When it comes to good banks for American digital nomads, Charles Schwab Bank is often readily recommended. They offer great features for nomads, but they’re not the only good option anymore. Recently, more banks have popped up and are offering similar and better features.

NOTE: Simple Bank, which is listed in this article no longer exists. For more great international banks for nomads, check out our guide: “The World’s Best Bank Accounts for International Travelers and Nomads”

In this article, I review the 3 best online American banks (Aspiration Bank, Simple Bank, and Ally Bank) and determine which ones are the best for a digital nomad. Each will be reviewed based on some criteria and then you can make your decision as to which one is best for your financial purposes.

There are four main criteria that I believe digital nomads look for when choosing a bank to use abroad. Support, ATM Fees, Transfers, and App.

Support

How well does the bank handle online and phone-based communication? Do they send debit cards to foreign addresses? Can you use your card in any country? How long can you stay abroad before you need to put in another travel notice?

Digital nomads are often in different time zones and having support available at crucial times is an important factor. Also, if something happens to your card, knowing if the bank can send you one while you’re abroad can be a lifesaver.

ATM Fees

Does the bank refund international ATM fees and how low are their international transaction fees?

Transfers

How low are the bank’s incoming and outgoing wire transfer fees? Does the bank accept international transfers?

App

How good is the bank’s Android / iOS app? Do they provide card control features like blocking the card and resetting the pin? Also, does the app have budgeting features that support you in saving the most money?

How each bank will be ranked

Each category will receive a rating from 0 to 2 based on how well the bank does when answering each question. Support will receive a 0 to 4 because there are more questions to answer.

I will review the banks in alphabetical order. I want to make it clear that these are best in class banks and I’m simply comparing features from a high level so you can determine which one is the best for your purposes.

Bank Reviews

Ally Bank

Support: 3/4

Ally Bank offers 24/7 support. From my experience calling on a Saturday morning in Thailand, they picked up quickly and they were patient during times when the internet wasn’t stable. Also, they confirmed that they’re able to send cards to a foreign address. However, they said shipping could take up to 2 weeks and they can’t guarantee that the card arrives.

Ally Bank has a short list of blocked countries where you cannot use your card. Those are Belize, Burundi, Central Africa Republic, Cuba, Dominic Republic, Iran, Iraq, Lebanon, Libya North Korea, Somalia, South Sudan, Syria, Yemen, Venezuela, Zimbabwe, and countries in the Balkan Peninsula.

In terms of how long you can put in a travel notice, Ally Bank’s support team told me you can do it up to a year. However, you can call again and put in another notice if you need more time. That’s pretty good. You will also have to call and let them know the countries you will visit beforehand so your card doesn’t get blocked.

ATM Fees: 1/2

Ally doesn’t charge any fees on their end for withdrawing money. However, they do charge a cross-border / currency conversion transaction fee that’s up to but not more than 1% of the final amount. Although on their website they state that they will refund up to 10 dollars in ATM fees (that the ATM owner charges you) that will only work with specific ATMs in America. If you’re abroad you have to pay the ATM’s fee, which in some countries can be around $5 per transaction.

Transfer: 1/2

Incoming domestic and international transfers are free with Ally Bank. However, it costs $20 dollars to wire money to another domestic bank in the United States. Lastly, Ally Bank does not offer outgoing international transfers.

App: 1/2

Ally Bank wins when it comes to card control features. They recently released an app called Card Controls that gives you fine control of how to use your card. For example, spending limits for any single transaction, what type of transactions (online, store, ATM) are allowed, Merchant types (Grocery stores, restaurants, department stores), and the location where the card can be used.

That’s a lot of control, but people have given it bad reviews because it’s a 3rd party integration that reads your financial data. The terms and conditions state that they aren’t liable if any damages occur. Also, it’s a separate app which doesn’t make sense. Still, they at least have this feature and it can be very beneficial if you want to use your card instead of cash.

Ally Bank doesn’t have any built-in budgeting features so they don’t get the extra point for this one.

Aspiration Bank

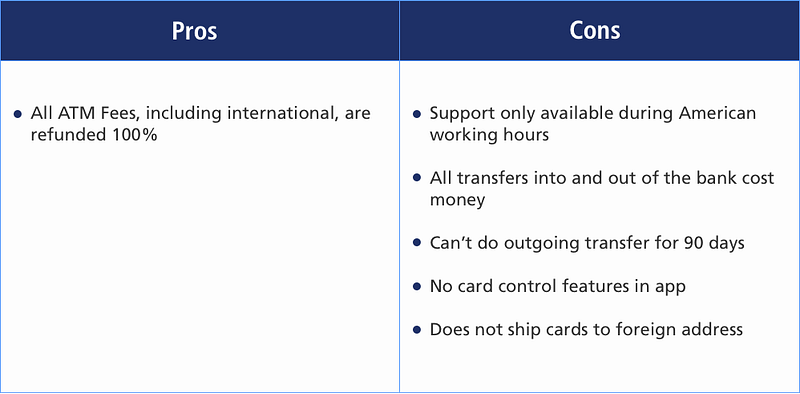

Support: 2/4

They offer phone and email support from 8 AM — 5 PM Pacific time Monday through Friday and from 11 AM — 1 PM Pacific time on Saturday and Sunday. That’s not enough because digital nomads are usually in a completely different time zone from America. That being said Aspiration is a new institution and their support team told me they’re rapidly expanding. In the coming months they will be expanding their support hours as they add more team members.

They do not send cards to foreign addresses. They can only send them to the American address that they have on file for you.

You can use your card in any country according to Aspiration’s support team. However, there is a possibility that the card could get flagged and blocked for your security in areas with a probability of high fraud. If that happens, just call their card vendor directly at 1–727–227–2447 or 1–800–369–4887 and they will take care of that for you.

As for travel notices, they put in a 1.5 year travel notice for me in Thailand, but if you need more time call again when you need it. Also, be sure to call before you go to any other countries so you can use your card.

ATM Fees: 2/2

Aspiration hands down wins in this category. Their international transaction fee is 1.1% of the final amount: They charge a 0.2% Currency Conversion Assessment and a 0.9% Cross-Border Transaction Fee. But that’s nothing compared to how much they can save you in ATM fees.

On the 10th of every month, Aspiration Bank refunds all the ATM fees you paid from any ATM anywhere. You will find a deposit from Aspiration, labeled “ATM Fee Rebate.” This will reflect reimbursements for each ATM fee paid in the prior 30 days. There is the small possibility that some ATMs will not track the fee you paid correctly so you might not get refunded the full amount. Their support team recommended that you always take pictures of your ATM withdrawal receipts, so if that happens you can send them an email.

Transfer: 0/2

It costs 10 dollars to domestically transfer money into Aspiration and 20 dollars for an outgoing transfer. 10 dollars for an incoming international transfer and 40 dollars for an outgoing international transfer. At least they offer international outgoing transfers when the other two don’t.

The biggest surprise is that you can’t do wire transfers out of the account for the first 90 days. So once you move money in the account it’s stuck there for a while. That scares me because what if you lose your card or it gets stolen?

App: 0/2

From what I can tell Aspiration does not yet have options in place for controlling your card through the app and neither do they have budgeting features what so ever.

Simple Bank

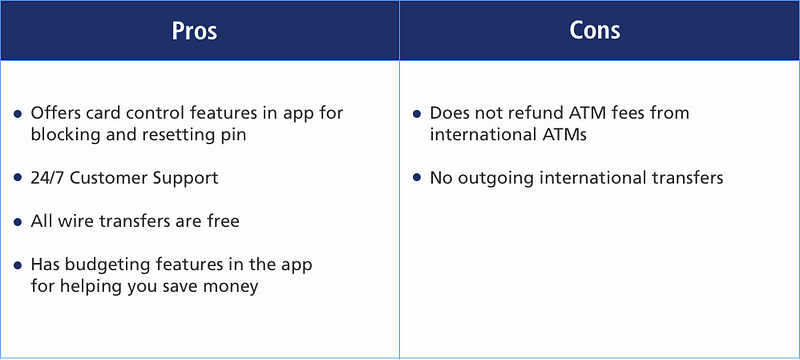

Support: 2/4

Simple Bank has 24/7 support. When I asked about sending cards abroad they didn’t give me a clear yes or no but said it was a possibility. They said there’s a required approval process with the department concerned with sending out the cards. Who knows what the requirements are? It might not be accepted. Even then they said shipping will probably take around 2 weeks.

I’m not giving them the point for sending cards to a foreign address though because it was a vague answer.

Simple has quite a few countries where you cannot use your card due to government regulations or increased risk of fraud. Those include Afghanistan, Albania, Angola, Belarus, Bolivia, Bosnia, Brunei Darussalam, Colombia, Congo, Côte D’Ivoire (Ivory Coast), Croatia, Cuba, Democratic Republic of the Congo, Iran, Iraq, Kyrgyzstan, Latvia, Lebanon, Liberia, Libya, Macedonia, Moldova, Myanmar (Burma), Namibia, Nigeria, North Korea, Slovenia, Somalia, South Africa, South Sudan, Sudan, Syria, Tajikistan, Ukraine, Yemen, and Zimbabwe

Lastly, Simple’s support team told me that having longer periods of travel of 1 year or more isn’t a problem. Just make sure to put the travel notice in through the app or call them. If you need more time call them again before the travel notice finishes.

ATM Fees: 1/2

Simple doesn’t charge ATM specific fees on their end. You will get Visa’s wholesale rates (which is usually very close to the interbank exchange rates) plus a 1% international transaction fee—which is the same as for POS transactions. You can calculate Visa’s current exchange rates here. Also, Simple will not refund any ATM fees from the ATM provider.

Transfer: 2/2

Incoming and outgoing wires are free for domestic transfers. You can receive international transfers as well, but they don’t offer international outgoing transfers though. Simple is the clear winner in this category.

App: 2/2

Simple also has the best app in the game hands down. They give you the option to block your card and to reset your pin right from the app. It’s more stable than Ally’s Card Controls and it’s integrated directly in the Simple Bank app, The budgeting features are also helpful, especially Goals. They really do help you save your money and stay on track.

How do these online banks compare to Charles Schwab?

Charles Schwab might be the best bank overall for digital nomads. I tried opening an account with them two different times over 2 years but I couldn’t because my credit score isn’t all that great due to student loans. Maybe you’re in a similar position, and if so, you’ll still be able to open an account with the 3 banks mentioned above.

According to reviews online, a Charles Schwab account refunds all ATM Fees and they have no international transaction fees. So in the ATM fees category, they beat out even Aspiration Bank. I don’t know about the other categories because I’ve never had an account with them. Still, open an account with them if you can.

Conclusion and my recommendations

These are all best in class online banks, but my standards for the criteria were high too. They all have their strengths and weaknesses.

My personal recommendation is to open an account with every single one of these that you can and take advantage of all their strengths and minimize the weaknesses. Shit goes wrong when you travel. Cards get stolen, you stick a card in a machine and it gets stuck, you forget it in a taxi, or somebody decides to steal it.

Use Simple to keep most of your money in because they offer great support, free transfers, helpful budgeting features, and the highest quality app. If you get accepted and can open a Charles Schwab account use that as your main bank for making ATM withdrawals. If not, use Aspiration Bank. Make a monthly transfer from Simple into Aspiration and occasionally make ATM withdrawals being confident that all ATM fees will be refunded. Keep some cash in Ally Bank and use it as a backup in case something happens to the main two banks.

Lastly, Thank you

Thank you very much for taking some time out of your life to read this article. I hope it brought you some value and you find it useful when choosing your bank. If you found it beneficial, please share it and recommend it. Also, the Nomad Gate email list provides more helpful articles like these to digital nomads. Please subscribe if you think you’ll find it useful. Once again, thank you for your time.

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.