N26 has long been my favorite bank in Europe, and for good reason. Their user-friendly app, low fees, useful integrations—like Wise—and their investment module puts them miles ahead of most of the competition.

The fact that you don’t have to show up in a physical branch anywhere makes it an even sweeter deal—especially for the nomadic crowd.

I’ve written extensively in the past on why I love N26 so much, so if you’re still not sold check out this article.

In short, all you need to do is to:

- Register for an account here

- Download the N26 app to verify your ID

- Pair your smartphone

- Add funds to your N26 account (recommended)

The process is quite quick and easy, but if you’re unsure about anything, keep on reading for all the details you might possibly need…

In this article I cover:

Requirements

The account opening process

1. Online registration

2. ID verification—outside and inside Germany

3. Pairing your smartphone

4. Adding funds to your N26 account

FAQs

Requirements

Anyone can open an N26 Bank account, as long as they are resident in the EU and EEA. In order to open an account, you need a mailing address in one of the countries where N26 operates for them to send you your Mastercard.

As of this writing, N26 operates in all the Eurozone countries, except Malta, Cyprus, Lithuania, and Latvia (although the latter two are set to return soon). That leaves Germany, Austria, Spain, Italy, Ireland, Slovakia, Greece, France, Belgium, Estonia, Finland, Luxembourg, the Netherlands, Portugal, and Slovenia. Recently, they made their EUR denominated accounts available in Norway, Sweden, Denmark, Poland, Iceland, Liechtenstein, and Switzerland. They also had local GBP accounts for residents of the UK but decided to close these after Brexit. See some great alternatives to N26 UK bank accounts.

You also need a smartphone running iOS 9 or Android 5 or higher.

The account opening process

Opening an account in N26 bank is easily done in three steps:

- Filling out the online registration form

- Completing an ID verification,

- If your address is outside Germany: ID verification by taking a selfie and a photo of your ID through the app or

- If your address is in Germany*: ID verification through an in-app video call or at a German post office

- Pairing a smartphone with your account

The first and thirds steps are the same for everyone, but the second step varies depending on your nationality and residency. We’ll get back to that in a minute.

1. Online registration

No matter your residency and nationality, you start by filling out the N26 registration form. Just go here and click the Start registration button.

The country you sign up with will determine the features and pricing for your N26 account “forever”, even if you move to another EU country at a later date.

You will be asked to enter your:

- Email address

- First name

- Last name

- Country where you live

- Date of birth

- Password

- Phone number (can be from any country, but not a virtual number like Google Voice)

- Mailing address (where they will send your Mastercard)

- An optional promotional code. Unless you already have the paid ISIC student card you can safely ignore this field as any other referral code will not benefit you, only the person who referred you. But once you’ve signed up for N26, you can refer your own friends and make some extra cash.

Next, you’ll be asked for “the serious legal stuff” (standard AML—anti money laundering—questions), which includes your:

- Gender

- Job title and industry

- City of birth

- Nationality

- Tax residency (the country where you pay tax)

- Tax ID number where you’re tax resident (optional)

Finally, you have to agree to their terms and conditions, and optionally opt in to product updates and some privacy settings.

After you have confirmed your email, you can log in to your account and choose which N26 plan you want.

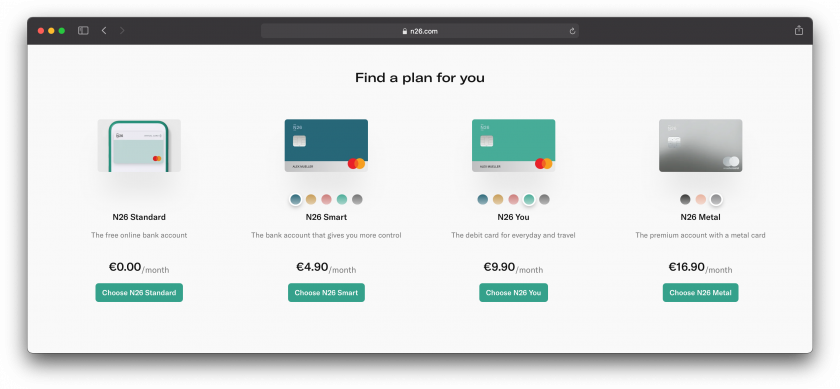

Which plans you can choose from depends on which country your delivery address is. Most plans are available for everyone, but there are some exceptions. The Metal card is not available for Greece, Slovenia, and Switzerland. They offer four different plans:

- N26 (recommended if you don’t need travel insurance and don’t withdraw a lot of cash in other currencies, comes with a free virtual card)

- N26 Smart (free physical card, sub-accounts for saving and budgeting, but no travel insurance)

- N26 You, formerly Black (good travel insurance, and no FX fee on cash withdrawals)

- N26 Metal (same as You, but with priority customer service, a super cool metal card, and exclusive deals and discounts)

These plans are also available for business accounts targeted at freelancers using the accounts for business purposes. These accounts will be in your personal name and are not suitable for incorporated businesses.

If you’re unsure which one to choose, just go with the regular N26 plan for now. You can always upgrade later. NOTE: If you select the Business plan you can not change it to a personal plan later, so for most people, I would not recommend it!

2. ID verification

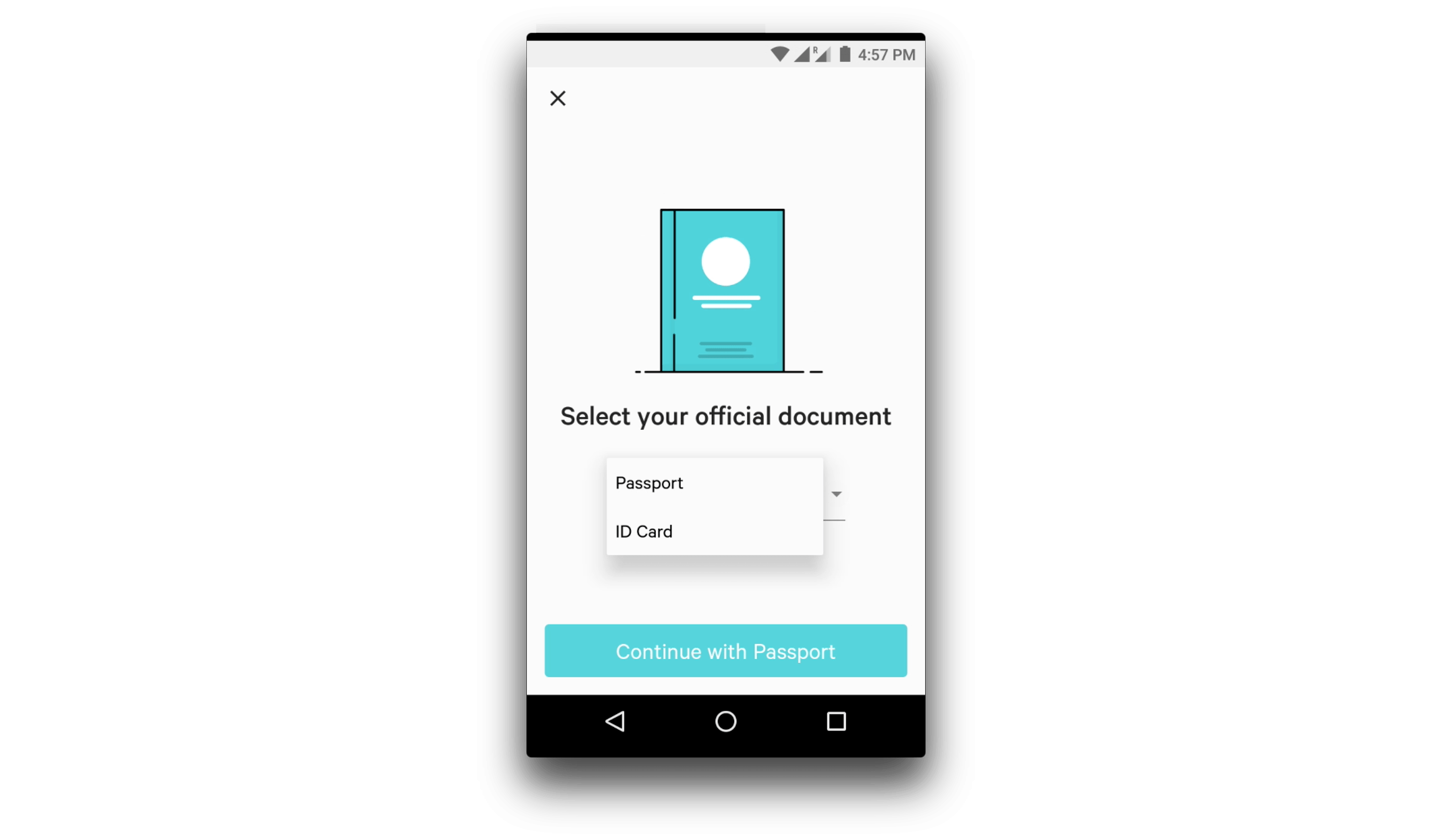

The next step is confirming your identity. Whether you can do this through a selfie or video call in the N26 app in a matter of minutes, or if you have to visit a German post office, depends on your nationality, ID documents, and delivery address of your card.

2.1 If your delivery address is outside Germany

Assuming you don’t have a German address, the ID verification is super simple: You just need to take a selfie and a photo of your ID document with the N26 app.

These are the ID documents for various nationalities that are supported through the N26 app:

- Algeria (Passport only)

- Angola (Passport only)

- Argentina (Passport only)

- Australia (Passport only)

- Austria (Passport & ID card)

- Belgium (Passport & ID card)

- Bosnia Herzegovina (Passport only)

- Brazil (Passport only)

- Bulgaria (Passport only)

- Canada (Passport only)

- China (Passport only)

- China - Hong Kong (Passport only)

- China - Macao (Passport only)

- Colombia (Passport only)

- Croatia (Passport & ID card)

- Cyprus (Passport only)

- Czech Republic (Passport & ID card)

- Denmark (Passport only)

- Egypt (Passport only)

- Estonia (Passport only)

- Finland (Passport & ID card)

- France (Passport & ID card)

- Germany (Passport & ID card)

- Ghana (Passport only)

- Greece (Passport & ID card)

- Hungary (Passport & ID card)

- Iceland (Passport only)

- India (Passport only)

- Ireland (Passport & ID card)

- Italy (Passport & ID card)

- Japan (Passport only)

- Kazakhstan (Passport only)

- Latvia (Passport & ID card)

- Liechtenstein (ID card only)

- Lithuania (ID card only)

- Luxembourg (Passport & ID card)

- Malaysia (Passport only)

- Malawi (Passport only)

- Malta (Passport & ID card)

- Mexico (Passport only)

- Morocco (Passport only)

- Netherlands (Passport & ID card)

- New Zealand (Passport only)

- Nigeria (Passport only)

- Norway (Passport only)

- Peru (Passport only)

- Philippines (Passport only)

- Poland (Passport & ID card)

- Portugal (Passport & ID card)

- Romania (Passport only)

- Russia (Passport only)

- Serbia (Passport only)

- Singapore (Passport only)

- Slovakia (Passport & ID card)

- Slovenia (Passport & ID card)

- South Africa (Passport only)

- South Korea (Passport only)

- Spain (Passport & ID card)

- Sweden (Passport & ID card)

- Switzerland (Passport & ID card)

- Thailand (Passport only)

- Turkey (Passport only)

- Ukraine (Passport only)

- United Kingdom (Passport only)

- USA (Passport only)

There are exceptions where an older passport, even from the mentioned countries, is not supported. That might be the case if it lacks biometric safety features—something most modern passports have.

If you don’t hold any of the passports or ID cards listed above, your only option is to open an account with a German address and go to a German post office.

After you have verified your email address, download the N26 app to your phone and log in. Make sure the lighting conditions are good so the pictures are clear.

Make sure you have your passport or ID card (according to the list above) and follow the instructions in the app. It shouldn’t take more than a minute!

2.2 If your delivery address is in Germany

N26’s German partner for identity verification via video calls, IDnow, currently supports the following passports and ID cards:

- Algeria (Passport only)

- Argentina (Passport only)

- Austria (Passport & ID card)

- Belgium (Passport & ID card)

- Bosnia and Herzegovina (Passport only)

- Bulgaria (Passport only)

- Canada (Passport only)

- China (Passport only)

- China - Hong Kong (Passport only)

- China - Macao (Passport only)

- Colombia (Passport only)

- Croatia (Passport & ID card)

- Cyprus (Passport only)

- Czech Republic (Passport & ID card)

- Denmark (Passport only)

- Egypt (Passport only)

- Estonia (Passport only)

- Finland (Passport & ID card)

- France incl. oversea territories (Passport & ID card)

- Germany (Passport & ID card)

- Ghana (Passport only)

- Greece (Passport only)

- Hungary (Passport & ID card)

- Iceland (Passport only)

- Ireland (Passport & ID card)

- Italy (Passport & ID card)

- Japan (Passport only)

- Jordan (Passport only)

- Kazakhstan (Passport only)

- Latvia (Passport & ID card)

- Liechtenstein (ID card only)

- Lithuania (ID card only)

- Luxembourg (Passport & ID card)

- Malawi (Passport only)

- Malaysia (Passport only)

- Malta (Passport & ID card)

- Mexico (Passport only)

- Morocco (Passport only)

- Netherlands (Passport & ID card)

- New Zealand (Passport only)

- Nigeria (Passport only)

- Norway (Passport only)

- Peru (Passport only)

- Philippines (Passport only)

- Poland (Passport & ID card)

- Portugal (Passport only)

- Romania (Passport only)

- Russia (Passport only)

- Serbia (Passport only)

- Singapore (Passport only)

- Slovakia (Passport & ID card)

- Slovenia (Passport & ID card)

- South Africa (Passport only)

- South Korea (Passport only)

- Spain (Passport & ID card)

- Sweden (Passport & ID card)

- Switzerland (Passport & ID card)

- Thailand (Passport only)

- Turkey (Passport only)

- Ukraine (Passport only)

- United Kingdom (Passport only)

- United States of America (Passport only)

Again, there are exceptions where an older passports without biometric features are unsupported.

If you don’t hold any of the passports or ID cards listed above, don’t worry. Just skip ahead to the section about the PostIdent method.

2.2.1 Remote opening of N26 Bank account (IDnow method)

After you have completed the initial registration form, you’ll be instructed to download the Android or iOS app to complete the identity verification.

Make sure you have your:

- Passport or ID card (according to the list above)

- Your smartphone with the phone number you entered previously

- A few minutes in a quiet place with good lighting conditions to have a quick video call—you will be interacting with a human being

Once you initiate the call, you will usually be connected to an agent without much delay. On some occasions you might have to wait a little bit, but rarely more than 5-10 minutes. Note that you can only do the video verification between 8 am and midnight German time.

During the call you will be asked to verify a few details from your registration form, as well as typing in a code sent to the phone number you registered with. You will also be asked to show your ID document to the camera in different angles so that the agent can verify that it’s legit.

If you’re interested, here’s a video made by the IDnow team that explains the call in a bit more detail:

Note that the call will take place within the N26 app, not the separate IDnow app mentioned in the video—but it still follows the same format.

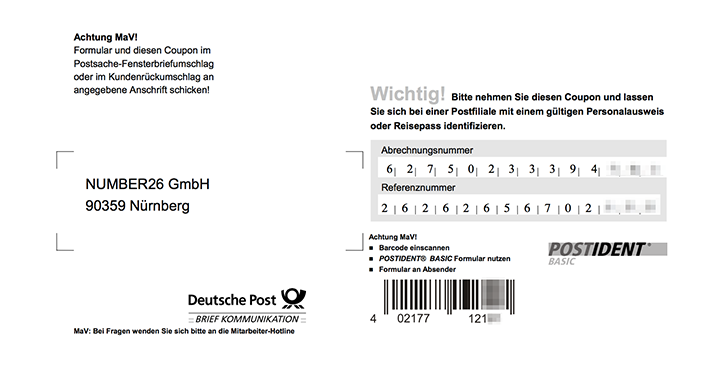

2.2.2 ID verification at a German post office (PostIdent method)

If your delivery address is in Germany and you don’t have one of the ID documents listed above, your only remaining ID verification option is the PostIdent method. It is really only practical if you’re living in Germany or are planning to visit.

To be honest, visiting a city like Berlin for a while is not such a bad thing, anyway. At least in the spring or summer. It’s one of the most creative cities in Europe, and still relatively affordable. And I’m sure other parts of Germany is worth visiting as well. Oktoberfest, anyone?

Anyway, once you do find yourself in Germany, this is how you verify your identity:

- Sign in to the mobile app, and follow the instructions

- Choose either to do the ID verification with your passport or ID card (if supported, see the list below). Click the button to request the PostIdent coupon.

- Print out the PostIdent coupon you received per email.

- Bring the coupon, your ID proof, and residency proof to your nearest German post office. Third party parcel shops generally don’t provide the PostIdent service, so you should seek out an official Deutsche Post office. The service is free of charge.

- Wait a day or two until you receive an email from N26 about your account being ready.

Citizens of the following countries should use the PostIdent method:

- Afghanistan (Passport only)

- Albania (ID card only)

- Angola (Passport only)

- Anguilla (Passport only)

- Antigua and Barbados (Passport only)

- Armenia (Passport only)

- Aruba (Passport only)

- Australia (Passport only)

- Azerbaijan (Passport only)

- Bangladesh (Passport only)

- Barbados (Passport only)

- Belarus (Passport only)

- Belize (Passport only)

- Benin (Passport only)

- Bermuda (Passport only)

- Bhutan (Passport only)

- Bosnia and Herzegovina (ID card only)

- Botswana (Passport only)

- Brasil (Passport only)

- British Indian Ocean Territory (Passport only)

- Brunei Darussalam (Passport only)

- Bulgaria (ID card only)

- Burundi (Passport only)

- Cambodia (Passport only)

- Cameroon (Passport only)

- Cape Verde (Passport only)

- Cayman Islands (Passport only)

- Chile (Passport only)

- Comoros (Passport only)

- Democratic Republic of the Congo (Passport only)

- Dominican Republic (Passport only)

- East Timor (Passport only)

- El Salvador (Passport only)

- Eritrea (Passport only)

- Ethiopia (Passport only)

- Fiji (Passport only)

- Gambia (Passport only)

- Georgia (Passport only)

- Gibraltar (Passport & ID card)

- Grenada (Passport only)

- Guatemala (Passport only)

- Guinea (Passport only)

- Guinea- Bissau (Passport only)

- Honduras (Passport only)

- Indonesia (Passport only)

- Iran (Passport only)

- Iraq (Passport only)

- Israel (Passport only)

- Ivory Coast (Passport only)

- Jamaica (Passport only)

- Kenya (Passport only)

- Kyrgyzstan (Passport & ID card)

- Laos (Passport only)

- Lebanon (Passport only)

- Lesotho (Passport only)

- Liberia (Passport only)

- Liechtenstein (Passport only)

- Madagascar (Passport only)

- Maldives (Passport only)

- Mauritius (Passport only)

- Micronesia (Passport only)

- Moldova (Passport & ID card)

- Monaco (Passport & ID card)

- Montserrat (Passport only)

- Montenegro (Passport only)

- Mozambique (Passport only)

- Myanmar (Passport only)

- Namibia (Passport only)

- Nepal (Passport only)

- Nicaragua (Passport only)

- Niue (Passport only)

- Oman (Passport only)

- Panama (Passport only)

- Papua New Guinea (Passport only)

- Paraguay (Passport only)

- Republic of Macedonia (Passport & ID card)

- Republic of the Congo (Passport only)

- Rwanda (Passport only)

- Saint Helena (Passport only)

- San Marino (Passport only)

- Sao Tome And Principe (Passport only)

- Senegal (Passport only)

- Seychelles (Passport only)

- Sierra Leone (Passport only)

- Somalia (Passport only)

- Sri Lanka (Passport only)

- Taiwan (Passport only)

- Tajikistan (Passport only)

- Tanzania (Passport only)

- Togo (Passport only)

- Tonga (Passport only)

- Trinidad and Tobago (Passport only)

- Tunisia (Passport only)

- Turkmenistan (Passport only)

- Turks And Caicos Islands (Passport only)

- Tuvalu (Passport only)

- Uganda (Passport only)

- United Arabian Emirates (Passport only)

- Uruguay (Passport only)

- Uzbekistan (Passport only)

- Vatican City State (Passport only)

- Vietnam (Passport only)

- Virgin Islands, British (Passport only)

- Yemen (Passport only)

- Zimbabwe (Passport only)

3. Pairing your smartphone

The final step to activating your account is to pair your smartphone.

Just download the N26 app and log in (if you haven’t already). Since your account isn’t yet paired with a phone, you will be guided through the steps when you open the app.

Make sure the number you entered during the activation is correct and click confirm. You then receive a four digit verification code via SMS and enter it in the app.

If you need to change the number you registered with, just contact N26 support and they will help you out.

Once you have paired your smartphone, you can use it to verify transactions such as SEPA transfers, Moneybeam, activating your Mastercard or Maestro card, and a few other things.

4. Adding funds to your N26 account

You can actually start using your account right away, even before you receive your Mastercard in the mail. To do that, you simply need to add some money to your account.

There are many ways of doing so, including:

- Asking your employer to deposit your salary into your account

- Transferring money from your current bank account into your new N26 account (hint: if you don’t have a euro account, use Wise for the cheapest possible transfer)

- If you’re in Germany, you can deposit cash at one of the many CASH26 locations

There’s no limit to the amount of money you can add to your N26 account. It’s a real bank account. And the first €100,000 of your balance is protected by the German Deposit Protection Scheme.

While you don’t need to do so to activate your account, I recommend transferring at least a small amount of money to your N26 account right away, so you can start using your N26 card as soon as you receive it in the mail. And you can always transfer the money out of the account again at a later date, without any limits or costs, if you change your mind.

Not yet sure if N26 is for you?

While N26 has long been a well known name in the European fintech market, we have an entire guide on the best banks for international travelers, including other alternative products that should meet the needs of perpetual travelers and nomads.

We have also written guide of suitable business banking products to help you operate across the globe. Enjoy!

Frequently Asked Questions

Can I keep my account if I move or travel to an unsupported country?

Yes, you will have no problems keeping your account for stays abroad of at least 18 months. If you don’t plan to return/move to a supported country by then N26 may ask to close your account.

That’s it! Look out for your shiny new N26 Mastercard in the mail!

So what are you waiting for?

Open your N26 account right now—you won’t regret it!

Join  now!

now!

Get free access to our community & exclusive content.

Don't worry, I won't spam you. You'll select your newsletter preference in the next step. Privacy policy.