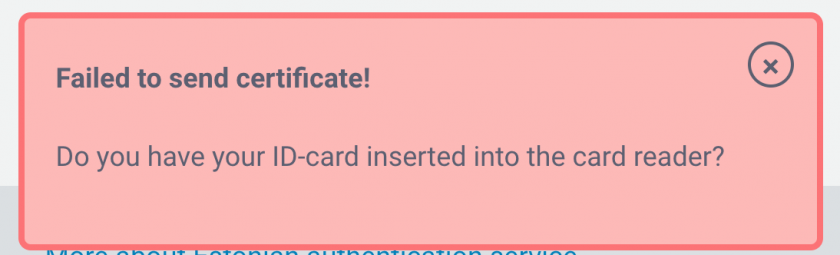

If you get one of the errors shown in the screenshots above (or anything else remotely similar), your certificate might not have been activated yet. Follow the official id.ee page for instructions.

Note: Some similar errors you might encounter are usually easily fixed by restarting or trying another browser:

If you get the error “Failed to send ID-card certificate” when logging in to online services, you may have an overzealous firewall or antivirus software blocking the connection. Try disabling your firewall or antivirus program to see if that solves the issue.

FAQ

Table of Contents ↺

How much does the e-residency cost?

The current application fee is €150. Since the card is valid for 5 years, that works out to about €30 per year. This price includes a delivery of your chosen Estonian embassy.

How long is the e-residency valid for?

Your e-Residency digital ID will have a validity of 5 years.

How do I renew my e-residency?

You will have to go through the same application process again, as well as paying another application fee.

Do I need to have an Estonian bank account for my Estonian company?

Not really. The only reason you needed it in the past was to confirm that you paid the share capital. And since 2019 the law has changed so that you can use any bank or payment institution in the EU/EEA to confirm the share capital. And that includes easy-to-open options such as Wise Business (free).

Is Stripe available in Estonia?

Yes, since 2019 they have been available in Estonia. Their pricing starts from 1.5% + €0.25 for European cards.

There are also several Stripe alternatives available for you payment processing needs, such as Paypal Braintree and the local offering EveryPay.

Which service provider do you recommend?

We have another article dedicated to this topic which I encourage you to check out, however Xolo is the service provider that I personally use in Estonia, as I’ve found them to offer excellent service, and offer the most competitive pricing long-term.

Unlike most other providers they give you one predictable fixed monthly price, which includes everything that others charge extra for, such as giving you both a contact person service and legal address service (including scanning and forwarding), submitting any government reports automatically without you ever having to ask them to do so. Other companies also charge extra for things like creating and submitting your annual reports, tax returns, extra accounting entries and so on. But with Xolo everything is included—even a very nice interface where you can easily get an overview over how your business is doing, including easily upload documents, create and send invoices, etc.

They provide automatic daily imports of all your transactions from LHV, Wise Borderless, and PayPal (from any country).

Per 2025, these are the banking providers they sync with automatically:

- Wise

- Revolut

- Wamo

- Payoneer

- PayPal

- Stripe

- LHV bank

If you use another service where you can give their accountant read-only access they will even manually import your transactions once per month, so you never have to download and send them monthly CSV exports from your banking solution.

Xolo will also help you open a bank account in Estonia (if you want one). It will cost €300 and you’ll have to visit the bank branch once to get everything set up.

By joining Xolo, you put your company on auto-pilot!

Open an Estonian company with Xolo

Special offer: Xolo is currently giving Nomad Gate’s readers €100 credit when signing up through this link.

If Xolo for some reason isn’t able to offer their services to you, there are other, more customizable providers to choose from instead.

What’s the €100 Xolo referral code?

Special Offer: Xolo is currently giving Nomad Gate’s readers €100 credit when signing up through this link

There’s no lock-in, so you can switch to another service provider at any time… but I doubt you will!

Open an Estonian company with Xolo

Do you have any questions about the Estonian e-residency that I wasn’t able to answer in the article? Leave a comment below! I will try my best to answer all your questions and post the answers here as well, so more people can benefit from them.

Please note: I am not a lawyer and nothing in this article is to be considered as legal advice. It is simply a best effort representation of the information I have gathered through countless hours of online and offline research into the subject, as well as my more than 4 years as an e-resident.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.